Micromoney: The Decentralized Credit Bureau. Bringing 2 Billion unbanked into the New Global Crypto Economy.

What is Micormoney ?

MicroMoney is a microfinance institution that helps the business to become a decentralized Open Source Credit & Big Data Bureau on the Blockchain. Micromoney provide individuals and SMEs (Small and medium Enterprice) short-term loans to meet their financial needs. Micromoney provide clients with online credits with no guarantee prerequisites. Customers can get the cash by simply filling in the application frame on Micromoney’s versatile application. Utilizing machine learning calculations, Micromoney can support a credit in only 15 seconds and can convey the assets in 60 minutes. MicroMoney uses innovative risk scoring powered by artificial neural network. In the long term, Micromoney is able to help 2 billion unbanked and underbanked people to build a multi-purpose digital identity, creditworthiness, and financial reputation. Without geographical boundaries or third parties. Micromoney’s mission is to bring these people to the new global decentralized crypto economy. At the same time, Micromoney aggregate large sets of data showing customer’s needs and their online behaviour. By sharing and exchanging this Big Data, Micromoney thus enable banks, financial institutions, e-commerce, and retail businesses worldwide to efficiently level. They will get access to new customers who were unserved before, mitigate risks while expanding to new markets and better understand the needs of customers.

Global Problem.

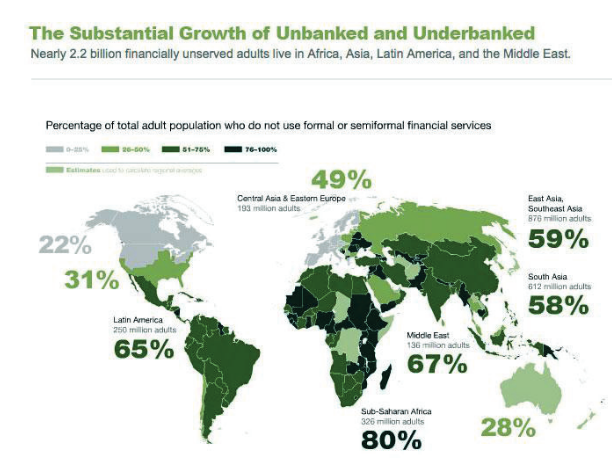

There are still approximately more than 2.2 billion unbanked individuals in the world. These individuals are prohibited from the neighborhood and worldwide economy and they still use cash and don’t approach essential monetary administrations. Applying for a credit is an extraordinary test for them unless they get a history of loan repayment. As individuals overall the world need access to fundamental money related administrations. They have limited ability to overcome poverty and to enhance living standards. That suggests an absence of access to both managing an account administrations like credits, home loans or financial balances and access to every other administration and openings. No record as a consumer implies restricted access to banking services, which implies no advances and no financial record. However, there is a hope to break this endless loop. There is a huge level of unbanked people in the Asia-Pacific Region, which is currently the greater part of the world’s web clients, almost 54% of the world’s online networking clients and approximately 56% of all web-based social networking clients. This pattern demonstrates that most Asian individuals might be unbanked but computerized administrations and inventive arrangements have enhanced individual’s living standards. Below is the diagram that shows the substantial growth of unbanked and underbanked people in Africa, Asia, Latin America and Middle East.

The solution Micromoney is providing.

Micromoney with the team of professionals is working in emerging markets. Micromoney targets 100 countries of the world where there are 2 billion unbanked people who depends upon cash, having no credit history and are widely smartphones users and Facebook. This implies a huge amount of new customers and Micromoney is to bring them to the new global crypto economy. In an emerging market, a smartphone can tell us everything Micromoney need about its owner, so that Micromoney can estimate his/her creditworthiness. The fact is smartphone knows about it’s owner much better than even his/her best friend. Keeping that thing in mind, Micromeony has made an app, which gathers 10,000 parameters. Micromoney analyze this Big Data using Micromoney’s AI Neural Network Scoring and this is enough to obtain a loan approval decision in just 15 seconds. Now, to borrow money using micromoney’s app is as easy as to order an Uber. Micromoney will always keep improving the system too. Micromoney understood that 90% of it’s clients take the first loan in their life. In the meantime, Micro money were overpowered by the thought: by providing money to people, Micromoney is not just helping to address daily needs, Micromoney is helping to create a digital financial identity, to build creditworthiness and reputation and to start their credit history. And if Micromoney want to improve the lives of over two billion people, Micromoney must give them access to the global economy by building and Open Source Credit Bureau on Blockchain Loans through smart contracts, transparent and reliable credit history. Micromoney must enable businesses to get access to our customers, offering them the high level service. Micromoney’s mission is settling poverty and hunger by giving unbanked individuals the entrance to money related administrations and a plausibility to construct their first record as a consumer on a Blockchain. Helping unbanked little business visionaries develop their organizations by offering them online credits. Empowering banks, money related organizations, e-establishments, and retail organizations worldwide to productively scale and serve clients, who already had no entrance to their administrations. Making a broad miniaturized scale financing biological community. For more details about Micromoney project, please visit whitepaper.

In outline, the real motivation behind Micro-Money is to offer;

Offering monetary administrations to unbanked individuals and the best approach to set up their history of credit through the stage of piece chain

Offering advances to unbanked organizations, on the web, to help the development of their organizations

Offering approaches to banks, internet business, money related establishments, and retail organizations to serve and scale their customers, in an effective way, who can’t achieve budgetary administrations

Setting up a situation of miniaturized scale back though offering nearby speculators to set up establishments of Micro-Money

Offering consultancy administrations other instructive devices with the expectation to expand the budgetary information of the customers

Offering present day money related foundations and other budgetary people to encounter an advanced universe of overall crypto economy also.

ICO will start on 18th October and below are the important links for any further details:

Website: https://micromoney.io/

Whitepaper: https://www.micromoney.io/MicroMoney_whitepaper_ENG.pdf

Bitcointalk ANN thread: https://bitcointalk.org/index.php?topic=2199477.0

Facebook: https://web.facebook.com/micromoneymyanmar/

Twitter: https://twitter.com/micromoneyio

Author of the article: https://bitcointalk.org/index.php?action=profile;u=1142652

Hi very nice and good post i like it i upvoted for you please upvote me thank you

https://steemit.com/art/@keerthi12345/its-a-dog-my-baby-drawing-3-years-old