How to survive a crypto market crash

TL;DR:

- Get your emotions in check, don't panic sell, think rationally, observe your mind

- Diversify your portfolio to avoid psychologically difficult situations and getting rekt

- Categorize your investment into short, mid and long-term buys and always stick to it

- Learn to profit from the correction by buying the dip, moving into fiat or margin short

- SUBSCRIBE to CryptoDash or karma will make BTC crash again 📈🚀

A crash is a strong word. I used it intentionally since many think what just happened in the last 48 hours is, in fact, a crash or bubble burst. If we look at a bigger picture, we are just going through a correction which is healthy.

Maintaining sanity whilst looking at all the negative news of doom and government bans can be hard. In addition, negative sentiment across social media influences lots of opinions causing panic sells. Just a few weeks ago a similar thing happened when CoinMarketCap changed their market capitalisation formula on a website.

Considering how volatile crypto markets actually are, it is not a surprise that any digital asset can dip 50% in a few days. Nevertheless, when this event actually occurs, lots of people are not really psychologically prepared. Now ask yourself: "How do I feel losing half of my portfolio value?". Your answer is your risk profile. Many people usually overestimate how much they are willing to lose, therefore the best test is actually being in the market whilst it is happening. It's a harsh lesson, but very worthwhile and can be counted as a tuition towards the future.

Survival tips

1) Psychology

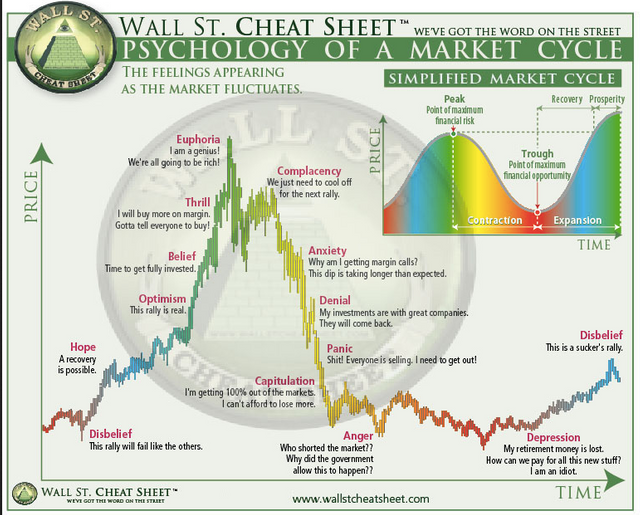

I know, sounds pretty counter-intuitive but you haven't lost any real cash until you have sold at a loss no matter how red the percentage loss is (this also doesn't imply that you should always hold on to your coins, in you should never emotionally yourself to the investments). Market cycles are natural and you might have seen this graph of emotions before:

Nothing grows forever, what comes up, must come down and vice versa. Staying calm and being patient is the key factor to make money in cryptocurrencies. If you feel like your heart is about to explode, you should definitely revisit some psychology books or chill for a while to start thinking rationally about the decisions you are about to make.

You have to dig inside yourself to understand what is working for you. This is probably the biggest point in trading & investing that most of the folks underestimate and eventually it will hurt, both psychologically and financially.

Based on the above, here is another point to consider.

2) Portfolio diversification

As a rule of thumb, if you see your gains going down by 20% regardless of the asset and you are getting all sweaty and nervous. It means you are risking too big of a chunk of your savings and it doesn't fit your risk profile. Now the problem with crypto is that all assets are inherently correlated. Therefore based on the BTC runs or dumps all other digital assets suffer because they are traded in pair with BTC. Nevertheless, some assets are more stable than others based on their volume, price support and market capitalisation (harder to manipulate). In short, here is an example how you can diversify:

- 20% in BTC for short-term trades with tight stop losses

- 30% in BTC for grabbing dips when the market goes down

- 50% in long-term altcoins with at least 3 of the following: proven team, working product, updated GitHub, big & active community, solid advisors (board seats, VCs, angels, backers). Basically, everything that is not scam and has rock-solid fundamentals (think ZRX, FCT, KNC)

This is just an example. Adjust the percentages based on your risk profile.

3) Strategy

Now based on the above we can have 3 strategies in order to accumulate more BTC in a long-term (which is the ultimate goal). ALWAYS categorise your positions into following buys:

- SHORT-TERM - when the market starts correcting, all the short-term trades MUST HAVE stop losses. Otherwise, you will get destroyed and left with horrible assets that may take a long time to recover and eventually leaving you unhappy due to the opportunity cost of other gains.

- MID-TERM - this is something that I have been personally doing mostly based on the combination of fundamentals, technical analysis and news. This strategy assumes you buy an asset 1-2 weeks before the major news and hold during accumulation time until news hit and FOMO kicks-in. Unfortunately, this particular strategy is most susceptible towards huge losses if things go south since BTC can do a lot of things in the meantime, together with the "invisible hand" of news and government regulations. If things go really south, exit the market at break-even. If you missed the exit and project is solid, makes sense to move it to the long-term bag. Don't trade horrible tokens for mid-term, price support usually is very weak. You can notice that some coins dump much more than others (ETH vs. BCD).

- HOLD - pretty self-explanatory. Only hold high-quality projects, and forget about them for a year or two, don't panic sell.

How to profit from the crash or correction

1) Buying the dip

This is usually very rather easily said than done. The worst thing is trying to buy the dip just to realize you caught a falling knife with % loss in a few minutes. If the market is crashing hard, it is beneficial to rather just wait until we see a bounce from key price levels. Close the charts and go for a dinner with friends.

There are no clear rules what actually dip is. In a bear market, it can just reverse and move further down. Thus its always good to look at long-term charts like daily and weekly to see what is the current trend and where are we heading. Makes the decision much more precise.

2) FIAT

Exiting to FIAT requires some good timing and notion of how deep the rabbit hole can get during the dip. Whilst in BTC you can use GDAX, Gemini, Kraken or Bitfinex to sell some BTC and buy back at a lower price eventually making a profit. Same as with finding the dip, it is very hard to predict when the downtrend will end, therefore recommended rather to more experienced folks.

3) Margin short

This option takes into account trading on the margin by borrowing and selling BTC and buying it back at a lower price. Not really recommended for non-experienced users of trading terminals and exchanges, although when executed right can bring lots of profit or also a margin call at the liquidation price (duh). There are plenty of platforms where you can practice short selling like Bitmex Testnet platform.

Conclusion

Keep calm, make your crypto safe and use logic to make rational buying decisions. Again easily said than done, but with some practice, the sky is the limit!

Happy profits everyone & apologies for typos 🤓

If you liked this article, consider subscribing to CryptoDash newsletter. You will get bi-weekly blockchain & crypto articles, podcasts, interviews and other golden nuggets for free!

Coins mentioned in post: