The Curse of Mt. Gox 💀 Current Bitcoin price crashed yet again due to Mt.Gox

You've probably heard the story of the fabled Mt.Gox debacle that plagued Bitcoin back in 2011-2014. Mt.Gox was at the time the world's largest Bitcoin exchange and when it got hacked and almost a million Bitcoin was stolen and it caused Bitcoin to crash. Now it has been discovered that the curse of Mt.Gox continues, as it turns out that these past two months or so a Mt.Gox-trustee has been discovered dumping the remaining 200K Bitcoin into the markets.

KOBAYASHI

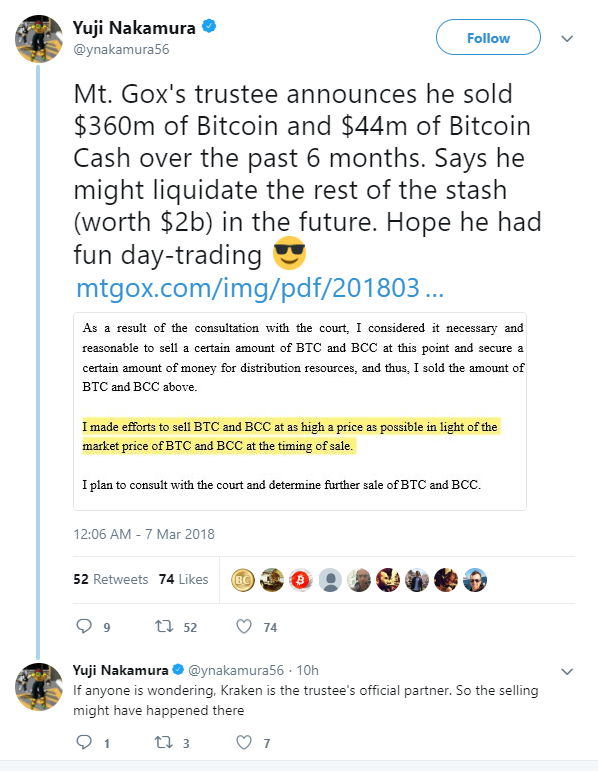

The person responsible is Nobuaki Kobayashi and he is the japanese attorney and bankruptcy trustee of Mt.Gox. Despite the hack having happened years ago, most people who lost their funds at the time have yet to receive any kind of compensation for their losses and Mt.Gox is still held liable by the court. Kobayashi is responsible for doing his best to repay those who lost funds during the hack.Not all of the Bitcoin that were stolen were lost forever. Out of the 850.000 or so BTC that was stolen, abotu 200.000 BTC was recovered. Now, in order to repay the missing funds Kobayashi has apparently started dumping a significant part of these funds on the open market: about $360m worth of BTC and $44m worth of BCH:

(source: Twitter)

An article I found describes how Kobayashi sold the first batch of BTC on December 22nd 2017, sending the Bitcoin price from $16,000 to a dipping point of $10,800. Then on January 17th a second batch of BTC was sold which crashed the price in a similar fashion once more. Then again on January 31st another batch was dumped. In total about $360 million USD was dumped on the markets.

Most particular is that a large batch of BTC being sold act6ually happened on February 6th, which was the bottom at $6000, arousing suspicion that this was in fact an attempt to further crash the market by dumping at the bottom on purpose.

WORRISOME

What's most worrisome is that this particular 'whale' has another 180.000 BTC at his disposal to dump onto the market. That's almost $2 billion dollars of sell pressure that can hit the market at any time, probably causing even more repeat occurrences of the price crashing. It doesn't sound like this is over yet.On the bright side, the total value of the Bitcoins stolen back in the day was $460 million USD. Of course, the price was still low then. If Kobayashi did in fact liquidate $360 million USD worth of Bitcoin already to repay those lost funds, then it seems he is on track to recovering the whole amount of capital. One might assume that after another $100 million USD is liquidated there should be no reason to continue the massive sell-off and in fact it will be interesting to find out what actually happens to those funds left-over.

If you've been around the space you've heard the tales of whales manipulating the price. This example shows that it's not always ill-intent per se that is behind it: it can very well be a pragmatical reason too. But it also illustrates that Bitcoin market manipulation is very real, and that big whales do in fact have the power to make or break the market.

Disclaimer: I am just a bot trying to be helpful.

This post has received a 0.42 % upvote from @drotto thanks to: @pandorasbox.

😮 Oooh damn. Ya know what would have been better, is if he GAVE THE PEOPLE WHO ARE OWED COMPENSATION THOSE BITCOINS. But I suppose he WANTS to manipulate so he can buy low.

It's going to happen again to a lesser degree perhaps 19 March, when US Marshals dump $25m of Bitcoin at auction: https://cointelegraph.com/news/us-marshals-service-to-sell-nearly-25-mln-worth-of-seized-bitcoin-at-auction

They can't give back 850.000 BTC if they only have 200.000. But they can give back the 2014-value of 850.000 BTC by selling 200.000 at today's price. I trust the lawyer is just trying to do his job and following Japanese law. And I very much doubt this is part of a deliberate effort to manipulate the market.

Right, but, why do they only have 200,000? They should be on the hook for the rest. They took what was cheap then and had it remained in the hands of the people who owned them, made them rich now, but now those people are only getting the cheap price back. They should owe those people the CURRENT price that they WOULD HAVE HAD if they had been hodling for four years, you know what I mean? It would be like stealing someone's baseball card in 1962 that today is worth $100,000, and today saying, I feel really bad about that, here's the penny you paid for it in 1962, now we're square!

I'm sure it's legal, but that doesn't make it right.

Quote from the article we're discussing:

It's lucky Mt. Gox has any BTC at all.

Mt. Gox is bankrupt. Bankruptcies suck for everyone involved. Creditors never get back their full value, unless the bankrupt company had an amazing insurance policy.

This case is a very special bankruptcy case, in that the 200.000 BTC they still have is actually worth more than the 850.000 BTC heist that bankrupted them. The best solution for those who had their BTC stored at Mt. Gox might have been to divide the remaining BTC among them instead of selling it and giving them the money. The problem with this is that these aren't the only debts Mt. Gox has! They probably owe money to banks, investors, landlords, employees, the power company, and dozens of others. And few of those would accept BTC as payment, and thus they have to sell most of it.

Alright, that's true. Fair point, thanks.

If the MtGox Curse also comes with a fine x-multiplier recovery (like all the previous times), I am all for it.

Somehow, it is fitting that MtGox remains relevant for the Bitcoin scene.

That is likely to be a factor indeed, combined some other stuff: Binance weird transactions FUD + SEC statement on unlawful exchanges + Japan's potential crackdown in exchanges.

We'll recover :-)

Interesting. The ghost of Mt Gox still haunts us! Resteemed.