Weekly crypto update 20.05.2018 - More Correction Coming

General overview

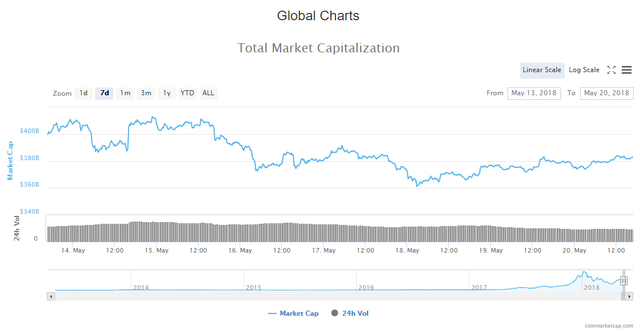

Market Cap: $383,203,468,592 24h Vol: $15,118,655,008 BTC Dominance: 37.2%

At the start of the week on Monday 14. May cryptocurrency market cap evaluation was 407,285,000,000$ and it soon dropped to 386,345,000,000 before it spiked up to 412,903,000,000$ which has the week’s high. From Monday to Friday market cap has been steadily dropping and it hit 361,113,000,000$ which was the week’s lowest point. From yesterday, the evaluation has been increasing but it looks like it entered the bearish territory, judging by the spike to 383,159,000,000$, and a quick drop. However, this may be a new support level, as the evaluation appears to be stabilizing around these levels.

Analysis

BTC/USD

At the start of the week the price of Bitcoin was 8700$ and the only time it went higher was on the same day when it hit 8815$ after a drop to 8365$. It is now sitting at 8370$ which is a 4,8% decrease.

Looking at the daily chart we can see that Monday’s candle was a pin bar doji which indicated stronger buying pressure than the pressure from the sellers, but the position of the candle, however, indicated more downside.

Yesterday’s candle closed as a red doji and as you can see from the wick, the price hit the 0.382 Fibonacci level and retraced since so judging by the wick there’s still a lot of selling pressure.

Today’s candle is green, which is very unusual for Sunday, as on weekends there’s a lot of selling going on.

Market sentiment

Daily chart technical signals a strong sell.

Oscillators are on sell and moving averages are indicating a strong sell with 13 MA’s on sell.

Pivot points

S3 5360.5

S2 7120.1

S1 7795.5

P 8879.7

R1 9555.1

R2 10639.3

R3 12398.9

ETH/USD

From Monday till today the price of Ethereum has decreased by 2,8% coming from 733$ to 712$ where it is now sitting. The price fell even lower to 660$ on Friday which is the week’s low.

On the daily chart we can see that the candle on Monday was a pinbar doji like in the case of Bitcoin, and since the price fell to 0.5 Fibonacci levels, where it found support. Yesterday’s candle was a doji also like in the case of Bitcoin, and the current one is green but not higher than yesterday’s which is still a bearish sign.

Market sentiment

Ethereum’s daily chart technicals signal a buy.

8 oscillators are on neutral and moving averages are signaling a strong buy.

Pivot points

S3 499.01

S2 596.73

S1 646.17

P 694.45

R1 743.89

R2 792.17

R3 889.89

XRP/USD

From Monday’s open till today the price of Ripple has declined by 5,82% coming from 0,73$ to 0,688$ where is currently sitting. The price went further down on Friday to 0.645$, but since it has been steadily rising to the levels on which it is currently.

Looking at the daily chart we can see that Monday’s candle was a pin bar doji like in the case of Bitcoin and Ethereum, but correlation doesn’t end there as we can see that yesterday’s candle was a doji also, like it was on the BTC and ETH daily charts.

Market sentiment

Ripple is still in the sell zone, as daily chart technicals signal a sell.

Oscillators are 3 on sell and 8 on neutral, but moving averages signal a strong sell with 12 on sell.

Pivot points

S3 0.48085

S2 0.58545

S1 0.63011

P 0.69005

R1 0.73471

R2 0.79465

R3 0.89925

LTC/USD

Overall, this week Litecoin has decreased by 3,38% - from 144$ on Monday’s opening to 139,2$ where it is today. The price went higher than it was on the opening to 151$ on Monday, and it was lower than today’s, on Friday 129$ which was the week’s low.

Looking at the daily chart we can see that the price of Litecoin is currently interacting with 0.236 Fibonacci retracement level which serves as resistance. On Monday there was a great indecision which can be seen on the Monday’s candle wicks. On Wednesday we had a pin bar doji that closed above the Fibonacci level which indicated buying pressure, but as you can see the buyers failed to push the price higher, and the sellers were stronger so the price fell below the Fibo level on the next day.

Market sentiment

Daily chart technicals signal a sell.

Oscillators signal a sell, and moving averages a strong one.

Pivot points

S3 90.493

S2 114.733

S1 124.937

P 138.973

R1 149.177

R2 163.213

R3 187.453

Conclusion

I don’t believe that the corrective move is over. The prices of four major cryptocurrencies failed to exceed prior highs even though we are experiencing a move to the upside in the last couple of days. I think we are in for another low.

This will correspond with a retest of prior resistance for support which is around $333B.

For more information about what’s likely coming in the following week make sure to watch the substitutionary video in which I provide a forecast and reasons why I believe there’s another low coming.

For more daily, weekly updates, chartings, trade setups, educative text click the follow button, and make sure to check https://forex.academy/

▶️ DTube

▶️ IPFS

Coins mentioned in post: