Is ICN Undervalued? Price Analysis and Overall Market Opinion

It is my belief that through using traditional valuation metrics, ICN is currently undervalued. The irony is, ICN is one of few Blockchain assets that has enough scope to allow for valuation metrics to determine current market price.

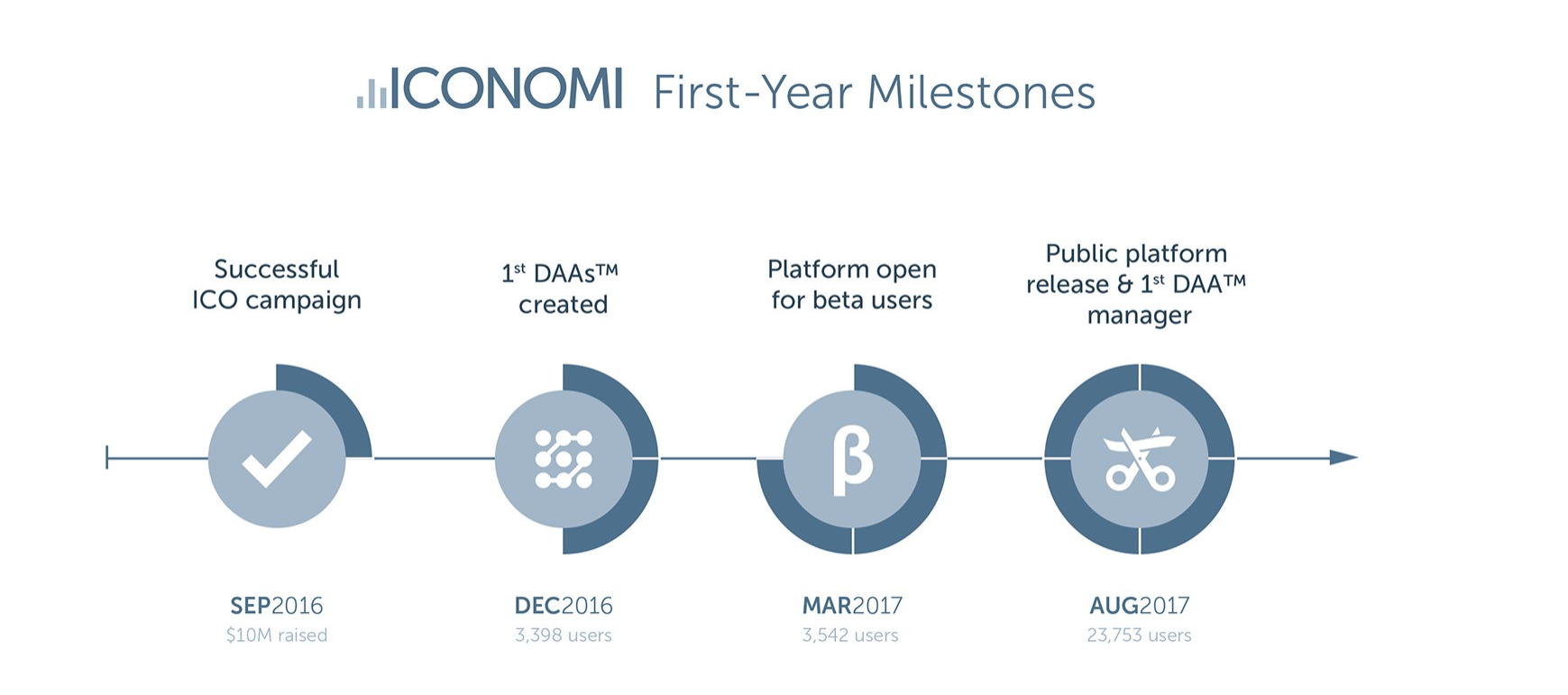

ICN represents a share of the Iconomi platform all inclusive of assets, intellectual property and future profits. It was distributed in an ICO late 2016 which raised $10M.

In the last Q2 Financial Report, Iconomi reported a book of value of $108M. That means the percentage of ICN you own in relation to total supply of ICN is the same percentage you own relative to book of value. Back then, the combined marketcap of all blockchain currencies and assets was $100B. As of posting this article, that marketcap is now $150B. It is safe to conservatively assume that current book of value should be in the $130-$140M range, however, that is only a rough estimate and will be confirmed in the coming weeks through Q3 Financial Report.

![]()

Current Marketcap of Iconomi is $150m. It is my belief that this is reflective of an irrational overall market and the current state of dumb money flowing around . I am going to look at the current price from a risk : reward ratio to determine whether it is accurately reflected.

Let's Start With Risk

The worst Case Scenario:

- SEC deems ICN a security.

- Kraken ordered by SEC to delist ICN.

- Iconomi's decentralised ownership structure deemed illegal by EU and all major governing bodies worldwide.

- Assuming those extreme circumstances, Iconomi would have no legal right to exist and offer products and services within any jurisdiction in the world. In addition, it would have no exchanges that supports its trade. The team behind Iconomi would need to shut it down and return all assets; divided equally to each ICN hoder. An Ethereum smart contract would allow you to claim a proportional amount of ETH relative to the ICN you send to it. Source: Comment from discussion ICONOMI AMA - May 2017.

- Assuming those extreme circumstances, Iconomi would have no legal right to exist and offer products and services within any jurisdiction in the world. In addition, it would have no exchanges that supports its trade. The team behind Iconomi would need to shut it down and return all assets; divided equally to each ICN hoder. An Ethereum smart contract would allow you to claim a proportional amount of ETH relative to the ICN you send to it. Source:

Yes, if the absolute worst case scenario were to occur, today, right now. Each $1.5 ICN you buy is backed by roughly $1.3 worth of ETH (If we go by last official estimate, it is roughly $1.1 from Q2 report). I struggle to find any other Blockchain project that has such an impressive financial position, which is directly related to the tokens you hold.

There is of course the risk of a total market collapse meaning the book of value is likely to be a lot less. However, this risk is not specific to ICN because all Blockchain currencies and assets would be affected by it. Could it happen? Yes, of course. It is important to also keep perspective that this current $150B bubble is no where near the Multi-Trillion Tech Bubble from early 2000s. NASDAQ peaked at a combined value of $6.7 Trillion before it collapsed. Let that sink in for a minute.... :)

Enough doom and gloom, lets talk about the reward aspect of this equation:

Iconomi has 30,000 users as of September, almost double the users 16,000 in August. 100% monthly user growth indicates strong demand for Iconomi services. The average lifetime value per user in most tech firms is $100. That is why companies like FB, Google, Snapchat, Twitter etc… have such high valuations. However, those companies are not great at monetising those users. The average annual revenue from each user is around $1 per year. I would argue Iconomi should have a higher value per user because the annual revenue from each user should be greater than $1. However, even a very conservative approach adds $3m to the valuation.

We have to also consider the intellectual property of the Iconomi website. Intangible assets such as the proprietary trading engine, trademarks, brand, domain and existing infrastructure would be at least $5M conservatively. Considering that these days it costs roughly up to $1.5M just to develop an app with the same complexity. A fully functional platform with proprietary trading algorithms with a potentially scalable API to integrate within mobile apps and private Blockchains justifies a much higher value.

In terms of revenue, Q2 generated $16,573 from trading and withdrawal fees. This number is deceivingly low for a few reasons. Back then, the beta was being rolled out slowly with limited access to initial testers who signed up last year in November. It was limited to just a few hundred people. Then it was rolled out to ICO investors who again slowly received invites in batches and not all at once. There was a trading limit of 1.5 BTC per user throughout and only one DAA to invest in. At the time it was called ICNX but now it is Blockchain Index (BLX). We will have a better idea of revenue in the coming weeks based on next financial quarterly report. We can then extrapolate that to an annual figure that encompasses projected growth forecasts.

Iconomi needs to generate roughly $2m in revenue per year roughy to reach profitability or at least cover the costs of operating the platform. My personal estimate based on limited figures available is Iconomi would probably start to generate the revenue required by end of Q1 2018 just from fees alone (I.e. Generate $166k in March 2018 from trading and withdrawal fees). This would be a fantastic achievement for a Start-Up Fin-Tech company in it's second year of operation. However, I will not hold them to this deadline as I realise adoption and potential delays need to be accounted for. This is just my guess and further financial reports are needed to accurately project those figures.

I also have not considered profits from CCP (formerly ICNP) that is a closed fund and was seeded with $5m from ICO. Last estimate was close to $50m in last quarterly report and probably higher now. Realised profits from CCP will fuel more buy-backs, cover operational expenses and most importantly enable future investments back into scaling the platform. Also means raising further capital in the future will be unnecessary. A solid bonus for ICN holders who do not need to worry about future dilution.

Wait what are buy backs? This is how profits are distributed. ICN is purchased from exchanges and burned every quarter. In simple terms, the available supply of ICN will decrease overtime from profits generated by the platform. Based on the law of supply and demand, as long as there is steady or increasing demand for purchasing ICN, the price will increase due to the deflation of supply. Furthermore, ICN is widely expected to have a central usage within the platform for the creation or management of funds. If the platform is successful, the demand for ICN will rise and so will its market value.

Conclusion and where does this leave us?

The current price basically accounts for everything in place today and does not reflect the future growth potential. Normally when you attempt to value a company, you add the total value of everything right now and multiply it by 2-5x depending on the industry you are in (hint, Fin-Tech companies are usually the ones on the higher end of the scale) because you have to also account for projected growth.

From a risk : reward analysis, it seems the ratio is extremely favorable. At least based on traditional metrics. However, this of course assumes that crypto markets are rational efficient markets that can properly measure an asset’s value and future growth while pricing in the risk involved. Unfortunately, this new wild west is far from that right now. This of course presents great opportunities for the arbitragers and the speculators, but shows how early these markets are in their development and why there is a strong need for tools and services to measure the value of assets for the average crypto enthusiast.

**** One last thing to touch on to paint the full picture:

There is of course a strong case to be made that usage of ICN is not strictly defined yet and hence resulted in the current downtrend in price. I personally see it as the most ‘scientific’ excuse to justify this downtrend. Just like how every correction or bubble in history has some sort of excuse as to ‘why’ it happened. Seriously! You can look at long-term charts yourself of the stock market 20, 30 and even 50 years ago. Search each time period of a recession and there will always be some sort of excuse that in reality does not take into account the emotion of humans and the power of fear. Boom and bust cycles happen and will continue to happen because humans are involved. Humans are not robots and will sometimes make decisions based on emotion not mathematical certainties and logic.

![]()

The most obvious answer that makes most sense to me is that people in this space are simply impatient and driven by greed. I believe many investors/traders don’t look at fundamentals behind projects. They look at marketing and hype. They prefer to buy what their favourite YouTuber is shilling or whatever is pumping on Coinmarketcap. They throw millions at a website with a whitepaper even though it will most likely never generate that as revenue or value to the end user. They buy because Paris Hilton told them to on Twitter. They sell because China banned crypto (for the 5th time I think).

This whole space is comical. Despite the obvious flaws that cause my mind to boggle like this, I find it fascinating to watch it evolve at its infancy.

While the herd flocks to the next shiny brand new decentralised smart contract quantum resisting zero proof knowledge blockless and blockchain agnostic platform built on satellites with laser beams that travel faster than speed of light and process 1 million transactions per second when it is released in 2019.

I’ll stick to projects that generate revenue and/or value for its users. The ones that demonstrate strong growth and/or development. The ones that are most likely to reach the economies of scale needed for longterm self-sustainability.

Why? because those are the ones that will survive.

Disclaimer:

The content above published by steemit.com/@isteem should not be relied upon as advice or construed as providing recommendations of any kind. It is your responsibility to confirm and decide which trades to make. Trade only with risk capital; that is, trade with money that, if lost, will not adversely impact your lifestyle and your ability to meet your financial obligations. Past results are no indication of future performance. In no event should the content of this correspondence be construed as an express or implied promise or guarantee.

@isteem love your wrting style and I think your last part was spot on:

While the herd flocks to the next shiny brand new decentralised smart contract quantum resisting zero proof knowledge blockless and blockchain agnostic platform built on satellites with laser beams that travel faster than speed of light and process 1 million transactions per second when it is released in 2019.

I’ll stick to projects that generate revenue and/or value for its users. The ones that demonstrate strong growth and/or development. The ones that are most likely to reach the economies of scale needed for longterm self-sustainability.

Well thought out article and interesting perspective. I think ICN has really strong potential!

Thank you, glad you liked it! :)

Congratulations @isteem! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPThats Crazy.

we need to promote cryptocurrency to others to make brighter future

Congratulations @isteem! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!