How I Saw the Crypto Market Crash coming back 5 Hours Early and Got My folks Out Before it had been Too Late

How I Saw the Crypto Market Crash coming back 5 Hours Early and Got My folks Out Before it had been Too Late

crooked forward, shoulders tight, staring intensely at the screen, the costs billowy across the chart.

“Get out!” screamed the tiny voice in my head.

I unheeded it like I sometimes do.

Chicken very little. The sky is falling!

That stupid voice is Chicken Little. The sky is usually falling. It’s there to avoid wasting you from dangerous things happening however the matter is it invariably thinks dangerous things ar happening. Your brain sees disaster around each corner. It’s wired that method.

And it’s sometimes wrong.

But these days was totally different.

There was one thing wrong. I knew it. I simply couldn’t see it clearly however as a result of my head was spinning madly, my heart thundering in my chest.

A storm of confusing recommendation battered my bone.

“Don’t listen. You’re fiiiiiine. It’s all smart. HODL.”

“Remember that point you sold-out right before the massive run, loser? Hahahaha! That’s what’s happening. Perma-bulls ar right. It goes up forever!”

“It’s a mirage. You can’t predict the longer term. Forget it. simply suspend on. You’re gonna miss out success.”

But I unheeded all that too. I focused, lasering within the chart, respiration deep from the belly, property go of concern and high spirits, those twin imposters of the guts.

A minute passed so another in total silence, the voices going quiet, dropping into the racket. My emotions receded with the waves and that i was calm and seeing clearly currently.

“What is that the chart telling me? undergo the symptoms. See it clearly, while not feeling. Don’t guess. Zoom out. check up on the longer time line. What does one see?”

I turned to the in the future chart of Bitcoin.

And there it had been.

The answer.

Time to urge out.

I quietly warned my folks in Discord so began to walk towards the hearth exit, forcing myself to travel slow therefore I didn’t panic anyone else.

What did I see?

Let’s flip back the clock and go frame by frame. I’ll show you specifically what I saw and why I got the hell out and lived to fight another day.

Oh yea and that i created cash whereas everybody was down.

How did I do it? Do I even have God like clairvoyant powers? No.

Well largely no. :)

But I do have a group of rules. and people rules saved my ass.

It’s Four PM, does one recognize wherever Your Stop Loss Is?

I won’t lie. it had been an unpleasant week on behalf of me before my massive short. i used to be hemorrhaging cash.

After 3 or four weeks of alts running wild and delivering win once win on behalf of me, suddenly i used to be losing once more.

Coins poor up and force back in a very wild whipsaw. I dawned too late and left too early. i used to be depressed, obtaining down on myself, fighting the urge to envision the charts perpetually, not listening to my spouse once she was talking.

I had exited earlier within the week, once my signals told ME one thing was wrong. then again many days passed and that i was missing the action. I needed back in.

That was mistake beloved. If you have got a system, continue it. Whenever you’re feeling the requirement to urge in on the action once more, it’s sometimes the incorrect selection.

Remember: money may be a position.

It’s the position that says you can’t see any clear pattern or direction for the market. Alts were booming however currently they’d gotten stormy. They were losing steam, their engines of wealth obstruction at the highest of their pitched battle.

When that happens it’s higher to attend on the sidelines till the market makes up its mind concerning what it desires to try and do.

I came into the marketplace for no reason apart from I needed the juice. Terrible, terrible plan.

My system aforementioned get out and that i unheeded it.

Go grab this book immediately as a result of its cowl is chromatic.

What’s my system? It’s a group of rules supported the old style trend following greats the Turtles and on Richard Donchian’s powerful rules, that were initial written in 1934, that simply goes to indicate that markets ne'er modification as a result of human science ne'er changes. additional thereon later.

So there i used to be, back within the market and obtaining sliced to death. many days elapsed and none of my trades were figuring out. i used to be giving back cash I’d created on sturdy, sound trades, taking small very little cuts and harm out slow.

I started asking queries.

What’s happening? Why am I trading? Why am I even during this market? Was there any real reason to urge back in after I did?

The clear answer was no.

I began to scale back my positions. however even that wasn’t enough. I couldn’t utterly jilting.

I still had concerning five hundredth of my stack within the market. for a few reason, I wasn’t being attentive to my higher self. Another day passed. What was going on? I couldn’t figure it out.

What am I doing? I don’t try this any longer. i do know a way to trade. I don’t build stupid choices like this ANd however here i'm shag it up like an cretin. What’s going on?

Sometimes it goes like that. despite what quantity you recognize, you’re invariably battling yourself and typically you lose.

Fast forward to the day of the market crash.

If initially You Don’t Listen, Smack Yourself Awake

I went back to questioning my motives as I stared daggers into the screen.

If you’re creating stupid trades or going against what you recognize is true, you can’t let yourself off the hook. you have got to stay thereon, keep asking queries.

This time I got more durable on myself once another night of losing trades.

Why the fuck ar you during this market?

Are any of those trades good? I see plenty of red. Your rules aforementioned get out and here you're still enjoying around? Why?

The universal market cycle. NOTHING is immune. Not even your and my favorite cryptos.

At 3:30 I targeted in on Bitcoin. That was one ugly chart. It looked specifically just like the celebrated market cycle chart that shows an enormous run and an enormous crash. you recognize the one I’m talking concerning as a result of I’ve denote it before, however let’s show it an additional time simply just in case you uncomprehensible it.

Still, that wasn’t it as a result of I’d been seeing that pattern for many of the last month. It wasn’t new. however one thing was totally different concerning it currently. What?

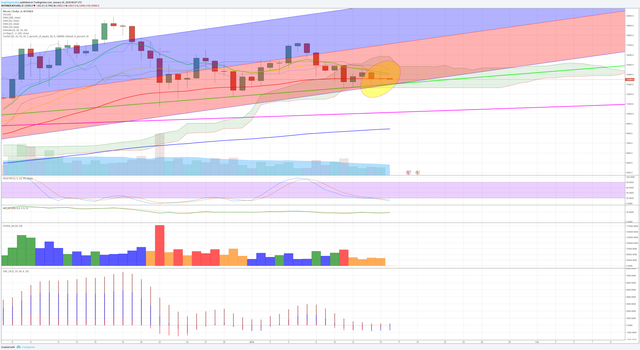

I zoomed bent on the in the future chart and it told a terrific tale. Let’s take a glance.

Here is that the chart I denote to my followers on the CoinSheet Discord and therefore the Bitcoin Masons Discord.

That was ME, zoomed in to seem abundant nearer at the candles on the in the future Bitcoin chart.

Here’s what I noticed:

That line just below the candles is that the exponential moving average fifty, or EMA 50. It averages the worth over fifty bars giving further weight to newer costs. I won’t bore you with the mathematics however you'll be able to Google it. during this chart which means it’s the common of fifty days.

Notice however the worth ripped through the EMA fifty multiple times recently?

We can see that for many weeks Bitcoin flirted therewith line once more and once more and once more before bouncing up to lower highs. you'll be able to see long wicks at the lowest of the candles probing the road, which implies the worth fell through it so bounced. you'll be able to conjointly see the whole candle slicing through the road multiple times.

That wasn’t smart the least bit.

I zoomed out once more and counted what percentage times Bitcoin had crashed through that line throughout its massive pitched battle. seems it had solely done it double, for in the future solely whenever, in Sept and Nov. That’s it. Two days.

And here it had been smashing through that line once more and once more over the previous few weeks.

But to be honest, it wasn’t specifically crystal clear that method it'd go at that time. i used to be obtaining mixed signals.

The pink and purple regression toward the mean channel was still inform up. regression toward the mean finds the most effective line through a chaotic pattern of points like stock costs. With Bitcoin on its massive historical run, the channel still pointed to the sky.

The last candle the day before conjointly closed on a close to excellent doji, that is usually the signal of a reversal. With the worth action at the lowest of the regression toward the mean channel and therefore the doji it may even as simply have signaled AN up trend returning.

And that was the $64000 downside.

The chart was mixed signal town.

That MEant uncertainty which took me back to at least one of the key Donchian rules.

Interesting analysis though I'm not normally into subjective TA but always curious what people think. Short term I'm bullish on BTC (and long term but it will have its ups and downs) as seen from my data below. Check this out if it interests you: https://steemit.com/steem/@weilii/introducing-the-neux-oracle-steem-and-bitcoin-trade-signals Just started following you, would appreciate a follow back if my price analysis content interests you as well :)

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly � Featured Posts are voted every 2.4hrs

Join the Curation Team Here | Vote Resteemable for Witness