My advice & tips for new cryptocurrency traders/investors

Hello Everyone,

I just wanted to share some info on Bitcoin and Altcoin trading/investing that could help people that haven't yet invested or even those who have.

This isn't financial advice by any means but they are lessons I have learnt while trading and scouring the internet reading many forums and posts.

Beginner Tips & Tricks:

1. Research

I know sometimes a chart can look like a delicious piece of pie that you want to take a huge bite from and everyone on Twitter is saying how great that pie tastes, but like some pies, it can end up leaving you with a sick feeling in your stomach and a lot of regret.

This is why one of my first rules is always research what you invest in.

If I find a coin/token that catches my eye on the market I will always go to https://coinmarketcap.com/ to check the chart history, announcements and website to make sure the team have put effort into designing their website, have a good road map and have a legitimate team.

I'm not saying read absolutely everything, but if after doing some research and reading what the coin/token is all about it leaves you with a good feeling about where they are heading with their project, then chances are others are going to feel the same when they come across it.

2. Keep your eggs spread

..Yes eggs, not legs.. Unless that's how you're making money to invest... I'm not judging.

So the saying goes "Don't put all your eggs in one basket", in the land of cryptocurrency anything can happen and FUD (Fear, uncertainty and doubt) can spread fast. There are a lot of influencers out there that use their powers to benefit themselves and a lot of this happens on Twitter, so if you aren't on Twitter yet, I would suggest create an account and follow these influencers (I will get into this later in the article).

If you are keeping all your eggs in one basket and that basket drops or implodes, then bye bye eggs.

Though if you spread those eggs across other coins/tokens then the impact of is much less severe.

For example at the time of writing this I have my money spread across 18 different altcoins (not evenly).

3. Twitter

Twitter has been one of the best tools for knowing what is happening around the clock in the land of cryptocurrencies. Follow as many people as possible but also take a lot of what gets said with a grain of salt. Though I do find if enough people are preaching about something it's worth taking some time and looking into it, this is how I've come across a lot of coins/tokens that I would have otherwise missed out on.

I use the 'Turn on mobile notifications' settings for a lot of the influencers because even though they are generally out to benefit themselves (not all), they can make a massive splash in the market and if you are fast enough you can also benefit.

One of the main influencers that I follow is John McAfee, when he spreads FUD or Shills an altcoin it really makes a splash.

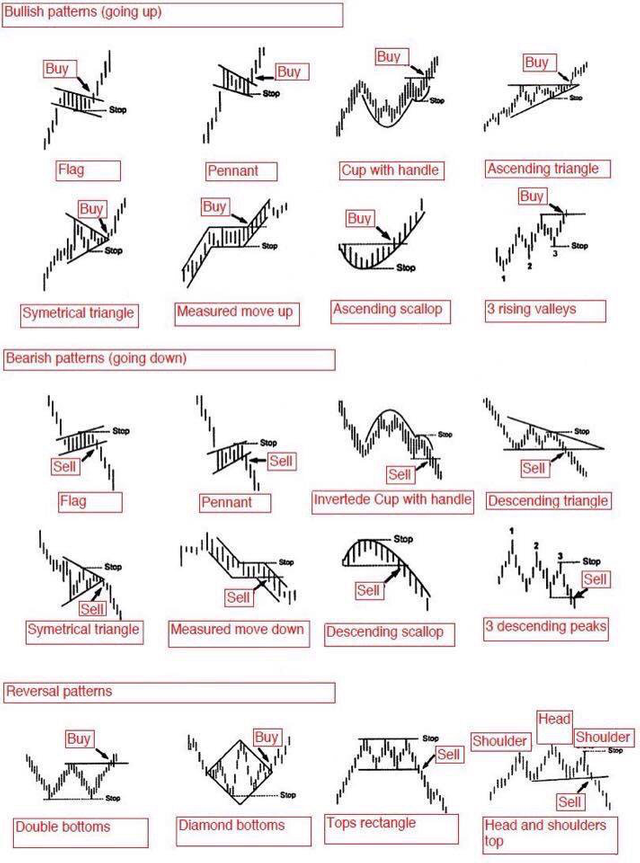

4. Learn Patterns and Indicators

Not everyone uses the same patterns and indicators to base their trades on and that's okay, there isn't a right way and wrong way. Try out some different indicators to base your buys on and find what works for you.

I read and watched a lot of different YouTube videos and found that for me MACD and MFI indicators worked best for my style of trading.

Here's a couple links to technical indicators and patterns:

Patterns:

Technical Indicators: https://www.tradingtechnologies.com/help/x-study/technical-indicator-definitions/list-of-technical-indicators/

Bonus Tip: If you see a cup and handle, buy that damn handle!

5. Hope for the best and prepare for the worst

Cryptocurrency may be around forever, but it could also all collapse.

If you are going to put your hard earned money into it, it's best to only put in what you can afford to lose, and remember that it's not something that will make you a millionaire overnight so have some patience.

TL;DR:

1. Research:

Find something you believe in before investing and do your own homework.

2. Keep your eggs spread:

Diversify your bonds!, this means much less risk if something goes wrong.

3. Twitter:

Info, tips and notifications all in one place.

4. Learn Patterns and Indicators

Find technical indicators that work for you and familiarize yourself with patterns.

5. Hope for the best and prepare for the worst

Invest an amount you are willing to lose.

Thank you everyone who took the time read this, it's my first blog post so any criticism is welcomed.

I will be doing more of these soon and will get a bit more in depth with some trading techniques that have worked for me and also some lessons I have learnt the hard way.

This is awesome, I’m just getting into the trading game and this sums up buying trends perfectly.

Congratulations @brock183, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that awesome content will get great profits by following these simple steps, that have been worked out by experts?