Taking Profits - Considerations

Einstein is often quoted in the field of economics. The saying "Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn't, pays it", or something to that effect, is often attributed to him along with the associated "Rule of 72".

The story of that being an Einstein quote is almost certainly apocryphal, and the Rule of 72 is definitely not Einstein's work (as if the father of Special and General Relativity needed a cheat method to estimate logarithms! 😆 ), BUT - the essence of the quote is absolutely true.

Compound Interest is an incredibly powerful way of growing wealth in a relatively easy and safe manner, with the major variables in the equation being Initial Investment, Interest Rate, and Time.

As much as we would all like to be rich, that isn't a reality. Compound Interest presents one option for the "not rich" to possibly become a part of "the rich". It's a method which is highly applicable in the crypto world, and one which I personally use daily.

Earning Interest

At the moment, I reinvest every crypto gain I can back into the crypto market. Anything I earn from my blogging gets invested, and dividends paid get invested. Airdrops, hard forks, competition winnings, donations, staking rewards... every last little bit goes back into crypto. I have never withdrawn a single sat.

In this way I earn interest not just on what I initially put in, but also on my earnings. It's not all strictly "interest" per se, but the effect of holding assets which increase in value over time is essentially the same as interest.

Taking profits is the opposite of that. Taking profits removes money from the interest earning equation, and leaves you with less earning potential. For that reason, it's important to get it right, you don't want to shoot yourself in the foot by taking profits in a manner which will hurt your investment.

Looking at the three variables of compound interest, we can see where and how manipulating each variable changes things.

Initial Investment is the amount of money that we put in. The more money we put in, the more we earn (how many of you wish that you had put more money into crypto when you started? I know I do!). You can add money into crypto after your initial investment, and it's a good idea to do so, but the general rule of thumb is: "the sooner you put it in, the better". Of course I understand that we put money into crypto as it becomes available to do so, so please, this is not me saying "don't DCA!", but rather "it's better to go big early than to invest in a piecemeal manner over a period of time".

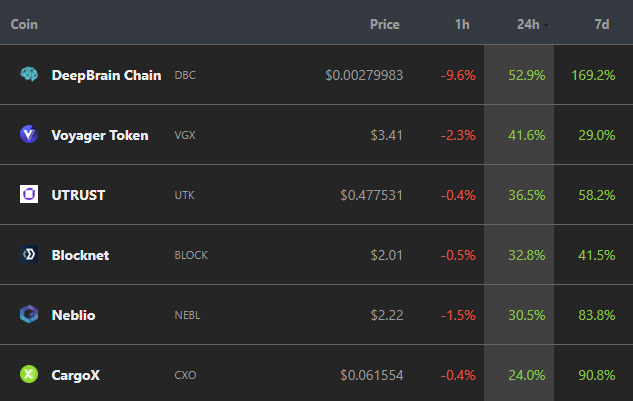

Interest Rate is something which we don't have much control over. Yes, we can chose which coins to hold based on their returns, but we can't control how they increase in price, and we alone can't determine something like the interest rate earned on a staked coin. Indeed, even though there are coins which offer a very good APY, e.g. 20% or more, this figure pales in comparison to the gains that cryptocurrencies themselves make during a bull market. The majority of "interest earned" in crypto comes from the gains in value that cryptocurrencies make during bullish periods. As I write this now, I have six coins which have gone up by more than 20% in the last 24 hours alone, that's the "interest" I want to compound!

From https://www.coingecko.com

Time is the variable over which we probably have the most control. For the patient investor, time can be the great equaliser. It's the way that a more patient poor investor can catch up to a less patient rich investor. Time is the reason that investing sooner rather than later is a good idea. The longer your money sits in crypto, the more chance it has to earn "interest". For instance, if you invested $100 invested today in a coin which averages an annual price increase of 50%, it would be worth $150 a year from now. But if you left the same $100 for four years, it would be worth just over $500.

The difference is non-trivial: the $150 payout means that you've earned an average profit of $50 per year. But the $500 payout means that you've earned an average profit of $100 per year - double what you would have earned with the shorter investment! What if you left it for 10 years? Then you would have $5766, an average of $567 per year!

Doubling your initial investment would double the profits you make, but doubling the TIME that you leave the money invested for, that leads to exponential returns! For this reason, it is absolutely vital not to take profits too early! When you take profits, you no longer earn gains on all your interest, and you invalidate the benefits of the compound interest equation.

Taking Profits

The key to successfully taking profits is simple: if you are able to do so - don't take any.

I've been running the numbers for some time. I knew a bull run was coming and I knew that it would be a good profit taking opportunity. I also remember that during the last bull run I found it difficult to divorce my emotions from my trading decisions. in preparation for that, I decided to determine a profit-taking plan before the market hype set in.

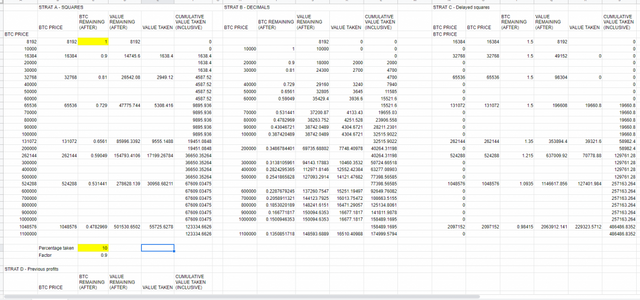

After many attempts, this is what I found:

There is no scenario in which taking profits works in my favour. No matter which strategy I use, no matter how much (or little) I take, no matter how seldom I take profits, no matter at which BTC price I take profits, I end up losing out in the long-run. And by "losing out" I mean significant losses.

I sat for many hours with the spreadsheet below, working and reworking the figures and strategies.

I found that the second you take profits instead of reinvesting them, you break the power of compound interest. Though I already knew this before going to the spreadsheets, I was hoping to find a way that I could take small profits while not affecting the later figures by much. There is no such way, not unless you're willing to take profits that are insignificantly small, and what would be the point of that?

The thing with compound interest is this, it is most powerful in the last few periods for which it is calculated. So if, for example, you earn compound interest over a period of 10 years, the greatest gains, by far, are realised in the final two years of investing.

Going back to our earlier example - the $100 which became $5766 after 10 years - more than half of that amount is made during the final two years. After eight years the return is only $2563, meaning that $3203 of the $5766 is earned during the final two years.

If I took profits of just $10 of the $150 I had after the first year of investing, it would translate into the loss of $384 after 10 years. Taking $10 in profits after 1 year means that I get $5382 instead of $5766. And $10 taken from $150 is only 6.7% - hardly a large amount.

The message is clear: taking profits today greatly hinders your ability to make big profits in the future. The longer you reinvest everything, the better - by a HUGE margin!

There is a caveat...

Taking profits - without hurting your investment

There is a way to take profits without harming your investment. In fact, you can help your investment along.

Unfortunately, the old maxim applies to this scenario: "there is no such thing as a free lunch."

As with most things in crypto, if you want greater rewards (or a higher "interest rate", if you want to see it that way), you need to accept higher risks.

IMPORTANT: Accepting risk is not for everybody! I am a BIG fan of the HODL strategy, and for good reason. It gives a great return, it's safe, it's easy and just about anyone can do it successfully if they are patient. If you are risk averse, new to the market, in a fragile economic situation, not good at market analysis or just in doubt, then I suggest that you just continue to HODL. It's all I've been doing for years, and I'm not sorry.

For those who do want to take profits and not hurt their investments, the solution is fairly obvious: sell at the top and then buy back in at the bottom. During this process, you can take a little profit on the side - as long as you buy back at least as much crypto as you sold!

While this sounds obvious and easy, it isn't. The reason for that is simply that nobody has a crystal ball which can predict the future. We NEVER know when we are at the top of the market and we NEVER know when or for how low it is going to dip. For this reason, we have to compromise when we trade: either we sell too soon and leave some profits on the table, or we risk missing the top (and therefore our opportunity to sell) entirely. The inverse applies at the bottom of a bear market.

Things change VERY fast in crypto. Your chances of hitting the very top of the market, or even calling the top within about 10% of it, are almost zero. Imagine you sell your BTC at $200 000 because you think that's the market top, and then BTC keeps on climbing for three more months, up to $350 000. That's a realistic scenario. How will you feel then? It's a bitter pill to swallow, and the temptation to FOMO back in would be very real!

Similarly, let's say you sold near the top and are waiting for a buy-back level. You want to buy at $40000, but BTC hits $75000 and then turns positive. What then? These things happen! In April of 2018, BTC dropped to $6500 and then started climbing again. It climbed for three weeks, up to almost $10000 before slowly turning negative again. How would you have felt during this time if you had been waiting for a price of $6000? Would you have been able to wait, or would you have panicked and forced a FOMO buy to avoid missing out?

You can not ignore the mental effects of trying to time the market and you can not ignore the fact that the risks are real. BTC may NOT hit your buy price! You may well miss the re-buy point entirely, that's a real risk. Throughout 2019 I heard people say over and over again: "I'm just waiting for one more drop to $6000/$5000/$3000 before I buy". Perhaps those guys were lucky, they got the rapid dip at the start of the Covid-19 drama, though I suspect that by then most of them had already capitulated and bought back in at a far higher price. But even after the March 2020 Covid dip, I still heard people waiting for another $6000 or $5000 or whatever price they wanted, only to see BTC keep on climbing and climbing to the prices we see today. So the risks of missing the boat are real, as are the stresses involved.

Good information is crucial to the making of good decisions. This presents a challenge of us. It is vital that you acknowledge how new cryptocurrencies are as an asset class. While we have seen a few market cycles in the past, we still have a statistically tiny number of cycles from which to work. We do NOT have well established trends or models yet, at least not ones accurate enough to trade on. We have best guesses based on extrapolated data, but we know that those guesses will grow increasingly inaccurate over time.

Remember: you are not special. You are not the one to which the rules do not apply. Most amateur traders lose money. Fact.

I am working hard to try to determine the most accurate trendlines possible. I am also devising a profit-taking system of my own based on those trendlines. It is a "sell and rebuy" system like the one described above, but it is still a work in progress. I believe that I am getting close to a good and accurately predicted strategy, but even so, it's still susceptible to the risks mentioned above. I have started typing a post about my strategy, but like the strategy itself, it's still a work in progress. If I can get it to a level at which I am 90%+ confident in it, I will share it with you and will execute the strategy myself.

Further Considerations

Before I end this post, there are a few more considerations which I would quickly like to mention.

When taking profits, plan which currency what you wish to sell into. Fiat currencies are an option, but I do not recommend them. Fiat currencies are immediately traceable by governments and banks, once you sit with fiat transactions, you sit with the issue of paying tax on your crypto gains. As I have said before: crypto has NOTHING to do with your government or banks, and they have no right to tax you on it - provided that you leave it in crypto. If you're careless or cowardly enough to tell your government what you are doing in the world of crypto, well then, that's your fault. Remember: the most effective way to imprison a person is to get them to build the prison walls within their own mind. Are you your own jailor?

What that means is that it's probably best to trade BTC into stablecoins. As much as I hate stablecoins - they're really just money-making schemes for centralised entities - I hate fiat currencies a whole lot more. Yes yes, I understand that stablecoins form a bridge for users and that they offer convenience and familiarity. But if they are so terribly necessary to crypto, how is it that I never need to use them? That will change if I decide to take profits. I'll sell BTC and hold it in stablecoins, and then buy it back later. Note, I said stablecoinS. Since I don't really trust or believe in any of them, I'll trade into several of them, in order to split the risk.

If I do take some profits for myself, chances are that I'll invest some of that money in precious metals. While inferior to crypto in many ways, there is still serious value in Gold, Silver and Platinum (hot tip: I think that Platinum is going to do very well this year!). Holding precious metals helps to further spread risk and is a good idea. just note that the precious metals market is also complex, not to mention highly regulated. DYOR before you even dream of getting into it. (Leave the more exotic precious metals like Rhodium and Palladium unless you really know what you're doing.)

I will never sell all of my BTC. I don't see myself selling more than half, and that's a maximum figure. I need to mitigate some of the risks, risks like "BTC just keeps on climbing" or "Tether turns into a full-blown exit scam and goes to zero".

There is another consideration: so far I've only really spoken about BTC, what about the altcoins? When and how does one take profits on them? That's a particularly difficult question and there is no simple answer to it. Some altcoins are staked long-term and can't simply be sold without sacrificing major future gains, if at all. Some, like exchange coins, may do well during periods of bearish selling and may be worth holding no matter what the market does. Some may be going through periods of great adoption and increasing in value despite an opposite market trend. Some may benefit from a hype event such as a main net launch.

It is my opinion that most altcoins are undervalued. I measure altcoin value in sats. Apart from a few over-hyped coins, most of which are currently in the top 20 by market cap, I expect most good (not the hoards of trashy ones which are designed to make someone a quick buck) altcoins to see new ATHs when measured in sats. Taking profits in altcoins is about having realistic expectations as to what total market cap the coin might reach, and about not missing selling opportunities due to excessive greed. When I sell altcoins, I sell to BTC. The job of my altcoins is to help grow my BTC stack. At the end of the day, BTC is my one and only long-term store-of-value coin, so it makes sense to bank my gains in BTC.

Exactly when and how much I bank is hard to say. I truly believe that some of my altcoins have the potential to rival some of the largest companies in existence today. Cryptocurrencies are not the same as shares in a company (in most cases), but they behave in a similar fashion. There is no reason why we can't have trillion dollar market cap altcoins. Because of this, I will probably never sell my way entirely out of a good altcoin, at least not for the purpose of taking profits. Instead I will sell e.g. 10% of it at a specific sats value, and another 10% at a value 5x higher than that, and another 10% 5 x higher, etc.

The final consideration I wish to mention is financial situation. It's easy for me to say "Don't take profits!", but for some people it may be impossible not to do so. I am acutely aware of the dire financial circumstances in which many people find themselves, especially in these times of government mandated economic shutdowns and rapidly rising costs of living (inflation - note that real inflation and government inflation figures are two vastly different things!). I know that some people may have to sell their crypto even though they don't want to. I sympathise.

What I do suggest to people in such a situation is: do your best to cut every other expense to the bone before selling off your crypto. From personal experience I can tell you that I took a 50% income cut two years ago. The way I survived was to start budgeting from the ground up. I terminated every contract, account etc that was costing me money, and focussed on paying off interest-bearing debts. I cut luxuries out altogether: no fancy phones, no new clothing, no vacations, no eating out, etc. I've even (politely) refused to let my wife buy me birthday presents since 2018. It's not pleasant at first, but you soon get used to it. The long-term goals are more important to me than the short-term pleasures and I'm honestly not unhappy living this way. I'm sure that it actually does me good. Even so, I acknowledge that I'm lucky: I still get paid something - many people don't, I could afford to pay off my debts - most people can't.

So as a final message, I say this to you: do whatever you can to keep as much as you can afford to in crypto. I am staking my own future in it, and I know that every dollar of crypto I save today is potentially $100+ of crypto in a few years time. Whatever you do, I wish you luck and prosperity.

Yours in crypto

Bit Brain

All charts made by Bit Brain with TradingView

"The secret to success: find out where people are going and get there first"

~ Mark Twain

"Crypto does not require institutional investment to succeed; institutions require crypto investments to remain successful"

~ Bit Brain

Bit Brain recommends:

Crypto Exchanges: