Crypto Noob Lesson 1 of 5 — Exchanges: Heed the Market

{The Giant Disclaimer}

First and foremost, if you don’t know me personally at all or aren’t familiar with who I am, I will let you know that I am the furthest thing from a cryptocurrency/blockchain expert. I have however, learned a lot in the last 3 years, from those who've gone before me, and from my own sometimes harsh learning curve of 'noob moves'.

Crypto "Experts"

Be wary of all the ‘crypto consultants' out there. A lot of them are just selling their Level 2 knowledge to Level zero noobs, and the problem with that for me is that a Level 2 person is only at my level and doesn’t nearly understand enough about where things will go or what will happen... to be even remotely certain they aren’t guiding people right off of cliffs. This is why you will not hear me adamantly point you to/recommend any one business name {exchange, wallet or otherwise}. There are things I feel comfortable advertising, and things I don't. On my facebook page among friends I will tell people exchanges I feel happy with. But 'feel happy with' is as far as I will go. It means I haven't personally encountered issues thus far, and for all intents and purposes it seems most others I run into are also satisfied with that exchange. Research on the exchange I personally use has 'checked out' to my own personal satisfaction, and that's as far as you should take that.

Some of the crypto experts in your social media feeds can help you, and they mean well; they're like your friendly neighborhood buddy who understands it quite a bit more than you may, and you can pay them to help you out... but it's important to learn enough yourself so that you also understand the level your buddy is really at, too. No need to fork over big bucks for information you could have learned in 2 seconds on YouTube, and information that isn't even thorough or properly inclusive.

If you happen to be someone who knows zero about any of crypto except for having joined Steemit here, I could almost sound like I’m totally knowledgable when I say an opinion I have, and some who know zero about any of it might think I know everything you could need to — faaaaaaaaar from it.

I'm A Permanent Learner, so Should You Be

I am on a giant learning curve with this technology every day, but having been paying attention to it for over 3 years [that's not even that long, you guys], I can honestly say that I did learn a few obvious 'what not to do’s in the last couple years.

Had I not done the typical ME thing I do, where I dive into something head-long trying to figure it all out by myself [an attribute of mine that has served me well and cost me greatly], I would have had a much less stressful ride in the crypto realm, and I would not have lost some of the money I did, in the various ways I lost it.

Crypto Noob Series

Ok, so here’s the deal.

I’m going to do a 5 part lesson series, wherein each one covers a topic related to cryptocurrencies. I'll just give some very basic pointers in each, backed by examples of something I specifically did so you understand why it was an ignorant ‘noob move’. Haha!

For those of you who always sort of intuitively understood how to trade, what to research or look out for, what graphs and charts that display markets really are and how to read them… for those of you that this came easy for, if you think I must be a moron for some of these moves, that’s fine. My ego is not wounded.

I’ve demonstrated in being who I am that I’m a sharp cookie in a lot of ways, I can almost always figure something out eventually, but we are all capable of being ‘retarded’ at something that to us is very foreign, especially when we really just don’t quite get what it is we’re looking at.

Ready, GO—

Cryptocurrency Exchanges : Noob Lesson 1 — HEED THE MARKET

The exchange websites you trade your currency on absolutely do matter.

Important questions to ask yourself:

What are my ethical and practical values with how I store and move my money?

Do I value privacy, and if so how much?

Do I value anonymity, if so how much?

Do I value speed and low cost transactions? How much?

Security?

You get it.

Yes, there are several that work well, but they are not all designed the same way, they are not all created equal. It is important to at least know what you’re walking into when you’re moving your monetary assets through these mediums.

Don’t Go To The 'Myspace’ Exchanges

There are what I would call the “back alley” exchanges. In those places, it's basically Sketchyville. Think of them as places where BOTH the owners of the site as well as the coins being launched and sold on the site are scammy, and your money might magically disappear when you try to trade it or move it off the site.

What should you look for, to see if an exchange is a ‘back alley'?

They are typically swamped with cryptocurrency coins coming from everywhere, disproportionately more coins than the other exchanges list, most of which are what some call ‘scam coins’ or ’shit coins’. On these exchanges there will appear to be no functioning support team, they will never respond to you and you will never have a real way to reach them.

And how will you confirm a lot of this about an exchange?

When you lookup their name in your search engine, you’ll find forums where people are fairly vocal about their experiences on the various exchanges. Read through different websites where commenters are discussing their preferred exchanges or why one is a sketchy place.

If nearly everyone is shouting angrily about an exchange, lack of communication, lack of support, loss of funds or weird transaction errors... that’s your huge warning to stay away from it. Even the best of exchanges will have complaints from some, but when basically everyone is saying “NOPE”… LISTEN. Listen to the market of your peers warning you about the hot stove that burned them, don’t touch the hot stove.

"Can you name some Hot Stoves/Back Alleys, Amanda?”

You betchya! Here’s two I know of for sure, and yes I got burned on them both, which is why I’m warning you all. And I’m far from the only one saying “stay the heck away” from these.

Yobit.net & Poloniex Taught Some of Us Hard Lessons

Yobit.net was one exchange that I was actually warned ahead of time is a sketchy one, but then at the same time there were some people I talked to who said they didn’t mind using it at times for buying specific coins which [they believed] were legitimate but hadn’t yet launched on the other exchanges.

I should’ve, but I went on too little info, and figured that I could use it briefly here and there when I needed to move money around because of maintenance on some of the other exchanges.

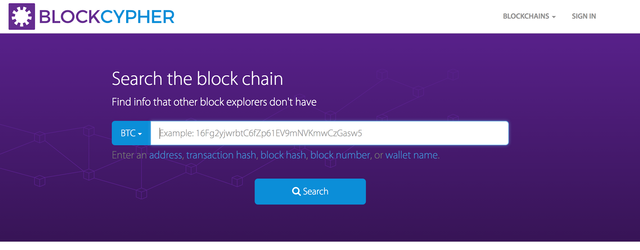

*A HUGE RED FLAG about Yobit is that unlike any fairly reputable exchange, you cannot see the details of your transaction.

You can see that a transaction for an amount occurred, under the deposits and withdrawals section, but you do not get to click on a transaction ID number that lets you see the transaction on the blockchain.

Well, I went to withdraw a cryptocurrency off of Yobit.net to move it to a better exchange, and ever since I did that, the Bitcoin Cash I had is gone. Other people have complained about this happening, I have since discovered.

I've always quadruple checked an address before I send, so the likelihood the address was wrong is slim to none.

...but on Yobit, there's no way to revisit the details of the transaction. The transaction is listed on Yobit as "cancelled", with no explanation or ability to see why it is, because I cannot view the transaction. The support team never responded to me, if there even is one? The transaction shows cancelled but my money never re-appeared in my wallet on the Yobit Exchange, and never got to where it was sent.

Similar problems among others have occurred on Poloniex as well, but the problem is that this was the first exchange I was ever on. Since most my friends at the time trading on Poloniex were also noobs like I was, none of us really knew there would be problems with Poloniex or how to look for signs of possible 'sketchyness' and/or instability and unpreparedness.

So there was no one I knew yet personally to warn me early on, and at that time I didn't see warnings online about it. That is not to say I couldn't have done better research though. Such is life!

I ended up with a lot of issues with my money being held up or disappearing for awhile before reappearing, and that might have been fine if it was only due to maintenance issues that the people working for Poloniex communicated to their customers about.

...but the Poloniex team quite literally ignored support tickets for ages, before a lot of people abandoned the exchange, and it seemed to light a fire under them to start at least responding with something so their customers had an idea what was amiss.

*A lot is forgivable if you simply communicate with your customers that you're doing your best but are behind or having technical issues. If you've ever been trying to provide a service to a customer, and understand business, you know things can go wrong, and technical issues occur. But leaving all your customer base's money hanging in a balance while you stay dead silent on what is going on, is absolutely unacceptable.

And guess what? There are plenty of exchanges that are quite a bit better or more promising so far.

![buffalo-jump-11[6].jpg](https://steemitimages.com/DQmUcAQByrZFDXB7PHPcTVFquHsFsuV8UybpCSSMrEfSgHt/buffalo-jump-11%5B6%5D.jpg)

A Few Other Important Things To Note

There are the most common, centralized exchanges, which are often easiest to use for Crypto Noobs. However, this ties into, again, asking yourself what your goals are here. Right now, in this space, you sometimes sacrifice a lot of security with ease-of-use, and that's important to know. Ideally everyone wants to have a moderate amount of both, but this tech is still new to the world and still growing and therefore is lacking a lot.

Anyone out there reading this who knows they're far above my level of understanding the space is welcome [nay, asked] to comment with sound advice or pointers.

Some popular centralized exchanges that people have been happy with [still be careful and do your research, don't take anyone's word for it] are Bittrex, Bitfinex, Binance, GDax, and Kraken. There are quite a lot of exchanges now and many of them are newer so it's hard to know all the way which ones are going to prove stable, with integrity, and which are not.

I have not tried all those exchanges listed, but I have paid attention to how many people seem satisfied with certain ones. Just because an exchange is less popular doesn't mean it's Sketchy, but it could mean your money gets stuck sometimes if the exchange suffers "growing pains" as it gets more of the crypto market moving to it.

PLEASE Do Your Best To Understand the Risk of Exchanges In General

A lot of these things you're reading are why you hear people say "DON'T LEAVE YOUR MONEY LAYING AROUND LONG ON EXCHANGES."

I don't think it's always the scariest thing to have your money on an exchange, I do still, and being on an exchange in and of itself hasn't been problematic for me if it's a good one.

Remember, Crypto Is A Risk, but It's Getting Less Risky Than The Dollar Every Day

In some sense everything with cryptocurrency is a calculated risk.

As the concept of government demonstrates-- Centralization of assets exposes those assets to huge risk. Government is the threat to security that masquerades as the protection itself. However, any centralization, such as with exchanges, means there are risks to be considered for the user that won't exist with decentralized exchanges.

We should all be careful not to be doing things blindly as much as possible, in this new space. We should take care with our words so as not to be leading others down paths we don't ourselves fully know.

There's no reason--with all the information out there on exchanges now, all the reviews by traders--to do anything entirely blindly or to just guess about where to stick your money/whose platform to move it through. That is the point to take away here.

There is always some risk in a new tech frontier, and if you don't at least do a bit of searching and reading first,well, you could run into some very very frustrating issues that involve something precious-- the digital representation of your spent LIFE/TIME.

This is a well written and researched post. I've come to some similar conclusions in my own research (so I know it wasn't easy) and agree with everything you said. Very much looking forward to your next posts in this series!

Agreed, Very well said!

:)

To succeed in buying and selling you must be honest and honest in your business

Here's a guy who gets it. I like you. Can't wait to see the next part!

I am a woman, actually. But I'm glad you feel that I 'get it'. Thanks for the support!

Thanks Rachel. It's a constant learning process and this article helps fill in some missing gaps for me.