How to Avoid Cryptocurrency Theft

Cryptocurrencies are the newest form of money. They are the Internet of Money — A financial revolution! However, problems exist. Security and custody of funds are still a major issue.

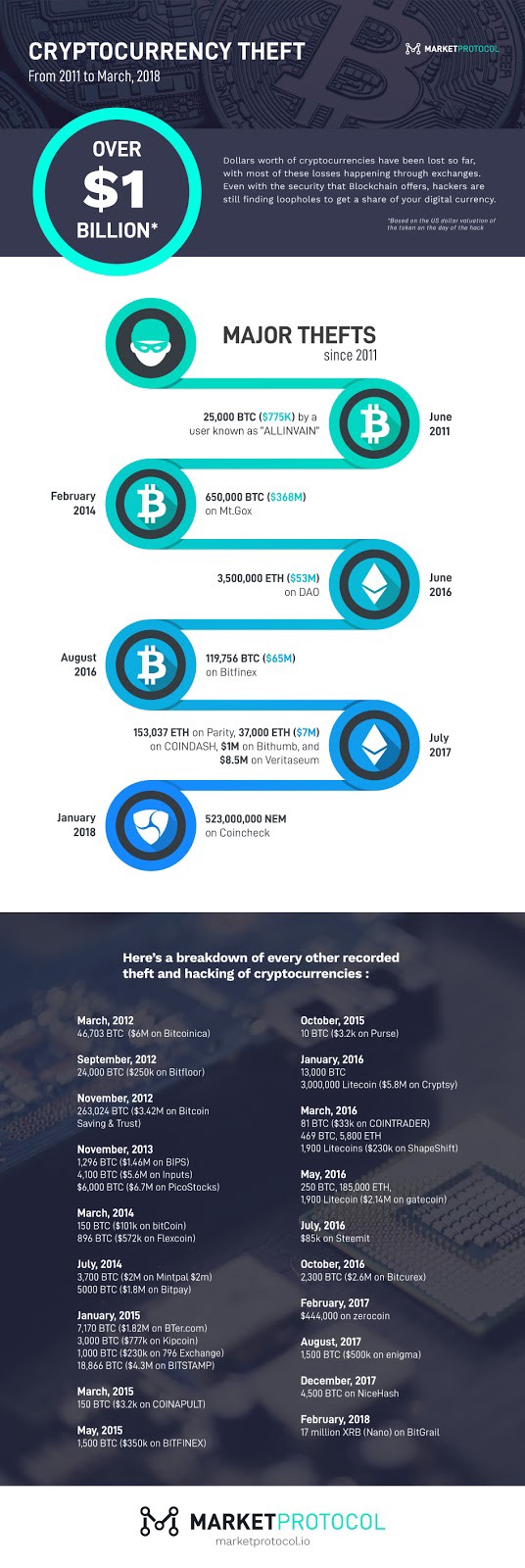

The growing number of cryptocurrency thefts and hacks

The rising value of cryptocurrencies has attracted investors, speculators and thieves alike. Many people have lost their coins to attacks with stolen valuations totaling billions of dollars. But by far, the highest number of thefts have happened on exchanges — around 80%. In 2014, approximately 650,000 bitcoin (now worth over $7 billion) was stolen from Japanese exchange, Mt.Gox, the largest recorded theft to date. More recently, another Japanese exchange, Coincheck, lost $500 million worth of NEM coins to hackers as well.

Yet wallets and exchanges are not the only targets of hackers. Other crypto-related businesses requiring the storage of large amounts of coins have become targets for theft too. One recent example is Slovenian-based mining company, NiceHash, which was hacked for 4700 BTC in December 2017.

Below is an infographic of recorded thefts and hacks of cryptocurrencies from 2011 to March 2018:

A list of recorded thefts and hacking of cryptocurrencies:

(Source: https://bitcoinexchangeguide.com/top-cryptocurrency-theft-hacks/)

Centralization comes with customer service support, convenient UI/UX, greater volumes, and instant off-chain trade executions. But all of those benefits come at a huge cost in favor of issues related to centralized custody of funds, disclosing personal information, and jurisdictional restrictions.

Cryptocurrency wallets

Not only have thefts taken place on hot wallets, but recently cold storage wallets have been a target as well. For example, Nano Ledger S recently discovered a vulnerability. There is also the issue of hacks that happen as a consequence of purchasing hardware wallets from third-party services like eBay.

The awareness of decentralized custody of funds and its importance amongst cryptocurrency traders and investors is one of the main focuses in the industry. One widely used decentralized wallet solution is Electrum. It was released under the MIT license in 2011 and is used for securing bitcoin payments. It is a free, open source software with support for all major hardware wallets and two-factor authentication. Electrum proves that decentralized software can offer a good user-experience and be reliable, however the security issues associated with using it are still ongoing. To compound the issue, Bitcoin is just one of over 1,500 different digital assets. Securing all of them in a decentralized manner is very difficult.

Many Ethereum network participants use Parity wallet to secure their funds. Unfortunately, it suffered a hack in July. It also had a critical vulnerability that resulted in locked funds for 584 wallets in November 2017. Their total balance is unknown, but outside sources have quoted that the funds were worth around 300 million dollars at the time.

Decentralized exchanges

Many market participants are short-term traders. They are not usually holding all of their funds in cold storage. Luckily, we are witnessing the emergence of many decentralized exchanges (DEXs) in the space like IDEX, Crypto Bridge or Bisq. At the time of this writing, none of the top 10 most used decentralized exchanges have been hacked. But they do have other downsides.

The two main issues affecting DEXs are extremely low volumes and lack of cross-chain trading relationships. In many cases, these exchanges only support the trading of ERC20 tokens. Atomic swaps could help solve this issue, but only exchanges for Litecoin/Decred and Bitcoin/Litecoin currently exist. Otherwise, there has been limited progress in the development of ERC20 token swap exchanges.

Novel ways of addressing the issue of custody

Smart Contract technology has empowered gifted developers with an opportunity to build products that could have the benefits of centralized solutions while enabling trustless custody of funds, trade execution, and settlement with no single point of failure.

With MARKET Protocol, there is no need to take custody of an asset. Using a series of smart contracts, a trader can gain the exposure he or she wants without having to constantly move coins from wallet to wallet. The contracts are also fully collateralized using smart contracts to eliminate counterparty risk. Users can trust that their funds are secure while managing their desired market exposure.

Please visit www.marketprotocol.io for more information, and join our discussion about MARKET Protocol on Telegram https://t.me/Market_Protocol_Chat

Coins mentioned in post: