Bitcoin Energy Consumption Index

Bitcoin Energy Consumption Index

Key Network Statistics

.png)

Did you know?

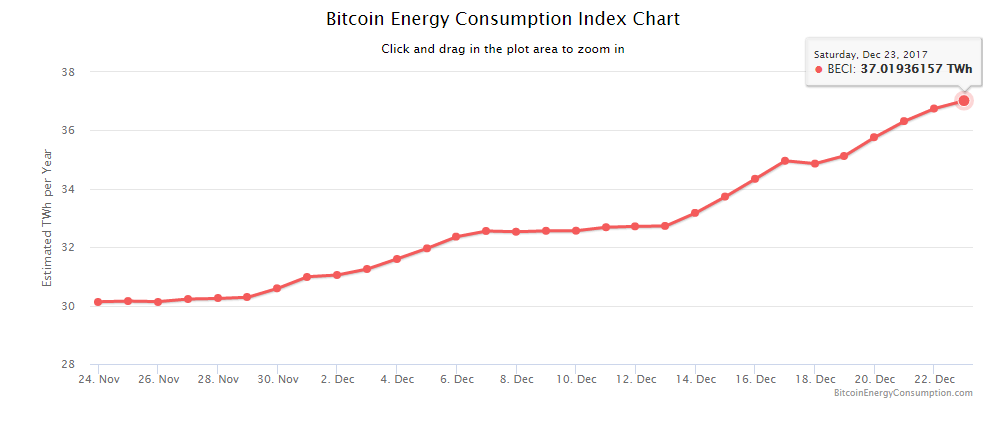

Ever since its inception Bitcoin’s trust-minimizing consensus has been enabled by its proof-of-work algorithm. The machines performing the “work” are consuming huge amounts of energy while doing so. The Bitcoin Energy Consumption Index was created to provide insight into this amount, and raise awareness on the unsustainability of the proof-of-work algorithm.

Note that the Index contains the aggregate of Bitcoin and Bitcoin Cash. A separate index was created for Ethereum, which can be found here.

What kind of work are miners performing?

New sets of transactions (blocks) are added to Bitcoin’s blockchain roughly every 10 minutes by so-called miners. While working on the blockchain these miners aren’t required to trust each other. The only thing miners have to trust is the code that runs Bitcoin. The code includes several rules to validate new transactions. For example, a transaction can only be valid if the sender actually owns the sent amount. Every miner individually confirms whether transactions adhere to these rules, eliminating the need to trust other miners.

The trick is to get all miners to agree on the same history of transactions. Every miner in the network is constantly tasked with preparing the next batch of transactions for the blockchain. Only one of these blocks will be randomly selected to become the latest block on the chain. Random selection in a distributed network isn’t easy, so this is where proof-of-work comes in. In proof-of-work, the next block comes from the first miner that produces a valid one. This is easier said than done, as the Bitcoin protocol makes it very difficult for miners to do so. In fact, the difficulty is regularly adjusted by the protocol to ensure that all miners in the network will only produce one valid bock every 10 minutes on average. Once one of the miners finally manages to produce a valid block, it will inform the rest of the network. Other miners will accept this block once they confirm it adheres to all rules, and then discard whatever block they had been working on themselves. The lucky miner gets rewarded with a fixed amount of coins, along with the transaction fees belonging to the processed transactions in the new block. The cycle then starts again.

The process of producing a valid block is largely based on trial and error, where miners are making numerous attempts every second trying to find the right value for a block component called the “nonce“, and hoping the resulting completed block will match the requirements (as there is no way to predict the outcome). For this reason, mining is sometimes compared to a lottery where you can pick your own numbers. The number of attempts (hashes) per second is given by your mining equipment’s hashrate. This will typically be expressed in Gigahash per second (1 billion hashes per second).

Sustainability

The continuous block mining cycle incentivizes people all over the world to mine Bitcoin. As mining can provide a solid stream of revenue, people are very willing to run power-hungry machines to get a piece of it. Over the years this has caused the total energy consumption of the Bitcoin network to grow to epic proportions, as the price of the currency reached new highs. The entire Bitcoin network now consumes more energy than a number of countries, based on a report published by the International Energy Agency. If Bitcoin was a country, it would rank as shown below.

.png)

Apart from the previous comparison, it also possible to compare Bitcoin’s energy consumption to some of the world’s biggest energy consuming nations. The result is shown hereafter.

.png)

Carbon footprint

Bitcoin’s biggest problem is not even its massive energy consumption, but that the network is mostly fueled by coal-fired power plants in China. Coal-based electricity is available at very low rates in this country. Even with a conservative emission factor, this results in an extreme carbon footprint for each unique Bitcoin transaction.

Comparing Bitcoin’s energy consumption to other payment systems

To put the energy consumed by the Bitcoin network into perspective we can compare it to another payment system like VISA for example. Even though the available information on VISA’s energy consumption is limited, we can establish that the data centers that process VISA’s transactions consume energy equal to that of 50,000 U.S. households. We also know VISA processed 82.3 billion transactions in 2016. With the help of these numbers, it is possible to compare both networks and show that Bitcoin is extremely more energy intensive per transaction than VISA.

.png)

Of course, these numbers are far from perfect (e.g. energy consumption of VISA offices isn’t included), but the differences are so extreme that they will remain shocking regardless. One could argue that this is simply the price of a transaction that doesn’t require a trusted third party, but this price doesn’t have to be so high as will be discussed hereafter.

Alternatives

Proof-of-work was the first consensus algorithm that managed to prove itself, but it isn’t the only consensus algorithm. More energy efficient algorithms, like proof-of-stake, have been in development over recent years. In proof-of-stake coin owners create blocks rather than miners, thus not requiring power hungry machines that produce as many hashes per second as possible. Because of this, the energy consumption of proof-of-stake is negligible compared to proof-of-work. Bitcoin could potentially switch to such an consensus algorithm, which would significantly improve sustainability. The only downside is that there are many different versions of proof-of-stake, and none of these have fully proven themselves yet. Nevertheless the work on these algorithms offers good hope for the future.

Energy consumption model and key assumptions

Even though the total network hashrate can easily be calculated, it is impossible to tell what this means in terms of energy consumption as there is no central register with all active machines (and their exact power consumption). In the past, energy consumption estimates typically included an assumption on what machines were still active and how they were distributed, in order to arrive at a certain number of Watts consumed per Gigahash/sec (GH/s). A detailed examination of a real-world Bitcoin mine shows why such an approach will certainly lead to underestimating the network’s energy consumption, because it disregards relevant factors like machine-reliability, climate and cooling costs. This arbitrary approach has therefore led to a wide set of energy consumption estimates that strongly deviate from one another, sometimes with a disregard to the economic consequences of the chosen parameters. The Bitcoin Energy Consumption Index therefore proposes to turn the problem around, and approach energy consumption from an economic perspective.

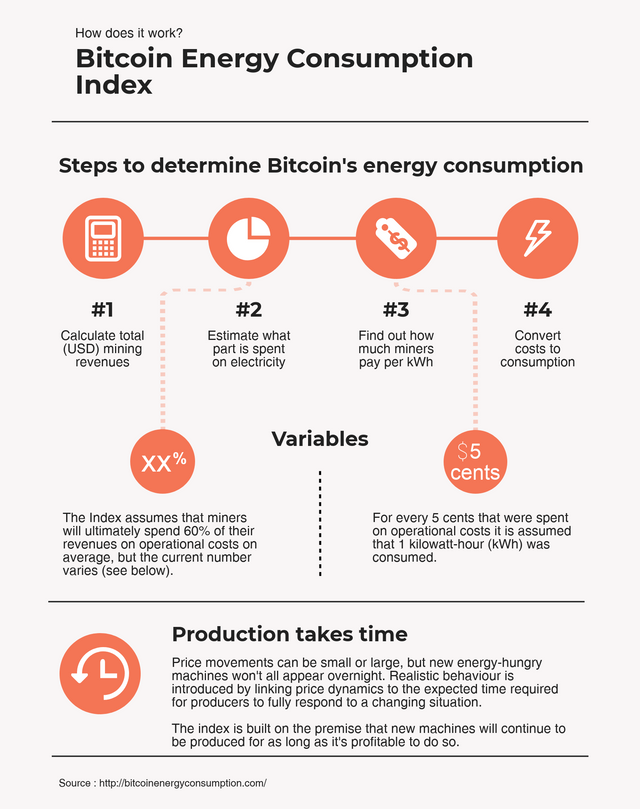

The index is built on the premise that miner income and costs are related. Since electricity costs are a major component of the ongoing costs, it follows that the total electricity consumption of the Bitcoin network must be related to miner income as well. To put it simply, the higher mining revenues, the more energy-hungry machines can be supported. How the Bitcoin Energy Consumption Index uses miner income to arrive at an energy consumption estimate is explained in detail here, and summarized in the following infographic:

Note that one may reach different conclusions on applying different assumptions. The chosen assumptions have been chosen in such a way that they can be considered to be both intuitive and conservative, based on information of actual mining operations. In the end, the goal of the Index is not to produce a perfect estimate, but to produce an economically credible day-to-day estimate that is more accurate and robust than an estimate based on the efficiency of a selection of mining machines.

https://digiconomist.net/bitcoin-energy-consumption