Technical Analysis (TA) in Cryptos

What is Technical Analysis

The basic premise of Technical Analysis is "ability to read charts and recognize patterns". The goal is then to derive a meaningful direction and possible future based on the historical analysis of a market commodity's behavior on an exchange. In short, TA traders apply some basic rules from years of exchange behaviors to gauge market direction.

Technical Analysis is a powerful way to make validations against market assumptions, and ultimately it's not all that difficult to do, if you follow a few basic guidelines and rules. An important thing to note about TA is that it's a tried and true method of market forecasting in securities commodities in general, and there is nothing inventive or special about someone being "good" at Technical Analysis trading, it really is just a finite number of fundamentals that validate and augment research.

Fundamental Elements of TA

The effectiveness of TA boils down to how adept you are at understanding the three key elements to Technical Analysis:

- Market history can indicate market sentiment

- Prices move on trends

- Sellers always want to sell, and Buyers always want to buy

The first step is paramount, History. You must see where something has been to understand where it might be going. To gather enough information about the overall health of a securities trade over time, you should step back past 24 hours and look at 4 weeks, 12 weeks, and 24 weeks, at the very least. In some cases, it's important to analyze year-over-year, depending on what the investment is.

The second element, trend analysis, is a key indicator on overall market sentiment toward the security. Items of note that alter market sentiment are Press, Rumors, and company health reports (commonly: Quarterly Earnings reports). Reducing the anomalies from the general trend to discover actual, and persistent trend analysis will help paint a realistic picture of what the actual fair market value and trend-lines tend to look like, allowing calls to be made that are clearer, and precise. This will lead to outliers (high points, low points) that don't fit the trend analysis. Comparing those spikes to press release times, or noise caused by rumors will help determine whether the trend is going to change, or if it's just a flash in the pan from over-emotional traders.

Lastly, it comes down to the individual. Sellers that want to move out of a trade and convert their shares in a security from X to Y or to cash out completely will depend on their position in the security as well as "humanity" factors that may not be reflected in the markets. After all, trades aren't the only factors of humanity. Therefore, discounts happen. Discounts can trigger panic sales.

Another familiar characteristic in market spending is FOMO. Buyers being sold into a trade based on something that speaks to them emotionally on a level that creates an emotional trigger to says, "buy into this now or miss out on something later". FOMO (fear of missing out) will drive the price of a security trade up artificially. Whether FOMO and panic sells can alter the generalized trend lines of a security is up to the other factors associated to that specific commodity: persistence of Press, health of the company, power of the product, etc.

How Does Technical Analysis Apply to Cryptos?

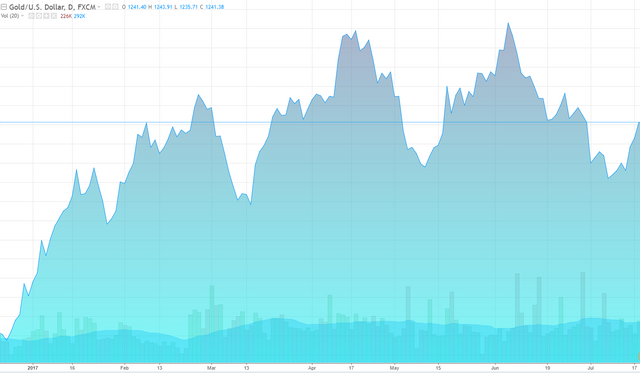

This is tricky. In short, Technical Analysis doesn't truly apply to cryptocurrency trading. It can, in a way, but not in the traditional and ultimately effective sense. Take Gold for example. There's a universal understanding of the value of Gold, it was the basis of currency until the late 70's in the US, and still holds value as a precious metal today. These are just facts. Trading is consistent, volume is persistent, and the value is inherent:

The result is a decent pattern that can almost be measured with a ruler. Pretty simple to spot, right? "Buying Gold right now is a good idea, it's more than likely going to increase in price from current ($1241USD) to somewhere above ($1270USD) in the next 2 - 3 weeks. Slam dunk. There's no need for fancy lines and weird sequences to try to make sense of it. That's just history, our understanding of the value of Gold, and knowing for a fact that Gold isn't going to become magically worthless tomorrow.

Apply that same philosophy to any cryptocurrency other than Bitcoin. Go ahead, name one. "Sure bets" don't exist in cryptocurrency trades, not even in Bitcoin. Market sentiment is based solely on the perception of potential and possibility associated to the "someday maybe". These bets don't make Technical Analysis useless, it simply makes it less effective, and far from the silver-bullet for guaranteed money.

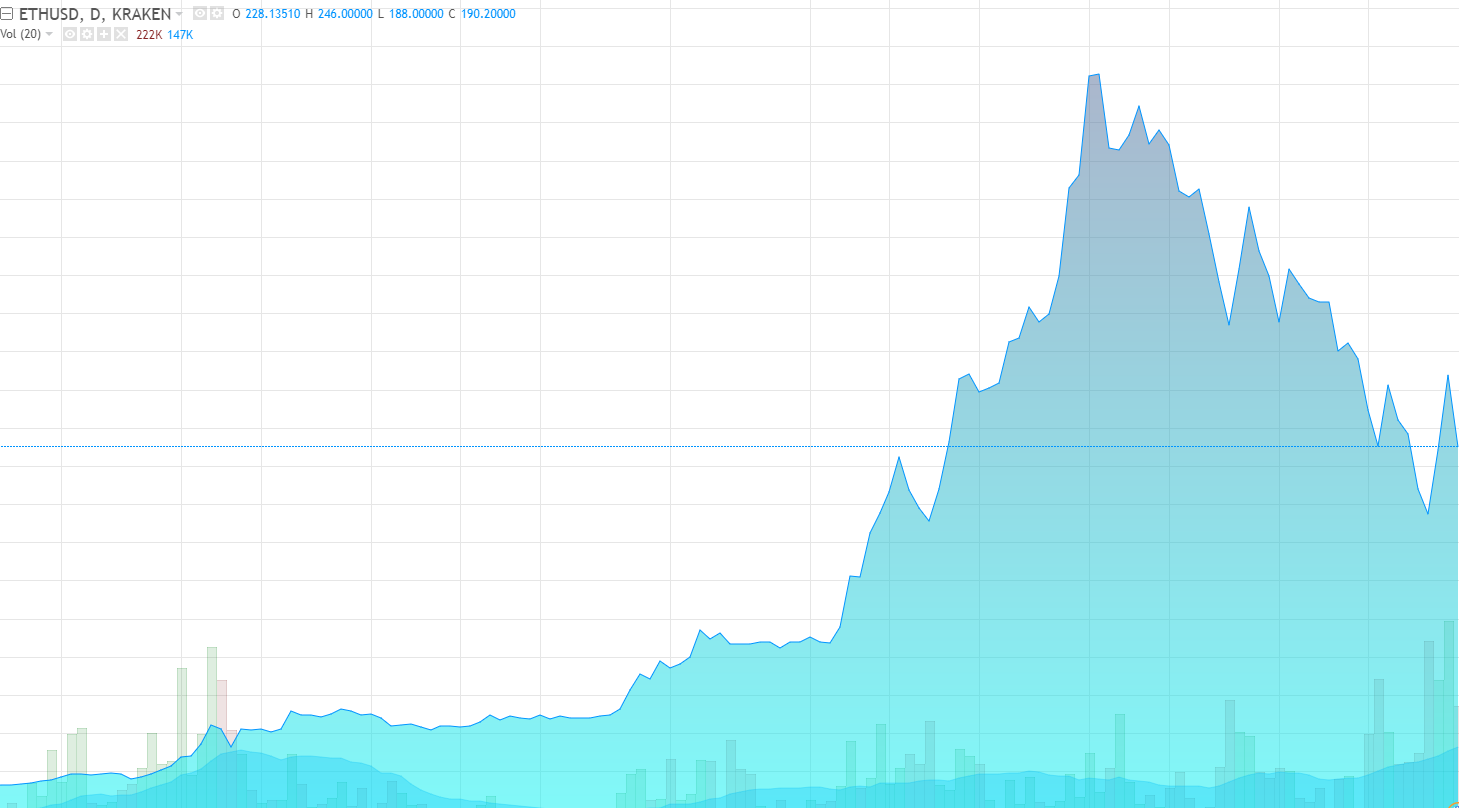

Here's ETH to USD:

Over time, there aren't any trends to follow, "up" isn't a guarantee, and down is never off the table either. The only thing anyone can really do is guess where the "floors" are and hope for the best.

Zooming down to a 24-hour period in ETH to USD there are some assumptions that can be made, and some lines that can be drawn:

15:00 > 15:00 day over day difference is a lot higher. There was a "correction" recently, bringing the ETH price to below the $200 USD mark to $190 (good time to buy), because in the next 2 - 3 hours, it could (and probably will) break $220USD-$224USD. That's what this chart says to me, based on day-over-day, and short-term trend analysis, with a few orange lines drawn into that that bisect a few key points I'm looking at.

That's "a good call" to the noble TA trader, and if I were kind, I would share it on Facebook and claim fame that I can make TA trade analysis calls all day and just roll in the money, but fact is... I know ETH breaks $200, it has in the past with frequency, the ATH (all time high) is $400+/- and people on Facebook, Reddit, and Bitcoin Talk aren't turning their back on ETH, so there's support. There's enough people that see ETH at $190 and think it's a good deal, and they'll buy it. Those people are all over the planet... especially in Asia, who will hit the exchanges in less than 3 hours.

The Self-fulfilling Prophecy Effect

Again, Technical Analysis isn't useless in cryptos, it does help to some degree. It's also more complex than I've covered here so far, to an extent, but just barely. When it comes to gauging where a coin is going to go it does help to look at the past to provide faith in the choices made for the future of these high-risk securities. It is not a silver bullet.

Technical Analysis, all tactics that can be done, are merely a litmus test for assumptions made about the space from other sources - or it should be. Be wary of Groups and people that only talk about and post the technical analysis of a trade. An interesting line to mention is the persistent footnote of "DYOR" on most responsible technical traders' posts (stand for Do Your Own Research) and that's true, but often - a "valued" technical trader will affect a market simply by mentioning a trade they took the time on to create a chart with some lines on it.

Continued Reading

This one article on Investopedia is a huge head start for anyone interested in learning to read what they see on exchanges:

Trend Analysis

http://www.investopedia.com/university/technical/techanalysis3.asp?lgl=rira-baseline-vertical

Support and Resistance

http://www.investopedia.com/university/technical/techanalysis4.asp?lgl=rira-baseline-vertical

Charting

http://www.investopedia.com/university/technical/techanalysis7.asp?lgl=rira-baseline-vertical

Chart Patterns

http://www.investopedia.com/university/technical/techanalysis8.asp?lgl=rira-baseline-vertical

Thx for sharing.

The charting, support and resistance links are interesting as well 😊

good job,

thanks bro, and I follow you.

Great info for anyone getting into cryptos. I found out quickly that there is A LOT more emotional buys/sells in coins as compared to stocks. It really has adjusted the way I trade.

Buy dips hodl till you can't hodl no mo

no.

Some great study material, thanks a bunch @nrek!

Interesting post about technical analysis for cryptocurrencies. If you want to get free technical analysis for Bitcoin, Ethereum, Ripple and other currencies, see: https://www.cryptocointrade.com/technical-analysis/