Stablecoins. The future of crypto.

Stablecoins. The future of crypto.

Greetings. You can be trader, an investor or just casual reader - in any case, this article will bring new knowledge about cryptocurrencies world, which, perhaps, will be useful to you in the foreseeable future.

As you can see from the title, today we are going to talk about stable fixed-rate cryptocurrencies (stablecoins). But, before telling about them, I want to share with you some observations from cryptomarket.

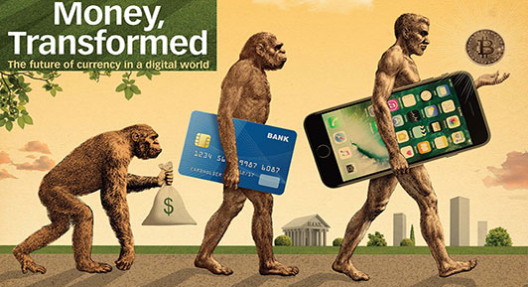

So, let’s start with that recently some news appeared at cryptochats, it said that IMF website issued an article “The Future of Currency in a Digital World”,with the cover where parallel between the evolution of man and the evolution of money is depicted. It is noteworthy that at the very peak of evolution the symbol of bitcoin is depicted.

The article was written by Martin Mühleisen, he is the Director of the Department of Strategy, Policy and Review of the IMF.

In short, the article says that any technology that was created by a person works better and develops in close connection with the state, and the cryptocurrency is no exception. I will not discuss the issue of state regulation, but I will conclude that even if the IMF started talking about the cryptocurrency and compared it with the previously invented technologies that are developing to this day (for example, engines, electricity, the Internet), it can be assumed that in the near time new digital world will be waiting for us, in which will be applied block, smart contracts and cryptocurrencies. And yes, this is not just article about the cryptocurrency on the IMF website.

But let’s imagine world of the future, where smart contracts and cryptocurrencies are already being applied. Yes, smart contracts are easy to adapt to people’s needs, because in fact, they are improved contracts. And what about cryptocurrencies? They, of course, perfectly fit in the role of digital assets, but it would be quite inconvenient to pay for them, for the reason that their course is constantly changing. Imagine a customer entering a store and seeing on an electronic price tag that bread has changed its price relative to yesterday’s by 5% in bitcoins, and tomorrow, let’s say, the price will change by another 3%. You have to admit, this will cause him discomfort. Mankind still loves order and stability more than chaos and instability. Most likely, the classical currency will be unacceptable for trade and payment for services and goods. We are used to stable price ranges, even though they change under the influence of inflation.

How to find the way out?

Since we need stability, it would be nice to create digital currencies that will take full advantage of classical cryptocurrency, but they will also be convenient to use, as well as conventional money (for example, USD, EUR).

These universal currencies could have a blockchain, decentralization and a fixed stable rate.

And, of course, some blockchain developers realized that such currencies would be in demand, so teams began to develop various stablecoins.

To date stable cryptocurrency is on experimental stage, but it is already known about at least 3 approaches to the creation of stablecoins:

- With collateral in the classical money form (fiat) and “stable” assets (for example, gold).

- With collateral in the cryptocurrency form.

- Without collateral, including through bonds (debt obligations).

Let’s review it more detailed. Benefits and Disadvantages will be emphasized out only in terms of their use.

Collateralizing with fiat money and “stable” assets.

The easiest way: each stablecoin token is issued on bail of fiat or asset. For example, 1 token to 1 USD or 1 token to 1 ounce (28.3495 grams) of gold.

Benefits:

- Resistance to the market cryptocurrency collapse.

- Accessibility in understanding the mechanism of the system operation.

Disadvantages:

- Inflationary component, in case when it says about linking to fiat.

- Lack of transparency and the need for trust in the system.

- Possible involvement of third parties (for example, banks, auditors).

- Impossibility of full anonymity of the stabblecoin user and the presence of control of regulatory bodies in the system.

Projects collateralizing cryptocurrencies.

With this method, cryptocurrency is used as collateral. But because of its high volatility in the reserve system should be enough kriptovalyuty to keep the rate steiblkoina in case of a fall in the market.

For example, 1 token = 0.01 ETH, if the market falls by 50%, the system must have 0.02 ETH in reserve to ensure this token, so that it continues to function.

Benefits:

- The system is built using a blockchain, which gives it an accelerated emission / remission of tokens, and therefore a higher liquidity, in contrast to stablcoins with phyto-provision.

- Transparency. The user can check the provision of stablecoin at any time.

- The possibility of decentralization using DAO or similar organizations.

- Possibility of anonymity of users in the absence of control of regulatory bodies.

Disadvantages:

- The risk of the collapse of the system in the collapse of the cryptomarket..

Backed by nothing.

In addition to the various algorithms for creating unboxed stablecoin, which have their advantages and disadvantages, it is possible to single out a separate popular method based on bonds.

This method does not require the provision of Fiat or Cryptocurrency. To keep the rate at a fixed level, for example, DAO (or centralized analogue), which control stablecoin emission, increase it, when rate begins to raise, and decrease, when rate is falling down.

For example, a fixed rate of stablecoin is $ 1.

Then if the token rate becomes higher than $ 1, then DAO under the terms of the smart contract will generate an additional issue of tokens, so that the rate will drop to $ 1, while receiving revenue.

If the rate drops below $ 1, then DAO will use this income to buy tokens to raise the rate.

If the income is spent and the rate remains below $ 1 per token, the DAO will issue digital bonds (promissory notes) to raise funds, which will promise their customers revenue when the stablecoin rate rises in the future.

The whole system is based on the expectation that demand for stablecoin will increase.

If DAO finds itself in a situation where the token will cost less than $ 1, and the revenue has been spent, and no one buys the digital bonds, then the holders will lose faith in stablecoin, and its course will collapse.

Benefits:

When stablecoin is used in the real sector of the economy, the stability of the token will not depend on the cryptocurrency market. Accordingly, the risk of a system crash will decrease.

Disadvantages:

Strong dependence of the stability of the exchange rate on the expectations of buyers of digital bonds, therefore, the system is designed primarily to increase demand for stablecoin.

I think that in the course of time, new ways of providing for stebblekins will appear.

Now I suggest that you go over the existing projects of each of the ways of providing.

Projects with collateralizing of fiat money and “stable” assets.

1 - Tether

Today is one of the most popular stable tokens. For the first time this token appeared on the Bitfinex exchange.

This stablecoin is bound to the following currencies:

a. US dollar as 1 to 1 (USDT)

b. Euro as 1 to 1 (EURT)

Tether implemented on Omni platform, which structure is based on the bitcoin blockchain. You can buy USDT on many exchanges or in the Tether private account by bank transfer, but for this you will have to go through a complicated verification procedure.

All pledge fiat funds are stored in the bank account of the company, therefore it is extremely difficult to verify whether the number of tokens is sufficient to secure them. Yes, there are auditing companies for verification, but here too a significant role is played by the human factor.

This token is built on the Ethereum blockbuster according to the ERC-20 (etherscan) standard, and is tied to the US Dollar as 1 to 1. It is developed by the TrustToken project, whose goal is the tokenization of classical assets (for example, gold, dollar), that is, converting them into a digital shape.

According to the developers, the provision of this stablecoin is evenly distributed among various licensed partner banks and trust companies using escrow-accounts for risk diversification. This allows the TrustToken project not to participate in payment processing, and TrueUSD exchange transactions are performed directly between the user and the partner bank or the trust company. Thus, the system becomes slightly more transparent.

True USD can be purchased on several exchanges (Bittrex, Binance) or through a special form where you need to provide your data for identification by KYC/AML.

More about TrueUSD

3 - GoldMint

The project has 2 ERC-20 tokens on the Ethereum: GOLD and MNTP block.

GOLD — stablecoin (1 GOLD = 1 ounce of gold)

MNTP is a digital share of the project that allows investors to earn on growth and PoS-mining (at least 10,000 MNTP for participation), and also reduces the commission fee for trading GOLD. The token is necessary to maintain the efficiency of the block and the organization of the domestic economy.

In future, the project plans to launch these tokens on its own blockbuster.

Gold is purchased through delivery futures on the Chicago Exchange CME, OTC transaction. Information about the current size of the gold reserve of the project is confirmed by a guarantee issued by the bank by the custodian.

Also for some countries it is possible to exchange for physical gold.

4 - OneGram

The project has its own blockbuster and GoldGuard platform, through which oneGram token transactions are issued and processed (1 OGC = 1 gram of gold).

The project will charge a commission of 1% per each OneGram transaction. 70% of the profit will be reinvested in OneGramFoundation to increase the gold reserve. The rest will go to development and reward for PoS-mining. It will also be possible to exchange for physical gold.

5 - Digix Global

Stablecoin of this project is implemented on the EREC-20 ERC-20. DGX = 1 gram of gold.

The system is built on the basis of Proof of Asset (PoA) using a variety of smart contracts for greater organization and transparency.

The system is controlled by DAO. Participants of the project is charged DGDBadge in proportion to their contribution to the project, which allow the shares to be frozen DGD and make decisions on the proposals of the team.

6 - El Petro

National Venezuela’s cryptocurrency on NEM’s blockbuster, where 100 million tokens = 5.3 billion barrels of crude oil. The coin was developed by the central bank of Venezuela jointly with Onixcoin and is, to a large extent, a forced measure in the fight against hyperinflation in the country. The President of Venezuela, Nicolas Maduro, also ordered the largest petrochemical companies to use tokens to make at least part of the transactions. Common people can pay utility bills, taxes, fines, etc. with their help.

7 - SwissRealCoin

This project was created by a team of professionals in the real estate market and PropTech in Switzerland. Real estate prices in Switzerland are known for their steady growth, so the team decided to create a stablyokoin secured by real estate. SRC is a token on the basis of Ethereum ERC-20 and is a bond linked to the portfolio of the real estate market. The system is managed using the MIA platform, built on smart contracts. The rental income of the existing property will be reinvested in real estate by 80%, the remaining 20% will go to the development of the project. Purchase SRC can be purchased using BTC, ETH and Fiat.

8 - Stably

The StableUSD stablecoin will be based on a number of block-protocol protocols, including Ethereum and Stellar. StableUSD is provided with the dollar as 1 to 1. In addition to information from the transparent centralized reserve managed by Stable, Inc., developers promise frequent audits and timely broadcasts of information on reserve balances that are out of the network.

9 - X8

The project involves 2 tokens based on Ethereum:

X8C is a stable token, the rate of which is gradually rising in price, covering inflation. It is provided with 7 major currency and gold currencies. Its steady growth is due to profitable asset trading with ARM AI (risk management platform).

X8X is a token utility that gives access to the exchange of X8C to a Fiat without commission. The revenue from the growth of X8X is directed to the development of the project.

10 - GlobCoin

This project works in a similar scheme with X8. The system has 2 tokens based on Ethereum ERC-20.

GLX is a stable token, which is provided with 10 major fiat currencies and gold. Growth will be achieved through the proper management of assets.

GCP is a token utility that gives access to the exchange of GLX for fiat without commission. The income from it will go to the development of the project.

11 - ChronoBank

The financial basis of the project is Labor-Hour tokens (LH), which are tied to the average hourly wage and are provided with real workforce from large recruiting agencies and recruitment companies. Such tokens are protected from inflation and their volatility is insignificant. LH tokens will be created on the blockers Ethereum, Waves and NEM.

The project is also developing a decentralized portal for the recruitment and payment of LaborX. The entire system is centralized and managed using the Chronomint interface, which is implemented on smart contracts. For example, through this interface, the owners of the investment token TIME will be able to make important decisions in the management, or it will be possible to mine LH tokens.

Projects collateralizing cryptocurrencies.

1 - XRONOS

The XPO token is stabilized in this case using the XRSS standalone management system (XRONOS RATE STABILIZATION SYSTEM). Initially, the token will cost $ 2.15, but by 2019 developers are planning to grow XPO to the level of $ 21.53, where it will fix its price. Initially, the project will be centralized, but later the developers intend to introduce PoS mining, which will allow the system to become more decentralized.

2 - MakerDAO

The project is on the blockbuster Ethereum.

Dai is a stablecoin, the price of which is fixed at $ 1 (1 Dai = 1 $).

To create a Dai, you need to send the amount of ETH to the collateral CDP (Collateralized Debt Position) system that is 50% higher than the amount you would like to receive Dai. On the Dai exchanges, you can already buy 1 to 1.

MKR is a token that allows holders to participate in the management of the DAO, and also serves to invest in the project and stabilize the Dai with a sharp drop in the market.

The project will be interesting for speculators who would like to stand in the long with the shoulder on the air.

3 - LibreBank

The project includes 2 tokens.

LibreCash is a stable token, which is initially tied to the US dollar as 1 to 1, and later will be protected against inflation.

LBRS (LibreBank ReserveShare) is a reserve fund stock that serves to invest in the project and allows holders to make decisions in the management of the DAO.

Scheme for the acquisition of LibreCash:

The buyer sends the ETH collateral to the smart contract, and in return he receives an appropriate amount of LibreCash. If the price of ETH collateral falls, then the Reserve Fund enters into the case, which compensates for the losses. The size of the fund at any time can be checked on the relevant site.

Also, developers plan to diversify the Reserve Fund portfolio with assets such as commodity and gold tokens, stocks, bonds and CDPs.

Backed by nothing.

The mechanism of the bond-based system I described above, therefore I will give a brief information about each of the projects.

1 - Carbon

Project utilize 2 tokens :

Carbon Stablecoin (CUSD) is a token whose price is tied to the US Dollar as 1 to 1. Afterwards, developers are planning to introduce protection against inflation.

Carbon Credits is a bond-token used to stabilize the CUSD rate.

2 - Basis

The project uses 3 tokens:

Basis — a token, the price of which is tied to the US dollar as 1 to 1. Later developers plan to introduce protection against inflation.

Bond tokens is a token bond that is used to stabilize the Basis rate.

Share tokens — tokens for investing in the project.

3 - BitShares

The project includes the following stable tokens-contracts:

BitUSD — connected to USD as 1 to 1

BitEURO — connected to EURO as 1 to 1

BitCNY — connected to Yuan as 1 to 1

BitGold — connected to Gold

Such tokens appear when one side of the system takes a loan to buy BTS from another with an obligation to pay interest and return it at any time.

BTS is a token-share, which, in addition to the possibility of investing in the project, enables PoS-mining to its holders.

The project has its decentralized stock exchange.

There are also smaller projects without collateral: Fragments, Alchemint and Kowala. The first 2 of them are based on loans.

0 - NuBits

And here is an example of a stablecoin when it hadn’t complete its task. Holders of the NuShares stocks had to make decisions on the amount of interest accrued when the NuBits were frozen to stabilize the token, and, apparently, failed because of the market’s collapse. Whether the course is stabilized or not is unknown.

Summarizing, we can distinguish the two most competitive in this niche, but a little different in nature project: LibreBank and MakerDao.

Both have DAO, which allows the system to be managed by investors. And also a good stabilization mechanism. But in my opinion, the way with the classical, but transparent reserve fund LibreBank, which will include not only cryptoassets, but also classic assets, will be safer for the course. In addition, the team further develops the same loan model, which will only strengthen the course of their stablecoin.

And since the project is at the very beginning of the road, then I will invest in it. In the next article, I will explain this choice in more detail.

Read about LibreBank tokens (LBRS).

Buy LibreBank tokens.

Subscribe me on:

Medium: https://medium.com/@max_profit

Telegram: https://t.me/max_prof

Twitter: https://twitter.com/maks_profit

Golos.io: https://golos.io/@maxprofit

Keep in mind the resources of the country will not trace out any resources

Does it mean that goverments will not regulate stablecoins in future? Actually, I don't think so, but who knows...

Ru

Приветствую. Представляю студию блокчейн-копирайтинга. Предлагаю наши услуги по написанию WhitePaper, созданию видеороликов , написанию уникальных статей и обзоров (в том числе для steemit), переводов. Огромный опыт и большой штат сотрудников. Списко наших услуг и портфолио в нашем телеграм канале или на сайте.

En

Hello everyone! I present to you our blockchain copywriting studio. We propose to you next services: writing WhitePaper, creating videos, , translations, writing unique articles and reviews (Including for steemit). Extensive experience and highly qualified team. List of services and portforlio in our telegram channel or on our website.

I can write much better. So, sorry ;)

@resteemator is a new bot casting votes for its followers. Follow @resteemator and vote this comment to increase your chance to be voted in the future!

Small remark: Globcoin have 15 fiat currency and gold.

no spy device in your pocket NO MONEY!

no electricity NO MONEY

no expensive network NO MONEY