Will the ICO market clear up scam?

Bubble experience

According to the Gartner report, the blockchain has not yet entered the stage of getting rid of illusions. This means that the growth of skepticism and a decrease in rash investments by several times is normal, provided that the technology continues to develop and overcome its own limitations. It also means that not all blockchain projects will survive, but those who can - will take a confident, if not a leading position in the market.

A similar situation could be observed during the dot-com bubble. Investors with high expectations turned a blind eye to traditional metrics like price-earnings ratio and made decisions based on belief in technology and the loss of profits (FOMO), which led to the formation of a bubble in the securities market. Of course, there were fraudsters who took advantage of the situation.

When the bubble burst, few survived. The names of the dead will not say anything, but the survivors are known to all: Google, Amazon, eBay. Online stores used the already existing successful business model - TV shops and catalog sales. Amazon and others intelligently adapted it, automating orders, payment, and logistics.

Causes of scorching

What we are seeing in the ICO market is a repetition of the dotcom history. A lot of HYIP, 'stupid' money and fraud. All this leads to swelling and subsequent explosion of the bubble.

But if the explosion is still to come, then there is too much noise in the present that makes it difficult to see the future unicorn.

In order not to fall for scam, you need to understand the reasons why a project may turn out to be:

Intentional fraud. ICO organizers do not have a goal to make a real product - they just collect money and disappear.

Victims of fraud. The organizers of the ICO have good intentions, but their website is hacked, and the money of investors is spent on another wallet.

'Stupid' money. The product has a weak concept, useless realization, but there are people who have invested in it.

Incorrect / poor management. The organizers spent a lot of money on creating the HYIP around the project, but not enough money on the product itself.

As a result, all suffer. Good projects do not have access to the audience because of the hype around scam and the rising cost of marketing. Investors instead of consistent investment play the lottery.

Cleaning methods:

- Regulation

The paradox of many ICOs is that, in postulating the value of decentralization, they give control over their cryptocurrency to a small group of people. There is a need for external control.

State regulators are taken away from the scam. For example, the US Securities and Exchange Commission (SEC) is filing lawsuits and closes dozens of illegal ICOs. Her report refers to 271 projects marked with a “red flag”. On the one hand, it is a lot. On the other hand, this is only 18% of the viewed projects. And this is against the background of research on the proportion of scam among the ICO, which feature a horrendous figure of 80%.

- ICO not needed

There is a radical opinion that ICOs are no longer relevant, the market has become disillusioned with the tool and it is being replaced by venture investments in blockchain projects.

But common sense dictates that the ICO will return as soon as the market and projects become more transparent. Indeed, after the collapse of the dotcoms (as well as after other NASDAQ collapses), investors did not cease to participate in the IPO.

Considering the SEC requirement to register tokens as securities, it can be assumed that the difference between the IPO and ICO will gradually erase, but the meaning will remain the same - the projects will retain the ability to attract a wide range of investors, significantly increasing capital and increasing the liquidity of shares (tokens).

- Conscious investing

So, regulators do not minimize the risks soon. At the same time, projects that sell tokens at a price higher than the selling price exist, as there are also promising products created within the framework of ICO. To find them, you need to be able to sift the scam, and for this you already have the tools.

3.1. Manual analysis

In the network there are many checklists and methods for self-determination of scam. They all say that they need to check the team (do these people exist in reality? What did they do before the ICO? What is their expertise?), Read the whitepaper (what percentage of water and plagiarism?) And look at the MVP (is progress visible on GitHub ?)

You can dig deeper: check for KYC (Counterparty Identification) procedure, multi-signature (transaction reversibility), Escrow (transit account to guarantee the transaction), stabilization fund in case of force majeure, distribution of tokens (what percentage remains with the authors?).

Aerobatics - search for authors by e-mail and phone number in order to study the background, look for a legal entity on online maps, check dates of site registration (were they created last week?), Study old versions of sites through webarchive.org and, finally , ask technical questions to the authors of the project and to experts in thematic chats in Telegram and Reddit (the scammers either respond as extensively as they are, or are silent).

The pros and cons of this approach are obvious. Only you and no one else makes conclusions about the reliability of the project. In this case, you spend time and risk losing sight of something. In addition, the project can be tested once, but in the dynamics to show yourself is bad - you will need to constantly monitor the projects that interest you.

3.2. Ratings

The ability to save your time is provided by rating agencies. Their huge plus is that the low rating of the project with a high degree of probability means that it really should not be trusted.

With a higher rating is more difficult. Ratings are based on indirect signs, such as hype in social networks and expert estimates.

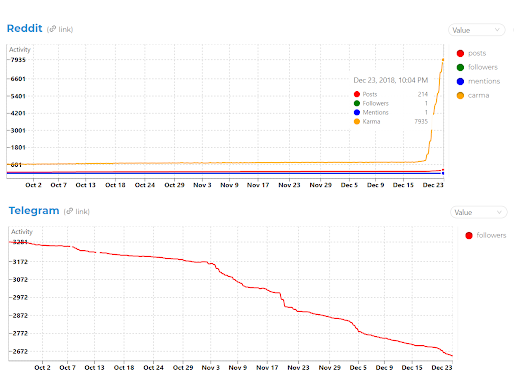

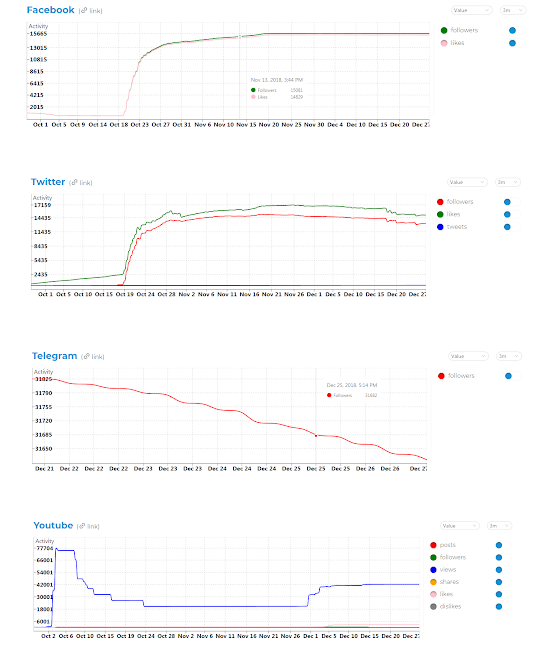

The karma of the Quarkchain project on Reddit has grown 10 times in a few days against the background of the constantly falling number of subscribers in the Telegram - a sure sign of cheating. Source: cryptomado.

Unfortunately, practice shows that if the scam project wants to attract attention, it will raise a wave in social networks, launch a viral hashtag on Instagram or catch up with subscribers in a chat in Telegram (where they will exchange trust lines after opening the scam).

As for the experts, they can also be engaged or deceived.

One example is the history of ICO Benebit, which received a 4.1 rating on ICOBench and collected $ 2.7 million, after which the crowdfunding organizers disappeared.

COBench is one of the rating agencies that investors are primarily looking at, and which are referred to by major media, such as Bloomberg.

On the other hand, you can find user investigations on the ICOBench topic online, according to which you can buy expert status in order to sell reviews later. And on Bitcointalk there is a separate thread with the sale of such reviews.

However, ICOBench's charges of evil intentions often resemble provocation or prejudice. ICOBench quickly removes purchased reviews and pages of scam projects. But the fact remains that ICOBench is not immune from errors.

A low ICOBench rating may be the primary filter for dropouts, but then you still need to study the project yourself.

And it seems that investors understand this. CNN writes, based on the Singularex study, that the relationship between expert estimates and the amount of raised investment is not found. In other words, if someone invested money in the project based on the ICOBench rating alone, it was a fluctuation. Other factors, such as site traffic (in the form of Alexa Rank), GitHub activity and the number of subscribers to Telegram or Reddit, affect the size of the collected investment is much stronger.

3.3. Analytical tools

Manual analysis as well as rating is based on expert assessments - only you become an expert yourself. This method is time consuming and subjective.

It is important to look at the data in the dynamics. The sharp increase in the number of subscribers to Reddit may look suspicious, and rare updates on GitHub indicate low development productivity.

Alpha-X is a bright example of cheating. The number of followers on Facebook and Twitter has grown 10 times in a few days, and almost simultaneously. Subscribers from Telegram are steadily leaving, the number of views on Youtube has plummeted - the project is massively deleting the video.

Such data, along with inclusion in the White List, the presence of KYC and ICOBench and ICOrating ratings, are provided by the Cryptomado service. On bloxy.info you can see analytics for each individual token and the market as a whole, santiment.net provides working tools for trading.

Unfortunately, none of these services will insure the investor from having the ICO website, in which it is invested, hacked, and the funds were taken to the side.

The advantage of analytical services is that they are not based on expert assessments, but on data, and give an idea of the project in retrospect. Among the minuses - on these services, while you can not find all the data you want to get.

The market lacks transparency, and the tools that would have become for ICO and blockchain the same as what Alexa became for the Internet are badly needed. So, services based on data will evolve. Expert judgment will give way to analysis using independent data sources. The number of criteria for evaluation will increase, the volume of data too - at some point this will allow the use of machine learning. It will be more difficult to manipulate such services, and the number of scam projects will decrease.