Battle of the Blockchains: Three Altcoins with High Growth Potential

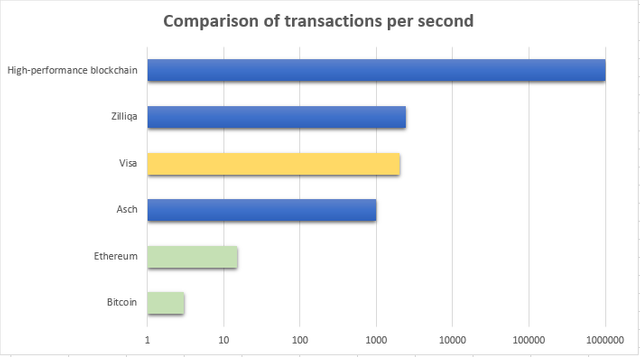

Scalability is one of the defining challenges facing crypto. From Segwit to the Lightning network in the case of bitcoin, to sharding and plasma in the case of Ethereum, the ability to increase throughput is a major obstacle to the scalability of crypto technology. Bitcoin averages around 3 to 4 transactions per second (set to increase with the Lightning network) and Ethereum around 15. This can be compared to an average of around 2,000 transactions per second by Visa. It’s no surprise, then, that a host of emerging projects are looking to overcome the scalability barrier. This article looks at three coins with high potential for growth when crypto resumes its upward trend:

- Zilliqa (ZIL), with an approach to sharding that has already broken 2,400 transactions per second

- Asch (XAS), which uses side chains to target 1,000 transactions per second

- High-Powered Blockchain (HPB), which proposes the use of hardware acceleration to target over 1 million transactions per second.

Figure 1. Throughput of High-Powered Blockchain, Zilliqa and Asch compared to Visa, Ethereum and Bitcoin.

Zilliqa (ZIL)

With an emphasis on scalability via sharding, Zilliqa has already achieved a throughput of over 2,400 transactions per second and the coin saw significant price growth following its listing on the Binance exchange earlier this year. A handsome market cap of around USD 500 million still leaves Zilliqa plenty of room for growth and with its mainnet launch scheduled for Q3 2018, the project will likely see renewed attention over the coming months.

Chart 1. ZILUSD daily chart with wave 1 shown in green and projections for wave 3 in blue (click image to expand).

Chart 1 shows what looks to be a clear first wave in an impulse sequence. Price rose from a low of USD 0.03 in March to almost USD 0.24 in May (around 680 percent), before correcting to around USD 0.05 in June (the square of the 0.382 Fibonacci retracement). It is currently sitting around USD 0.06. Assuming the bottom of USD 0.05 holds against the tail-end of the bitcoin correction, projecting a 680 percent rise from the low in June suggests an initial target of USD 0.46 for the next motive wave.

Asch (XAS)

A Chinese-based initiative, Asch sets out to tackle the scalability problem using side chains. The project is also innovative for its use of JavaScript and relational databases, which make the technology more accessible to a large community of developers. The coin won third prize and the best popularity award in the China Blockchain Technology Innovation and Application Contest 2017, with its founder Shan Qingfeng also scooping the outstanding individual award.

Asch has a relatively small market cap of around USD 40 million, which leaves ample potential for growth. By means of example, if Asch were to reach the top 50 coins by market cap, its price would see sixfold growth. With the coin yet to be listed on any of the big exchanges, this is a distinct possibility.

Chart 2. XASUSD daily chart (click image to expand).

As a relatively new coin with limited historic price data, it is hard to make reliable price projections. Based on Chart 2, the top of USD 1.62 in January 2018 could represent the end of a five-wave impulse sequence. However, the ensuing correction (currently hovering around USD 0.40) may still be incomplete. If we analyse this as an ABC-type correction, with an A wave that saw a 73 percent decline from the high of USD 1.62 to USD 0.42 and a B wave that rebounded to USD 1.21, another decline of 73 percent would give a potential bottom of USD 0.32.

The Relative Strength Index (RSI) and Stochastic indicators for the XASBTC chart suggest the bulk of the correction has passed. On the daily chart RSI has just bounced from oversold territory while Stochastic remains oversold. On the weekly chart, Stochastic is firmly in oversold territory although RSI remains over 40 (and thus not yet oversold).

High-Powered Blockchain (HPB)

Another Chinese-based project, somewhat unique in that its approach to the problem of scalability by including hardware acceleration, is High-Powered Blockchain. The platform has a theoretical target of 1 million transactions per second and a confirmation time of 3 seconds. Its advisory board includes Kai Long, Executive President at UnionPay Smart, which is interesting insofar as it suggests a link to UnionPay, China’s answer to Visa and MasterCard. With a market cap of just USD 60 million, there is also plenty of room for price growth going forward. For example, a return to its previous high of USD 13.07 would take the coin to a market cap of USD 437 million, currently just short of Zilliqa.

Chart 3. HPBUSD daily chart (click image to expand).

As another young coin yet to be listed on any of the major exchanges, the lack of historic price data makes analysis and projections difficult. The current all-time high is USD 13.07, which was reached in January 2018, is shown in Chart 3. The price subsequently fell to a low of USD 1.74 in April, representing an 86 percent correction. While this latter level seems to be acting as support, it remains to be seen whether the correction is complete. Following a subsequent rebound to USD 4.08, a further 86 percent drop would take price to USD 0.57, while a 53 percent drop (0.618 of 86 percent) would take price to USD 1.19.

Indicators for the HPBBTC pair are also promising and suggest the bulk of the correction has passed. On the weekly chart, RSI has recently bounced off 30 and Stochastic also looks to be in the process of bouncing from oversold territory. On the daily chart, both RSI and Stochastic have also recently bounced from oversold territory.

Get Ready for the Battle of the blockchains

All three of these coins offer something to the scalability battle that is about to begin. The relevance of the problem also means each is likely to have its spot in the limelight when the cryptosphere returns to growth. In terms of technicals, any price growth is likely to be conditioned by the completion of the bitcoin correction, meaning further downside movement is not impossible. However, indicators such as RSI and Stochastic suggest that this could be a good time to accumulate these coins in anticipation of the next round up.

All figures are approximate.

Disclaimer: I am not a financial adviser. Nothing in this post should be taken as financial advice. All content is provided for information purposes only.

All text copyright @cryptolaidlaw 2018. All rights reserved.

Coins mentioned in post: