WARNING - Why I think that market is topping right now. How to prepare for the upcoming storm.

Supply and Demand

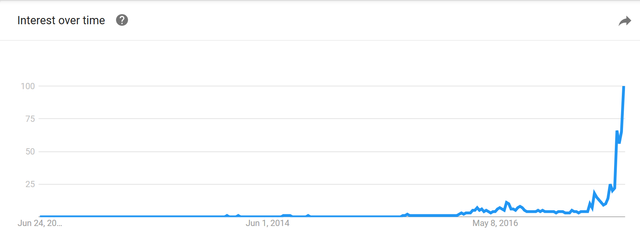

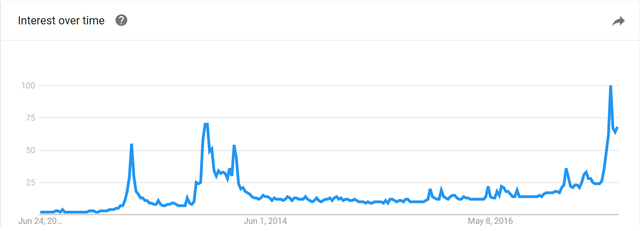

Currently the biggest risk factor is mining. Go to any cryptocurrency forum or board, check Reddit and other websites and you will find that crowd went frenzy about mining coins. I just looked up for two phrases in Google Trends.

mining coins

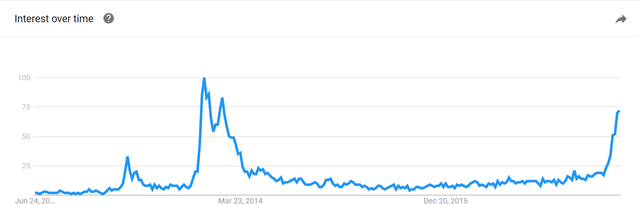

mining rig

Firstly I checked ,,mining coins" and I was like well the 2013 pattern is coming in it's glory. But then when I saw ,,mining rig" results it got me stunned. There are no more available Radeon cards and waiting time in many store is over a month. Recently AMD announced that they are going to introduce special ,,mining" cards, probably to counter the demand for their cards which is soaking all cards for mining and players are left with nothing.

https://www.cryptocoinsnews.com/nvidia-amd-to-release-cheaper-bitcoin-mining-gpus/

Mining is currently a great supply threat because miners are not investors, nor long time hodlers. They just bought some hardware and want to profit on it, ROI, as fast as possible. And now they can get return on their investment in less than a month if mining Ethereum.

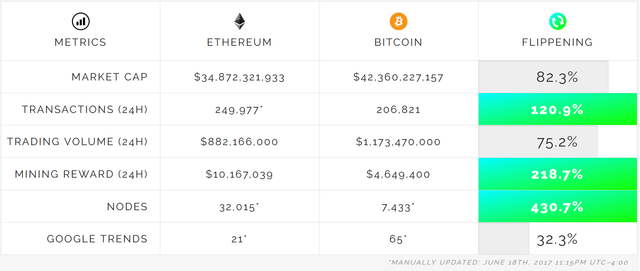

If you check the infamous Flippening website you can see that mining ETH is already 118% more profitable than mining BTC. Transaction number also already surpassed BTC by over 20%. The count of nodes in ETH is 330% higher but this is nothing unusual due to the technical characteristics of these coins. Although BTC is still unbeatable when it comes to popularity (Google Trends), trading volume and the market cap. But the gap is tightening.

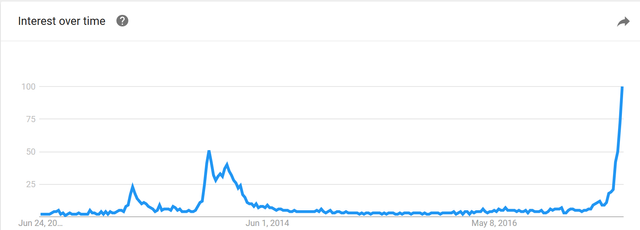

Take a look at Bitcoin in Google Trends

Bitcoin had it's peak few weeks ago and cooled down to relatively healthy levels. This is an interesting divergence because public interest in BTC dropped more than the price. My interpretation is that many weak hands left the boat but because strong hands are still there so the price had not reflected that drop.

and Ethereum

Which correspondents much more with the actual price chart.

The price of Ethereum is driven by ICO's. If you take a look at ICO ROI vs ETH you will see that only few projects surpassed ETH in profits but in most cases it was more profitable to just HODL Ethereum instead of putting it into an ICO. The demand for ICO is great but Etherum as a mother of almost of ICO's is taking the biggest advantage of it. If you want to buy an ICO of ERC20 token you need to buy ETH. Because there were so many projects in the last few months, with this month being the mania phase, there was a great demand for Ethereum. ETH gets trapped in ICO contracts and goes out of circulation for X amount of time. But will be back in the market one day which creates

But if you look at ICO calendars you will see that there are not many projects after half of July. Here is the list of upcoming ETH token ICO's with expected demand:

20.06 - Status (HIGH)

21.06 - Skincoin (MID)

21.06 - Civic (HIGH)

22.06 - OpenANX (LOW)

26.06 - AdChain (LOW)

29.06 - DAO.Casino (LOW)

30.06 - Sentiment (LOW)

July

01.07 - FundRequest (LOW)

17.07 - MyBit (LOW)

TBA

Prospectors (LOW)

Starbase (MID)

Mainstreet Investment (LOW)

For upcoming ICO's check:

So basically the ETH based ICO bonanza ends this Wednesday. Only Status and Civic are going to produce high demand for ETH but still much lower than Bancor did last week.

Press Release: Bancor Announces $153 Million Raise, Largest Token Generation Event in History

Just last month I was amazed by the ICO croudfundings:

66 million USD collected in ICO's in last 30 days - do we have a bubble?

Usually very bold events can mark tops.

And the whole market is looking like a topping formation.

I wouldn't call it a double top yet but the tempo of appreciation is slower then few weeks ago and we might be facing a serious correction soon. But it isn't said that it will be the whole market correction.

We might see crashing ETH because no ICO demand and all ERC20 tokens going to hell with it while BTC might start appreciating because the recent Bitmain announcement is already priced in so even expecting hard for the price is still over 2600$

My trade ideas are following:

Get rid of ETH before this Wednesday.

If you have a high risk tolerance than short ETH but don't go too crazy with a leverage.

Liquidate altocins so BTC accounts for at least 50% of your portfolio.

Get rid of mineable cryptocurrencies because the mining bonanza will turn them to ashes like it did back then in 2013.

Don

t you think that some of the Ethereum money will go to other cryptocurrencies such as Steem, Zcash or PIVX.... some of them dont look that much overpriced.They will for sure.

Great analysis, check my recent post on Ethereum and why I think there may be legs up, you are welcome to comment as well https://steemit.com/ethereum/@daudimitch/ethereum-is-less-than-7-billion-usd-away-from-overtaking-bitcoin-marketcap

Nice post, I have something which may add to it! https://steemit.com/cryptocurrency/@patcher/investing-101-5-basic-tips-for-beginners-in-cryptocurrency

I think you mean more profitable than mining BTC? judging by the comparison chart you had up, thanks for the advice, so I've been mining BTC for a few months, I'm doing cloud pool mining and I've noticed my returns are diminishing slightly, you think BTC would still be profitable when ETH drops? obviously wont be as profitable as it used to be but technically I just need to be turning a profit to keep this contract running.

BTC of course...

I think when ETH goes to hell then BTC will regain.

Did you see @kyriacos post yesterday The Magnificent Ethereum Machine? I think it applies here to your prediction. haha

Oh so funny haha.

Highly appreciated you knowledge about cryptocurrency & upcomming trend

Great Analysis

Thank you. We will see next week if I was right.

Got two days to take this in consideration. Still rather hold ethereum than Bitcoin over the summer.

Very interesting and thanks for all your stats and blog

Thank you.

Pleasure - have a great week

Thanks for sharing.

Good data here, however I think this time it will be different. Crypto like Steem, civic and Tezos are just getting started..I think we will see a shift this time, instead of a crash... Watch out for ripple (XPR) if it does crash, they seem to have an inverse relationship.

Check Out My video of Why Ethereum is the future of the internet

https://steemit.com/ethereum/@newmarket65/why-i-believe-ethereum-is-the-future-of-the-internet

Follow Me and I will follow you