Crypto Hedge Fund Costs? Invest $100k and Here's How Much You'd Pay

Hello Steemians,

Nobody works at no cost – least of all hedge fund managers.

So, despite their investments in bitcoin, ether and different rising digital assets, there area unit definitely no major leaps in however cryptocurrency hedge funds seem to be hard their prices.

All crypto hedge fund managers get paid within the fees they charge to investors – and, similar to in ancient markets, those fees are not continually straightforward to know. hard the prices and potential come back on your investment will prove difficult, providing fee structures area unit typically delineated in ways in which marry the worst aspects of expressive style with the wonky accounting of tax documentation.

To shine a lightweight on however these prices work, CoinDesk obtained a replica of a fee structure for a cryptocurrency fund. the subsequent example is loosely supported a product currently actively offered within the market, however greatly simplified to create its terms and conditions easier to take apart.

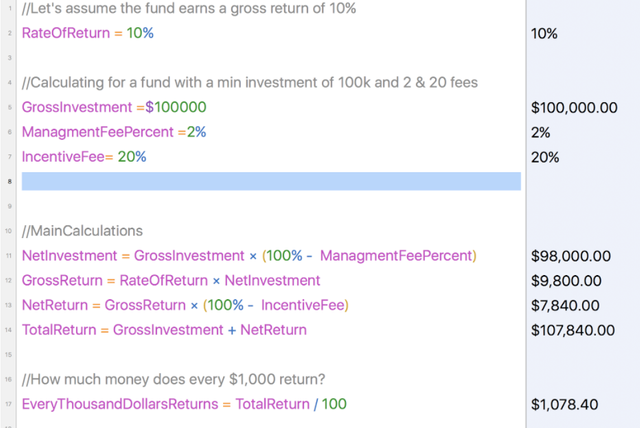

CoinDesk assumed a $100,000 investment in a very fund with a vanilla "two and 20" fee structure that earns a ten % gross come back.

source: coindesk

While the instance below is simply that – one example – it will still be a useful metric to assist you in your evaluations. After all, whereas a cryptocurrency hedge fund could {also be|is also} appealing – it ought to also be compared to the professionals and cons of your own active management.

Management fee: $2,000

The first purpose to know once viewing a fund is that the management fee, that is what you pay direct as before long as you invest within the fund.

The typical management fee is two % on each greenback you invest. As associate degree example, as an example you have found a fund with a solid strategy, and it's a minimum investment of $100,000. this suggests that on your $100,000 investment, you'd get charged $2,000, that means you are solely "putting to work" $98,000 within the investment.

Right off the bat, that is cash that will not be going directly into the market, and in cryptocurrency, wherever there are historical advantages to holding, that may be one thing to contemplate.

Still, that may not essentially be a deterrent. as an example at the tip of the year, the fund generates a ten % come back, as during this example, you may find yourself with a doubtless enticing profit.

Depending on what you were expecting, you will be excited otherwise you is also defeated – however, either way, you are most likely not done paying fees nonetheless.

Incentive fees: $1,960

In the most simple analyses, there area unit 2 styles of fees that hedge funds charge their investors: management fees, just like the two % mentioned earlier, and "incentive fees" that area unit applied to profits.

In a typical, vanilla fund state of affairs, investors pay around twenty % fees on their returns. These fees area unit sometimes referred to as incentive fees as a result of they request to align capitalist returns with the compensation of the fund managers.

The percentages charged on incentive fees area unit generally way above management fees, that is smart, as a result of the fund's managers or general partners area unit being rewarded for his or her product's performance. So, the larger the come back that fund managers create their investors the larger the fees they earn for themselves.

Let's still assume that the fund you invested with in generated a ten % gross come back. Since you attained ten % profit on your investment once management fees, the gross come back, before the inducement fees were charged, would be $9,800.

A twenty % fee charged against your gross come back means that another $1,960 in fees get assessed.

Total cost: $3,960 and come back

So, adding it all up, you'd pay a complete of $3,960 in fees on your investment within the fund.

Let's take a glance at the investment from a distinct angle — the speed of come back you received on your investment.

source:coindesk

After the management fee and incentive fees get charged, investors would receive a $7,840 internet come back on their investment, or a 7.84 % rate of come back for the year.

Whether or not that matches the bill together with your expectations, is up to you because the capitalist. As mentioned on top of, given the acute volatility of the cryptocurrency markets, there are often top or draw back in swing your cash to figure directly on offered exchanges.

Still, if you are looking for exposure to a really volatile market, and you are not fascinated by doing the legwork needed to actively manage your own portfolio, the on top of example ought to provide you with a much better sense of the potential prices – and potential returns.

sourcce:coindesk

Thanks for Looking in,

@dattabiitcoin - A.K.A CryptoAstronaut

Want more followers??? Just Do This-------------> https://steemfollower.com/?r=3542 (guide is there )

Thank you so much for sharing all this information! that's great! All the best! Waiting for more posts! :)

thanks man, i will never stop sharing info that i think will e valuale ffor crypto society , llove u alll guys

Awesome man! great article!

thanks so much :)