What to Expect from Tomorrow’s FOMC Meeting?

The cryptocurrency market was on high alert, anticipating key events that could influence investor sentiment and market trajectory. Central to this were the release of the Federal Open Market Committee (FOMC) Minutes, scheduled for tomorrow, August 21, and a critical speech by Federal Reserve Chair Jerome Powell later in the week.

Key Events: FOMC Minutes and Powell’s Speech

Investors were focused on the FOMC Minutes and Powell's upcoming speech, both expected to provide insights into the Federal Reserve's stance on inflation and interest rates. These events could significantly shape market sentiment, particularly in the crypto sector.

Fed Speeches to Watch

Fed Vice Chair Michael Barr on August 20. The highlight will be Powell's speech on August 23 at the Jackson Hole retreat.

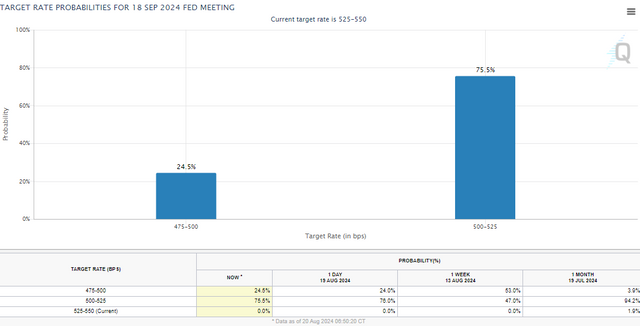

The market speculated about a potential rate cut in September, with the CME FedWatch Tool indicating a 75% chance of a 25 basis point cut.

Focus on FOMC Minutes and Inflation Data

The FOMC Minutes, set to be released tomorrow, were highly anticipated for clues on the Fed's policy direction. Recent inflation data suggested a cooling economy, boosting market confidence, though the crypto market had experienced volatility.

Investors were also eyeing the upcoming US Personal Consumption Expenditures (PCE) inflation data, expected to provide further insights into inflationary pressures.

Growing Optimism in Crypto Sector

Despite recent volatility, market experts were optimistic about the crypto sector. Many viewed Bitcoin as a hedge against inflation, expecting a potential rally in the coming days.

In summary, the crypto market was focused on tomorrow's FOMC meeting and other key events that could significantly impact its future, with attention firmly on the Fed's next moves.