What is FUD, HODL or FOMO in Cryptocurrency Lingo?

Are you caught in a bind not understanding what others are talking about while scrolling Reddit, Cryptocurrency related forums or Slack groups?

Just a year back, I was also left scratching my head when I first got involved in Cryptocurrencies. Therefore, I decided to put together a list of the Cryptocurrency Lingo/Slang which can help out others as well.

Cryptocurrency Lingo

HODL.

A misspelling of ‘hold’ that stuck around to mean ‘keep’. A crypto trader who buys a coin and does not see himself selling in the foreseeable future is called a hodler of the coin.

FOMO.

Short form for ‘fear of missing out’. The feeling when you see a huge green dildo on a chart and you don’t own that coin, so you sell other shit to buy into it freaking out. As crypto trading is still very much driven by emotions rather than valuation, FOMO is a huge factor to consider when swing trading in crypto.

FUD.

Short form for ‘fear, uncertainty and doubt’. Usually used in the form of “xxx spreading FUD again.”

Example: JPMorgan’s Dimon spread FUD by saying Bitcoin is a fraud that will eventually blow up.cryptocurrency lingo spread fud

ATH.

Short form for “All-Time High”. Therefore it means the highest historical price of a specific coin.

Whale.

A huge player who has a substantial amount of capital. Whales are often the market movers for small alt-coins too due to their huge capital.

Pump and Dump.

The recurring cycle of an Altcoin getting a spike in price followed by a huge crash. Such movements are often attributed to low volume, hence the ‘pump’. Traders who pump, buying huge volumes, may wish to invoke FOMO from the uninformed investors and then dump, or sell, their coins at a higher price.

Shill.

The act of unsolicited endorsing of the coin in public. Traders who bought a coin has an interest in shilling the coin, in hopes of igniting the public’s interest in that particular coin.

Bag Holder.

A term to refer to a trader who bought in at a high and missed his opportunity to sell, leaving him with worthless coins.

Margin Trading.

A term for ‘trading with leverage’. In this instance of trading.

An order placed at a future price that will execute when the price target is hit.

Borrowing Rate.

When you open a leveraged position, you will be borrowing coins at a pre-determined rate. This rate will be added to reflect your position’s overall profit and loss.

Lending Rate.

Some exchanges have lending accounts. You may deposit your coins into these lending accounts to lend your coins for others to execute their leveraged trades. The lending rate fluctuates throughout the day based on the demand for shorting the coin.

Fill or Kill.

A limit order that will not execute unless an opposite order exceeds this limit order’s amount.

BUY | SELL Wall.

A wall as seen in the depth chart of exchanges is an amalgamation of limit orders of the same price target.cryptocurrency lingo crypto buy and sell wall

Altcoin

“Alternate coin” so it is everything other than Bitcoin (BTC). Bitcoin is the main index for cryptocurrency market. If BTC goes up, other coins go up. If BTC goes down, other coins go down.

Circulating Supply.

The price of a coin has no meaning on its own. However, the price of a coin, when multiplied by the circulating supply, gives the coin’s market cap.

Market Cap.

A stock’s market cap refers to the market value of the company’s outstanding shares.

In the cryptocurrency market, the market cap is used to illustrate a coin’s dominance in the entire cryptocurrency market.

DDOS.

Short form for ‘Distributed Denial of Service’.

A well-timed DDoS attack at exchanges during volatile movements may be devastating as traders will not be able to execute any order manually.

Don’t forget to be part of our Crypto-Investing Facebook Group too as you can learn about the different types of crypto-coins, the platforms, the price charts and many more!

ICO.

Short form for “Initial Coin Offering”, which takes a page from the usual IPOs investors know.

Coins bought during ICOs are usually sold for a profit when the coin first hits exchanges. This is due to the initial hype which increases demand for the coin.

On the supply side, ICOs create entry barriers as the buyer has to set up his private wallet to receive the coins from the ICO purchase.

Arbitrage.

The act of buying and selling on different exchanges to earn the difference in the spread. Arbitrage opportunities occur due to differences in exchange reputation, community coin preferences and ease of bank funding.

Take note that fees, limits and prices could change anytime when you are transferring your coins between exchanges, especially during volatile times.

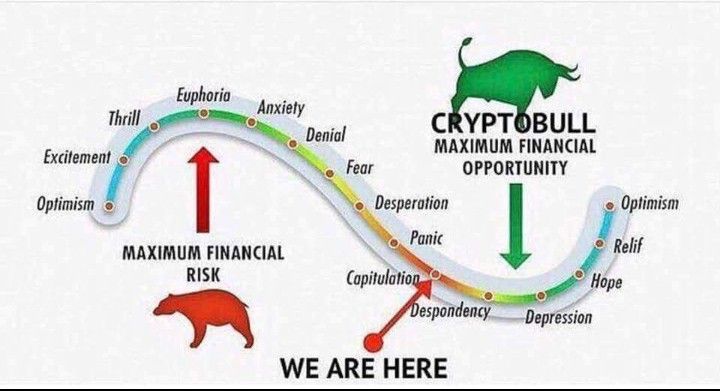

BTFD

“Buy The Fucking Dip” – When people are running around and selling because of fear, this is the time to buy.

Moon

Extreme bullish movement of a coin.cryptocurrency lingo moon

Weak Hands

Those who cannot be patient and sell at loss when the market is down.

Missed out on any Cryptocurrency lingo that you knew? Or have any burning question to ask? Email us (at) [email protected] today!

Are you getting pumped up on the Big Gains in the Crypto-Market?

Stay informed on the latest Crypto-currency Guides and Tools via our FREE newsletter today!

Great post! Very helpful.