Bitcoin’s Monthly Chart Signaling higher moves

Bitcoin’s Monthly Chart Signaling higher moves

Although the title of this article mentions the monthly chart, you might be wondering why the image shows the daily chart. I’ve placed horizontal lines identifying significant Ichimoku levels on the Weekly and Monthly charts on the daily chart. Bitcoin’s continued pullback from Saturday’s (October 26th, 2019) spike certainly shows expected and significant pullbacks from such a massive two day move. The daily Ichimoku chart shows that last Saturday was the first test of the top of the Cloud (Senkou Span B) since August 19th, 2019. That has brought Bitcoin inside the daily Cloud, something it has not traded inside of since August 11th, 2019. Senkou Span B is the strongest support and resistance level on an Ichimoku chart. It represents the most challenging value zone for prices to move through.

You can no doubt see from the chart that there are several critical Ichimoku levels. The last four trading days have seen Bitcoin trade between the current Weekly Tenkan-Sen (9121.28) and Kijun-Sen (9721.22) with the latter representing the week’s current support level. Bitcoin is currently above the daily Tenkan-Sen and Kijun-Sen (both share the same price at 8821.78). If we want to see a definition of a ‘squeeze’ that has formed or is forming, then we have strong evidence for this considering where the daily and weekly fast averages are sitting. Both the Weekly and Daily Kijun-Sens and Tenkan-Sens are between the Monthly Kijun-Sen (11384.57) and Tenkan-Sen (8368.69).

The Kijun-Sen is by far the most crucial level from a mid-range trading perspective. The Kijun-Sen represents equilibrium and balance. It is often referred to as a dynamic 50% Fibonacci ratio. A significant amount of Japanese styles of technical analysis and theory are focused on ‘equilibrium’ (Heiken-Ashi, for example). The Kijun-Sen on a Weekly and Monthly chart often dictates the overall trend direction – and crosses above or below the Kijun-Sen signal long term trend changes. Bitcoin is close to moving above the Weekly Kijun-Sen. The Monthly Kijun-Sen is the final and last source of resistance ahead for Bitcoin – we should expect an intense amount of resistance when Bitcoin tests 11,384.

In the near term, and for the remainder of the trading week, Bitcoin may be restricted to the upper and lower bounds of the Daily Cloud. That would mean a tight range between 9330 and 8600. I continue to see a high probability of a drop towards the 6400-6800 value areas – which will coincide with the Weekly Cloud, which increases in value now every week. In two weeks, Bitcoin will be trading at the same time as a Kumo Twist on the weekly chart. Kumo Twists can generate powerful and swift changes in trends, especially if price moves through that exact area. But one of the most critical changes to Bitcoin’s monthly chart could occur after the monthly close.

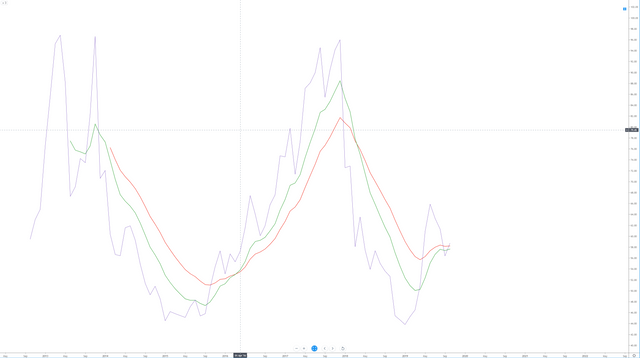

The image above is a 14-period RSI of Bitcoin’s Monthly chart. The green and red lines represent two EMA’s (Exponential Moving Average) of the RSI: a 9-period average and a 17-period average. I look for a specific, rare and powerful condition to occur when both the RSI and the fast-average (green) cross the slow-average (red). This is a strategy that has been known for many years – but I call it the ‘pinch’ because of the tight and pinched appearance the three lines make. If October’s Monthly chart closes green and with the RSI above the fast and slow averages, this could very well initiate a massive trend continuation higher.