The Crypto Markets Are Crashing Again

Last week was a stressful time for cryptocurrency investors as the markets plunged, seeing Bitcoin lose over 17% of its value over a four day period. BTC peaked at around $17,000 in December 2017, followed by a sharp drop to $7,000 in February 2018. Volatility is part of the game, but that doesn’t make it any easier for investors looking to take part in the crypto markets. Long-term crypto investors may understand these kinds of drops. Still, it’s hard to treat cryptos as a legitimate investment vehicle when drops like this seem to be the norm.

This Kind of Volatility Isn’t Okay

With tokens constantly evolving to provide streamlined investment opportunities, traditional cryptos like Bitcoin, Ethereum, Ripple, and others are being exposed for what they are — speculative bets on a new technology. Now, that isn’t to say that the crypto markets are just a form of gambling.

They definitely are not.

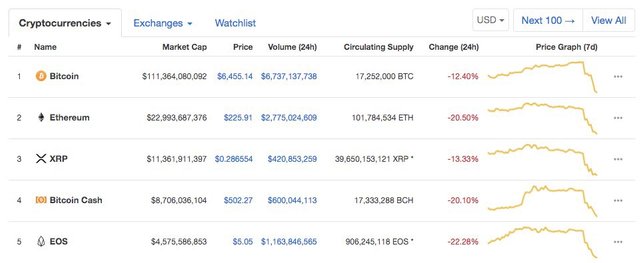

However, if we want to normalize crypto investing, we need to find ways to overcome this kind of destructive volatility. When Bitcoin, Ethereum, and Ripple drop like this:

You know you have a market that lacks stability.

What Caused This Crash?

Big banks have already made efforts to stabilize the crypto markets. The first move was the CME Group’s decision to create Bitcoin futures. By tethering Bitcoin to the futures market, it was thought that it would normalize prices and create proper flow. Still, the markets continue to witness large swings as certain events cause volatility to spike, leading to larger drops. On top of that, Goldman Sachs previously hinted at their desire to create a crypto trading desk. However, it appears that they are shelving that idea for now. It was this news, the fear that big institutions just aren’t that interested in cryptos, coupled with fearful investors, that caused Bitcoin to plunge 17%. If you read deeper, there is even a rumor that nearly $700 million worth of BTC was transferred from the Silk Road to the various public exchanges, leading many to believe that a big selloff is coming. All the goodwill that was built up since mid-August has been wiped out in a matter of four days. As an investor, how can you have any confidence in the crypto markets when things like this can happen almost overnight? The answer’s easy.

Asset-Backed Tokens Like Tiberius Coin Are the Solution

Asset-backed tokens like Tiberius Coin aren’t affected by volatility the same way.

Why’s that?

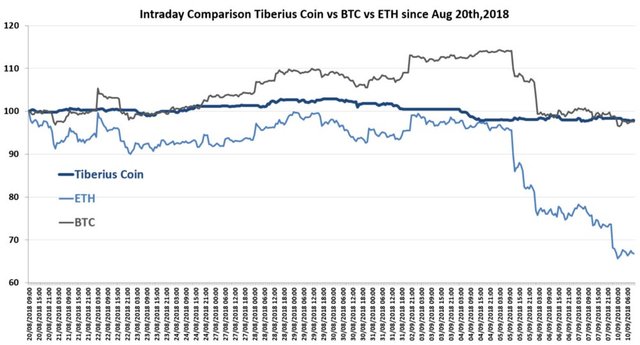

Because every Tiberius Coin is backed by the value of its underlying metal. Its value cannot decrease rapidly because the tech, electric vehicle, and stability metals that it’s backed by do not drop rapidly. The metal markets are simply too big to drop like that because they are worth far more than the entire crypto market. Let’s look at last week’s crash for perspective.

Unlike the major cryptos (BTC, ETH, and XRP), Tiberius Coin performed quite well. Where popular cryptos are fueled by irrationality, perceived value, and other unreliable sources, asset-backed tokens like the Tiberius Coin have legitimate value due to the metal that backs them. You see, each Tiberius Coin can actually be redeemed for the underlying metal too, making it an investment tool, a tradable commodity, an inflation hedge, and even a token that major manufacturers can use in the creation of tech sector products.

Stability and Transparency Do Exist

While most tokens are speculative bets, the Tiberius Coin is anything but that. You can always predict the value of a Tiberius Coin by simply checking the major metals that back it. There’s nothing wrong with investing in the major cryptos. That’s part of the game when it comes to speculating. However, if you want to speculate, you should also take the time to hedge your bets and protect your portfolio. Tiberius Coin provides you easy access to both the crypto and multi-trillion dollar metals market. So, the next time BTC melts down, you won’t be as worried because your portfolio will be partially protected from these kinds of irrational movements. Tiberius Coin is set to go live October 1st 2018, we’re ready to bring you the change you need, are you ready to accept it?

Change is good.

Stay up to date with the latest information about Tiberius Coin. Join the official Telegram discussion today!