Price Isn’t Everything – Dessert Dynamics

I find myself explaining the content in this post to various friends, family, and acquaintances quite frequently. Truthfully, the frequency in which I find myself explaining this concept is a bit bewildering, but I can appreciate why it is so misunderstood.

In recent months (correction accounted for), many of the crypto assets that have been surging the most are often the ones that are the cheapest in price per coin.

New investors come into the marketplace and likely have an inner dialogue that goes something like this:

This is grossly oversimplifying the thought process, I am sure, yet this appears to be exactly what is happening.

What everyone is missing in their foolhardy assessment is the concept of market capitalization and total supply. In short, people are forgetting about what makes any asset valuable: scarcity, and as an investor specifically, your portion of this scarcity.

Scarcity refers to the limited availability of a commodity, and when a commodity in high demand has a limited availability it’s price appreciates much faster than that of a commodity also in high demand, but with overabundant supply.

In other words, what we are concerned with is how large our piece of the pie is. The pie, of course, representing the total collection of capital associated with a specific asset. As investors – and dessert connoisseurs – we tend to prefer larger pieces of the asset pie.

The more pieces of the pie there are, the cheaper the price per slice, however, the smaller the amount of pie you have on your plate for each slice you acquire. Carrying through with this pie analogy, this means that although the price per coin may be cheaper, you ultimately end up with less of a stake of the overall pie.

For example, let’s say we slice a pie into 100 equal slices. These are very small portions of pie, which is why they are priced cheaper.

However, if you take this same pie and instead slice it into 10 equal slices, the slices are much more enjoyable, and thus, are priced appropriately higher.

Yet, if you are investing in an overall pie with the conviction that the price of pies will increase, just ask yourself, would you rather be holding 1/10 of the pie, or 1/100 when the price of pie goes up? In other words, serious investors should task themselves with identifying the most valuable pie as a whole, rather than the most valuable slice of any given pie.

Call me crazy, but investing in an asset means that I have conviction in said asset appreciating in price over time. In order to capitalize on a larger portion of the profits that result from this price appreciation, I will want a larger slice of the pie.

Speaking towards market capitalization, smaller market caps generally have much more potential to go up versus larger market caps. The same can be said on the downside, as smaller market caps are generally more volatile. In essence, smaller market caps are just like smaller bodies of mass. They are much more easily influenced by external forces than those objects of greater mass.

This does not mean larger market caps cannot go up as quickly as their smaller market cap counterparts. Rather, it means it’s harder for a $20 Billion asset to go to $40 Billion versus a $20 Million asset going to $40 Million. This is because an influx of $20 million moves the $20 million company 100% upwards, whereas it only moves the $20 billion company 0.1% upwards.

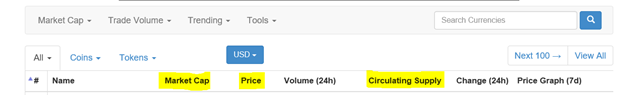

Next time you’re on coinmarketcap.com, don’t forget to look at all the other variables to consider in a coin besides price. Namely, price, circulating supply, and total future supply. If a large future supply is set to hit the market, there's good reason to suspect value dilution, resulting in depreciation of price per slice of the pie.

"The bitterness of poor quality remains long after the sweetness of low price is forgotten." – Unknown

DISCLAIMER : This content is for informational, educational and research purposes only. This post is not to be taken as personalized investment advice.

There is a small ''slice of pie'' in this article the way i see it. There is a good point in addressing this issues, but i believe one or you for example can inspire more awareness upon the masses by going to the roots of the problem and addressing that. And the big pie is financial/economiy literacy. One is not taught in schools how to take care of its budget or finances, unless you go to a specialised school or university. Government wants you dumb, stupid, careless and comfortable; therefore they made that learning institutions to teach you 98% of things that you don't need at all in real life. Think of that. Now your intention is good, but, let's scale this more, let your mind expand. What if you connect the educational system, governments, finances, blockchain technology and spending? This would have a much more in-depth effect towards awareness and a call for action. Yes it will take time to come with that post, but when you do, Bang! ;) Think about that :).

Creating trustless institutions and systems is the end goal my friend. I have said for awhile now that the true enemy of progress/ improved quality of life is none other than ignorance. I go back and forth on whether or not this ignorance is intentional or just apart of human nature (really, it is a hybrid of both, amongst other variables).

As the saying goes, "Never ascribe to malice that which can adequately be explained by ignorance."

That said, I have written another article you may find supplementary to your comment above, here:

https://steemit.com/education/@maven360/the-arbitrage-of-intimidation-and-misunderstanding

That sounds like a very good goal to achieve and accomplish. If there is anything i can help with in the process, i'd be more than happy to contribute if needed. It sounds like you and I can have a really good chat about the things around us. Looking forward for the upcoming posts.

Glad to have you on board @viog37!

I will say the main thing that you can do in contribution to the space as a whole is to add value to Steemit. Whether that be in educational resources, thought-provoking reflections, entertainment, travel, exploration, etc. it does not matter so much what you should decide to focus on, but rather in how you choose to represent those of us trying to learn and progress in order to create better lives for ourselves.

In essence, that is really the potential and power of Steemit. Best to you my friend. Feel free to chime in on any future posts, engagement has been lacking in my book and it's always nice to know someone read my work and took something from it.

well, there's always a learning curve for newbies, but articles like these help a lot. thanks!

Just trying to do my part (and selfishly have a link handy the next time someone seems a bit confused on the concept). Thank you for the kind words!

@originalworks