Major Events in the Crypto Industry This September!

Recent developments in Bitcoin whale accumulation have emerged as a potential catalyst for a price upswing, especially with anticipated interest rate cuts by the Federal Reserve in September. These factors, along with key upcoming events, created an optimistic outlook for Bitcoin’s price action.

Bitcoin Whale Wallets Reach New Highs

(Source: https://markets.coinpedia.org/bitcoin/)

After facing selling pressure at the $65,000 level and finding support at $58,000, a significant shift occurred in the market. Bitcoin whale wallets, those holding over 100 BTC, reached a 17-month high. Despite recent market volatility, the number of these wallets increased by 283 over the last month, bringing the total to 16,120. This marked the highest number of large Bitcoin holders in over a year, signaling confidence among major investors.

Reduction in Exchange Supply

On-chain data provided further insights into market movements. Over the past three days, Bitcoin supply on exchanges dropped by 40,000 BTC, equivalent to $2.4 billion. This indicated that whales were moving their Bitcoin to cold storage, a strategy often used for long-term holding. The aggressive buying during price dips suggested that whales were positioning for a potential price rebound, with $60,000 as the next critical level.

Positive Macro Indicators

Adding to the optimism, the US Personal Consumption Expenditures (PCE) inflation data released on Friday showed a figure of 2.5%, lower than market expectations. Additionally, the US core PCE index for July stood at 0.2% month-on-month. These positive macroeconomic indicators provided a favorable backdrop for Bitcoin, potentially supporting a price recovery.

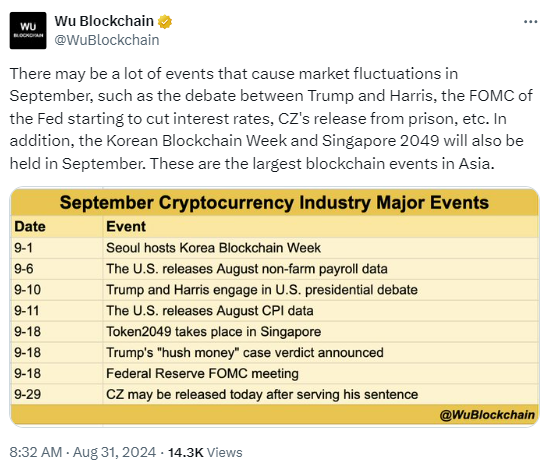

Key Crypto Events in September

September promised to be pivotal for the cryptocurrency market. Among the most anticipated events was the Cardano Chang Upgrade, scheduled for September 1. This upgrade aimed to enhance governance and decentralization within the Cardano blockchain.

Another critical event was the upcoming Federal Open Market Committee (FOMC) meeting, where Federal Reserve Chair Jerome Powell was expected to announce decisions on interest rate cuts. The market speculated on whether there would be a 25-basis point or a 50-basis point cut, with the possibility of a total 100 basis point cut by year-end. This decision could significantly impact market sentiment, influencing both Bitcoin and the broader cryptocurrency market.

Political and Regional Developments

The first presidential debate between Donald Trump and Kamala Harris also drew attention from the crypto community. With the crypto industry being a focal point in the 2024 US Presidential elections, any developments during the debate could have implications for the market.

Meanwhile, the Asian market prepared for major crypto events such as the Korean Blockchain Week starting on September 9 and the Token2049 event in Singapore later in the month. These regional developments, combined with ongoing Bitcoin whale accumulation and a decrease in exchange supply, were seen as potential triggers for the next phase of a market rally.

As September approached, the combination of whale accumulation, positive macro indicators, and significant upcoming events painted an optimistic picture for Bitcoin’s price trajectory. Investors and market watchers remained focused on these developments, anticipating that they could set the stage for the next major movement in the cryptocurrency market.