A beginner's guide to crypto currency investment

So you've heard your friend, coworker, uncle or random guy on the bus talk about crypto currencies so many times that you have finally decided to venture into it yourself? And now you wonder how you get started?

That was my situation not more than six months ago, and with this article I will try to share with you what I have learned in these six months of holding and trading crypto, to make the journey a bit easier for you.

disclaimer

I have no affiliation with any of the web sites mentioned in this guide, and the list of web sites is by no means exhaustive. It is simply the sites that I have found helpful, so use them at your own discretion and always be sceptical of advice from a stranger on the internet. The currencies used in the examples are just that. Examples. I might personally own some of them, but that doesn't not mean that it is a good idea for you, and this guide is by no means an endorsement of said currencies.

The initial buy-in

The first thing you have to do is exchange some of your hard-earned cash to crypto currency. For the time being, you cannot just buy any crypto currency you like with dollars or euros, so you have to start out by buying some of the larger ones, such as Bitcoin or Ethereum. The quickest and easiest way is to use your credit card. When using a credit card there is a daily limit on the amount of dollars or euros you can spend buying crypto. It is currently around 500€ per day. If that is not enough for you can make a bank transfer, but this may take much longer depending on your bank and the site you are using. If you are buying in for large sums the best thing you can do is to find an exchange in your own country and make the transfer to them. In this way you do not need to wait for the several days an international bank transfer takes (it's funny, this is actually one of the problems that is tackled by some of the crypto currencies out there).

Ok, so you have your credit card out, and are now ready to swing it. Here are some of the places where you can buy bitcoin with your credit card:

https://bitpanda.com

https://blockchain.info

https://cex.io/

When you register with one of these sites, make sure that you read everything carefully, and make sure that you save all the information that the site ask you to. Always turn on two-factor authentication when asked to. This makes it much harder for anyone to hack into your account and steal your valuables. The most common form of two-factor authentication uses google authenticator, which is an app on your phone that generates a six digit code that you need to type in to gain access to the site after you enter your username and password. Now that we're talking about passwords, I recommend that you use a different password for every site you use. You can always use a service such as 1password to help you remember.

Buying more exotic currencies

Ok, so now you have bought your first Bitcoins. Then what? Well, if Bitcoin was the currency you wanted to invest in, then that's more or less it (even though you should consider how you keep it, so please read on). But if you want to buy some other currency it's time to find an exchange that trades in that currency.

But what currencies are there?

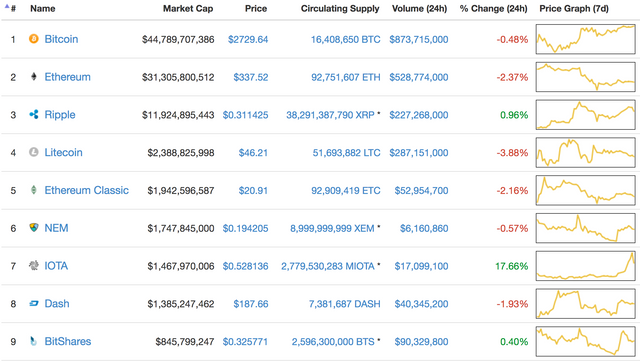

The number one place to explore the crypto currency market is at http://coinmarketcap.com

Coinmarketcap shows you all the 700+ currencies that are currently being traded, ranging from the one with highest current market cap, which is Bitcoin at around 45 billion dollars to the currencies that anyone hardly ever trades with market caps as low as a few hundred dollars.

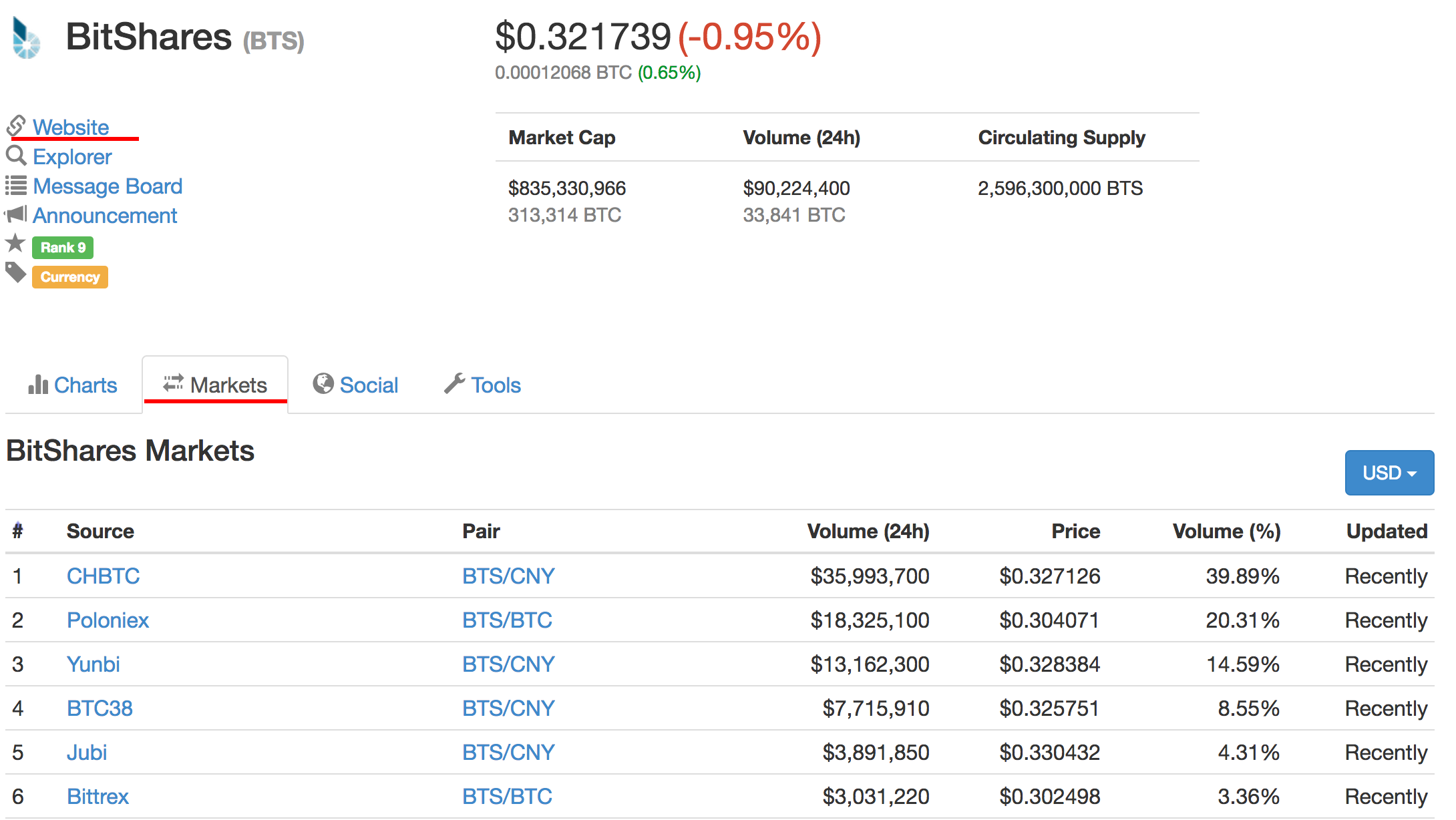

Coinmarketcap has a wealth of information for each currency, including the official web site for the currency, and where it is traded. If you click on the name of a currency in the list, you will see something like this:

If you click on Website, you are taken to the official web site where you can read all the details about the currency. You should always do this as an absolute minimum before investing. If you click the Markets tab, you can see which exchanges have this particular currency. They are listed in order of volume, meaning that the first exchange in the list has seen more trades in terms of value (meassured in dollars, during the last 24 hours) than the second one in the list and so forth. It's a good idea to trade on an exchange with high volume for that coin.

These are some of the exchanges that I have used to trade:

https://poloniex.com

https://bittrex.com

https://www.kraken.com

When registering on exchanges always enable two factor authentication, and always apply for level 2 or higher verification. Level 2 verification means that you have to send them photo's of your passport, and of yourself holding your passport. If you don't do this, it may take a lot longer when you want to withdraw your values from the exchange. Bear in mind that the exchanges have to live up to loads regulations regarding anti-money-laundering, so if they don't positively know who you are, any withdrawal that you make is sure to be flagged for manual approval and will take forever. Also have in mind that these exchanges are experiencing a great extra load of users signing up these days, so the actual verification may take some time to process. In my experience it was only a few hours on bittrex, whereas on poloniex it took more than a week.

Storing your assets

Ok, so now you have bought the currency that you wanted. What next? Do you just let it sit on the exchange? Well, if you plan on selling it again in a few days time, you could probably just leave it where it is. But an exchange is not a secured vault, so for your long term investments you should move it. If you haven't heard the horrific tale of Mt. Gox you should probably take the time to inform yourself and see why storing valuables on an exchange can be dangerous.

So, time to move your digital asset away from the exchange. The process is more or less the same for most coins, so I'll just give you an example. Say you have bought some Syscoin (SYS). You would now need to download and install the official Syscoin wallet. The easiest way to find the official wallet is to go to the website of the currency (as mentioned above) or just plain googling it.

What you need to understand about wallets on your own computer is:

- They take a long time to get up and running

- They take up a lot of space on your hard drive

- If you throw away the keys you lose your crypto currency. Gone... forever!

It takes a long time to get up and running, because once the wallet starts, it needs to download the entire blockchain to the computer. The blockchain is the ledger of all transactions that have ever been made using the currency. It is public, and is cryptographically verifiable, and it is needed by the wallet software to function. The blockchain can take up everywhere from a few gigabyte of disk space to tens of gigabytes, so you need some free space on your computer.

I would like to point out that there is a big difference between the wallet itself and the wallet software. The wallet software is what enables you to perform transaction on the currency's network. The wallet itself is something else. You may be used to think that a wallet is something that contains things. In the crypto currency world, that is not really the case. In crypto, a wallet is just a key that can unlock the assets that are stored on some address(es) on the blockchain. Nothing more nothing less. So as long as you have the key, you have access to the assets that it can unlock.

Therefore it is important to encrypt the key with a password. You do this by going to Settings and choose encrypt wallet. When this is done the wallet software closes and you need to open it again. If you don't do this, someone can steal your key and use it to get your valuables. If you encrypt it, someone would need to steal both the key and the password. So choose a hard to guess and unique password.

When the wallet is encrypted, you should make a backup of it. Go to File and then choose Backup wallet.

You need to store the wallet/key somewhere where you don't lose it and it doesn't get stolen. An external hard drive or usb drive is one option. You should preferably make more than one backup copy of it. Be careful if you upload it to cloud storage. You never know exactly how secure your cloud storage is.

Ok, now you are ready to send your Syscoin from the exchange to your local wallet. You find your receiving address under File and then Receiving addresses. Copy the address and go to the exchange and withdraw your Syscoin. I always start by sending a very small portion of my currency to make sure that everything is working as it should. I recommend that you do the same, because sending cryptocurrencies to the wrong address (or to an address of another currency's network) by mistake will likely result in you losing it entirely. When you withdraw from the exchange, you will be asked to enter your two-factor authentication code and maybe even to click on a link in a confirmation email.

Ok, I know that this may sound a bit overwhelming. But it is actually not that hard at all when you get the hang of it. And you can always run the risk of letting your valuables sit with the exchange if this is too much, although I don't recommend it.

HODL or day-trade?

Should you just hold (or hodl) your currency or should you try day-trading? Well, if you observe the crypto currency market, it is obvious that it is very volatile with prices going up and down every day by many percents. So if you could time your buys and sells correctly there is a lot more money to be made than can be made from simply holding the currency and watch the value go up (or down) over time. So it is a bit up to you and your temper. It is definitely tempting to try to day trade, but I can say from experience that it is not as easy as it sounds. I have personally not given up on the idea at all, but to be honest I have not had any success at all with it, so it will be something that I have to study more. If someone reading this has any insights please leave a comment below for us all to learn.

Initial coin offerings/crowdsales

Initial coin offerings (ICO's) are all the rage in crypto world these days, and I'm sure it wont be long before you stumble upon a ad for some new ICO. Basically, an ICO is a way for a team of people to gather money to develop some idea within the crypto currency realm. It is also an opportunity for you to buy that currency at a cheap price and make some money. Historically, participating in ICO's has sometimes been like striking gold (for example if you participated in the Ethereum ICO) but there have also been tales of ICO's that were mere scams to steal your bitcoins. So before you decide to participate in an ICO you really need to study the project closely. Take a close look at the team. Who are they and what have they done before? And make sure to read other people's opinions aswell if you don't feel capable to assess the value of the project entirely.

Free coins? There's no such thing as a free lunch.

I'm sure you'll stumble upon a link or someone saying that they have a bulletproof method for acquiring free coins. Be extremely wary of such claims. People will try to lure you into fantastic software programs that make money for you. The only thing you have to do is pay a subscription fee and money will start pouring in. Needless to say, if it sounds too good to be true it usually is. Most, if not all, of these programs are pyramid schemes in disguise.

There are a few ways that you can get free coins, but they will most like not work for you without specialized hardware.

Mining and staking

The processes of mining and staking are ways of helping a currency's network to function by validating transactions. Different currencies use different methods for validating transactions. Bitcoin uses an algorithm called proof of work (PoW) or mining. Mining is extremely CPU (or GPU) intensive and to successfully mine coins, you need your computer turned on at all time, consuming a lot of electricity, and you also need hardware that is very up to date. In theory you could start mining any currency right now, but in practice you would not have enough processing power for it make sense.

Staking, as opposed to mining, requires you to have a stake in the network already by owning some of that network's currency. So if you have the right type of currency in your local wallet you might be able to stake a few coins, but you will still need your computer turned on at all time. To read more about the difference between mining and staking see this post on stackexchange.

Just as a curiosity I want to mention that the currency Burst uses Proof of Capacity, an algorithm that lets you mine by using unused disk space, which is much less energy intensive than cpu mining. You still need a lot of empty hard disk space to get started here and you also need your computer on at all time. Some coins, such as Komodo, earn interest just by having them in your wallet (if you keep them on the exchange, the exchange keeps the interest).

Study and keep yourself up-to-date

Here are a few more sources of information that you may find useful.

http://www.altcointoday.com/ - news about currencies

http://www.coindesk.com/ - news and analysis

https://bitcointalk.org/ - bitcoin forum

http://www.investopedia.com/ - Investor reference

There are a lot of people you can follow on twitter to learn more about crypto. I have personally been enjoying @WolfOfPoloniex, but always remember that people may have ulterior motives to say what they say. Always form your own opinion.

Keeping track of your investments

You may reach a point when you have invested in quite a few currencies and it becomes hard to keep track of the day to day value. I have found that the app Blockfolio is very helpful in this regard. There are other apps out there that do the same, so choose the one you like the best.

Glossary

You may come across a lot of new terms in your new endeavor. Here are some of them explained:

Wallet: Can either mean the software that lets you do transactions on the network or the key that unlocks your funds on the network.

Blockchain: A public digital distributed ledger.

2FA: Two-factor authentication. By using it your account is more secure than without it.

Altcoin: Alternative coin. Basically all other currencies than Bitcoin are "altcoins".

ICO: An initial coin offering.

PND: Pump and dump. A scheme employed by a group of people who seek to drive the price of a coin up to sell a lot of it after which the price rapidly declines again.

FIAT: FIAT money is what you know as "normal" money, ie. money that is created and backed by a government.

FOMO: Fear of missing out. Fomo creates higher demands and pushes prices up.

FUD: Fear, uncertainty, doubt. FUD creates lower demands and panic sales, driving prices down.

Conclusion

The world of crypto currencies is an exciting one to part of, but remember that you always incur the risk of losing part of, or your entire investment. So my best advice is read, read and read to be as informed as you can possibly be.

Thank you for reading along. I wish you the best of luck in your investments!

Thanks for the lesson! I'm new to this and didn't realize the two factor would help at withdrawal time. Off to go set that up now!

Great and thorough overview, thanks for taking the time.

I can appreciate this - "It is definitely tempting to try to day trade, but I can say from experience that it is not as easy as it sounds." It's too tempting to be left to our emotional response, usually out of sync with our best interests.