How to pick a coin - Newcomer Strategy for discovering new potential coins.

I cherish new perspectives whenever I can try to find them, especially when it comes to cryptocurrency. In my search for new information, I've found a lot of people need help with a strategy. This is especially true when someone asks "Am I too late?" for getting into BTC or an altcoin. The ability to make an informed decision about which coins to invest in is mandatory before you can get into the market. Please keep in mind that my ideal strategy involves purchasing coins during accumulation phases and holding them during the bull market. The absolute best time to do that was a few months ago, but there are dip periods (such as now) when it is considered wise to accumulate coins to hold them for the long term. The risk in trading coins in great, and while the reward can be massive, you can lose a lot of capital very quickly if you make a mistake.

1. Mandatory resources

Without information you can't make any decisions. The bare minimum websites you should look at are coinmarketcap and coingecko.

Coinmarketcap has quick links to specific coin websites, communities, and message boards for further information. Coingecko is similar, with links to community sites and conversion calculators as well. These two websites are great for getting initial information on a coin's market performance and being able to look further.

2. Good Technology

The technology behind a coin ideally needs to be practical, future proof, and have a use in the real world. A good example would be the recent rise of RDDcoin, which saw a rise in volume due to the real world application potential of the website tipping system, and a classic example of this is Ethereum's smart contracts which saw its massive rise over the last few months.

3. Active Development

Every decent coin should have a development roadmap, active updates, and a communicative developer. If you look at a coin and the developer hasn't made an update in a long time, it's likely not worth your time and money.

4. Trustworthy Developer

If you can look into the experience and history of the developer, make sure there is a history of integrity and consistency.

5.High Volume

A coin needs to have high volume in order to be remotely valid. I feel like at the current market cap, a coin nearing 1 million should begin to be considered. As the market cap raises this value should raise as well.

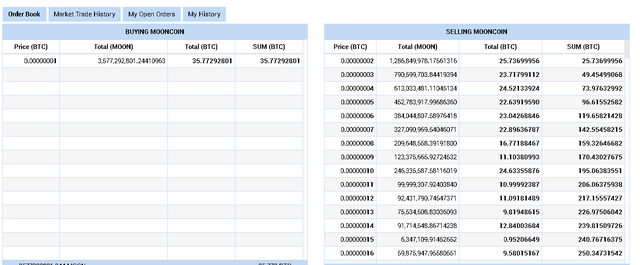

A coin needs to have high trading volume because without such a thing, there is no liquidity. Often most coins see a massive amount of sell walls, and in order for a coin to raise in value it needs to be able to move through them. Coins with high trading volume will demolish sell walls, and ones with low volume will see no upward movement. A good example of a coin with low volume seeing no movement is mooncoin.

Looking at the bids on the left, there is basically no volume for the coin to move upward. This coin would need to push a few hundred thousand in volume to raise, not considering if this sees upward momentum that the volume might need to rise to match new sellers. When a coin is liquid, it will see consistent momemtum.

7. It's available on a higher volume exchange

A coin on an exchange with higher volume has more users with more money to raise the volume of the coin, but on top of that, an exchange with high volume will be able to maintain its financial integrity.

8. Only buy during accumulation / Never buy during ATH

Ideally you only want to buy a coin during the accumulation and hold phase. If a coin is rising in volume and % gained, you ideally should wait for profit taking and the next accumulation phase. Buying at all time high is a guaranteed way to not get the most out of your investment. Keep in mind that experienced traders will take advantage of the FOMO (Fear of Missing Out) that causes people to purchase at ATH.

8. How to find interesting coins

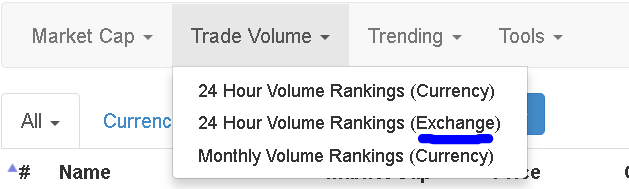

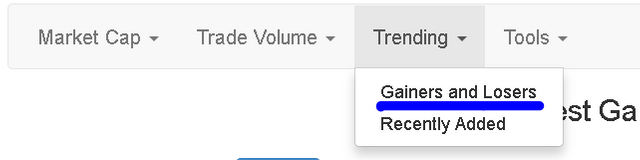

My favorite tool for finding high volume coins and exchanges gaining momentum is using the tabs on coinmarketcap. The trade volume tab can be used to find liquid exchanges to compare coins you find to their exchanges, and gainers and losers will show you coins which lost and gained the most throughout the day.

There are more strategies to cover in general, but I wanted to focus on how to find valid new coins for this blog. Thank you for reading my insights!

There are better ways.And that is to find coin before it's listed anywhere.One example:https://bitcointalk.org/index.php?topic=1857875.0

I mined few millions of this coins,if they get to exchange,and i sell them for only few satoshi,ill make nice profit.New coins are easy to mine,and if you are very lucky,maybe you can profit big.

All alt coins start their life on Bitcointalk.org forum,and that's the place if you want to be among first to find out something about new projects. :)

Thank you for adding this - I was considering adding very ground level coins and it's viable if you get lucky like you said. I felt like it was out of scope for this though. I may do a write-up on this later.

It's a lottery.Almost nothing to lose,except week or two mining...And there is a possibility o BIG gain. :)

I just pick airdrops. Some are here: https://crypto-airdrops.de