Cloud Mining: Hashflare

If you have been living in the cryptocurrency world for the past few months there is no doubt that you have seen an ad or article referring to cloud mining. Cloud mining allows for you to purchase hashing power from a company that will use their own equipment to mine cryptocurrencies for you while charging a small fee.

There are many reasons why utilizing cloud services can be advantageous. Here are a few:

You do not have the funds to purchase hardware for mining

You lack the knowledge of mining and/or hardware

You don’t want to deal with the high electricity bills from mining

You don’t want to deal with the noise and upkeep of mining rigs

Before I began mining with my own equipment I did some research on cloud mining and ended up throwing about one hundred bucks into a Hashflare mining contract. I wanted to share a few of my experiences using Hashflare.

Hashflare currently allows the user to purchase a one-year contract from a selection of five algorithms with four different payout options:

$BTC using the SHA-256 algorithm at $2.20 per 10 GH/s

$BTC using the Scrypt algorithm at $4.20 per 1 MH/s

$ETH using the Ethash algorithm at $2.20 per 100 KH/s

$ZEC using the Equihash algorithm at $2.00 per 1 H/s

$DASH using the X11 algorithm at $3.20 per 1 MH/s

Shortly after purchasing a SHA-256 contract with Hashflare the revenue forecast displayed my projected earnings for every day, week, month, six month, and one year. The one year forecast showed around a 900% profit… until I dug a little deeper. The revenue forecast does not factor in the increase in mining difficulty that will inevitably rise the longer that bitcoin exsists, nor does the forecast account for the hashflare maintenance fees which is $0.0035 for 10 GH/s using the SHA-256 algo. Needless to say, the 900% profit was a fairy tale.

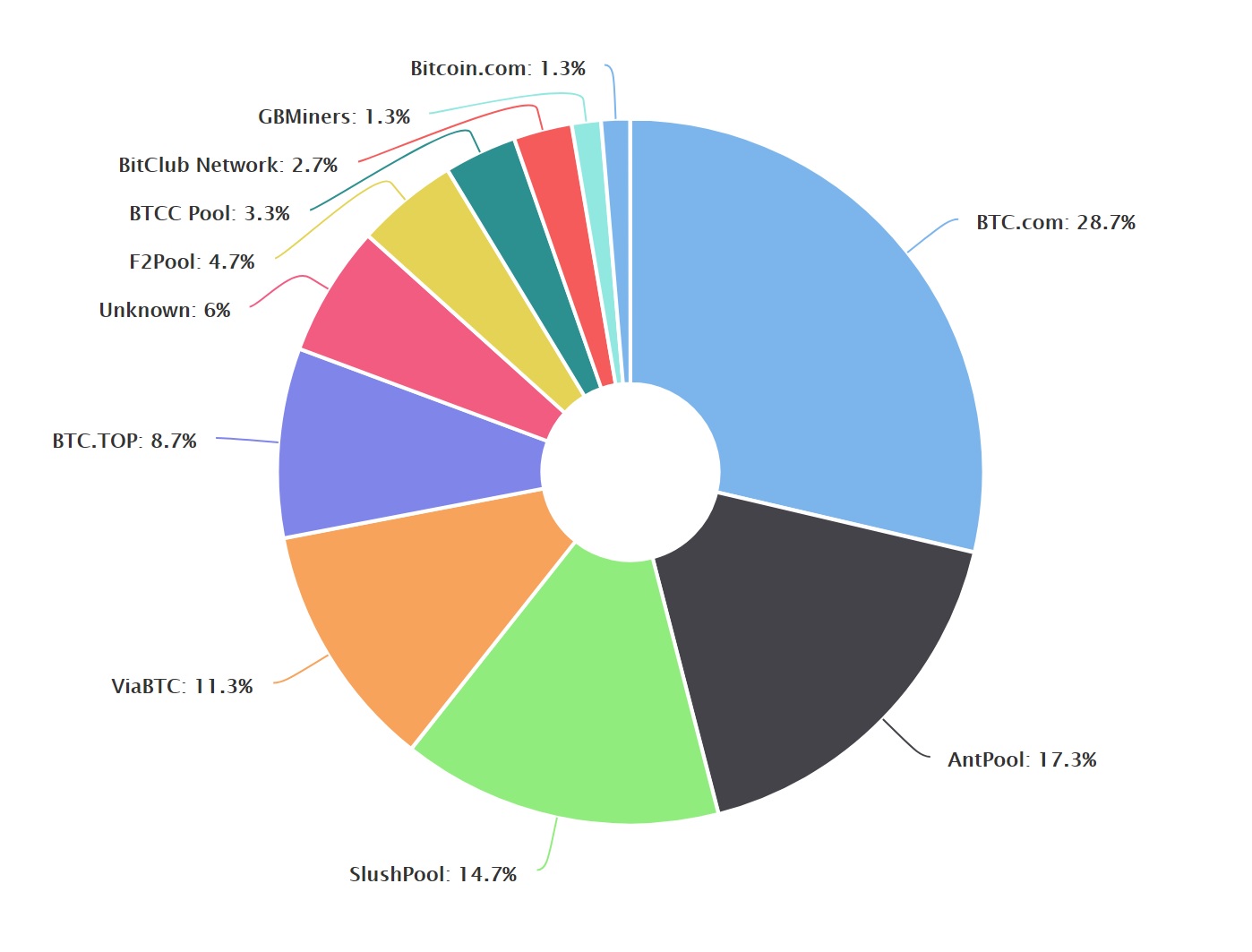

Another detail worth noting is the “Pools” option located on the dashboard. Your contract is preconfigured to mine in three different mining pools, but you have the option to select which pool(s) you want to mine from and how much hashing power you want to direct towards a specific pool. You can change this option only once per day. The bigger the pool the more likely you are to find a block, but you will receive a smaller payout. So it’s worth studying the different pools and playing around with your settings until you find a great setting. Blockchain.info is an excellent resource for an estimate of the hashrate distribution amongst the largest mining pools.

The most important function on any cloud mining site is the “Withdraw” function, and this is where Hashflare has the most issues. During January 2018 Hashflare shutdown the ability to withdraw $BTC earning for about two weeks. Once the function was back up-and-running there was a withdraw minimum of .05003672 BTC. I understand that Hashflare does not want to clog the network up with small withdraws, but currently I cannot withdraw until I am near the end of my contract. Many users will purchase smaller contracts and will not reach the minimum withdraw amount! Hashflare stated that if you never meet the minimum you can take it all out once your contract is up.

The important take-away is that Hashflare or any Cloud Mining service has a lot of control on your payouts. Nicehash, for instance, was hacked for over 60 million dollars’ worth of bitcoin in December of 2017. As with any cryptocurrency investment, it’s vital that you never invest more than you are willing to lose. Make sure to follow me on twitter @CoachCryptos and as always Happy Mining!

This post has been upvoted for free by @microbot with 0.1%!

Get better upvotes by bidding on me.