Do You Want To Be a Better Trader? - The Use of Stop Loss Orders to Minimise Trading Risk

![]()

Photo by rawpixel.com on Unsplash

Failing to plan is planning to fail.

Anon

Trading in any financial asset is hard. That is why so few people succeed at it. The key to success as a trader is to have a disciplined, methodical approach to your trading. You have to have a trading plan, and you have to stick to it. If you are trading without a plan then you are relying on a variety factors such as hope, luck and the grace of god to ensure your success. One of the many useful sayings that I carry around with me from my time in the military is that:

Hope is not a viable course of action

If you are serious about wanting to make money from investing though then I would hope that hope is not the best tool you can bring to the table.

A lot of this kind of thinking has been lost in crypto markets. It’s been so easy to make money for so long now, that almost any investment that you have made over the past 12 months has been profitable. The result? Complacency has set in. This won't last forever though. The discussion that follows is based on the following two opinions;

- Block chain technology will revolutionise the world over the next 10-20 years and make a lot of people enormously wealthy

- The vast majority of block chain projects will fail

These shouldn’t be controversial points. The first is commonly accepted by those involved in the crypto space and the second, in my opinion, is common sense. Crypto projects are at their heart businesses, and not all businesses are good businesses. I’ve written about this before here so I won’t expand any further on this point in this post. My approach to investing however is based on the two assumptions stated above.

What is a trading plan?

Trading plans come in many shapes and sizes. There is no one single strategy for success and different approaches suit different investors. Perhaps the most commonly known is the “buy and hold strategy” sometimes referred to as HODL. The superficial simplicity of this strategy is beautiful. In reality it’s a very hard strategy to implement. If you accept point two above, then to successfully HODL you need to be able to identify which of the 1500 or so projects currently available will be the success stories of the future. HODLing a failing investment is akin to throwing money down the drain. If you can pull it off, a successful HODL strategy is likely to be the most successful of them all. Don’t kid yourself about how hard it is though.

Today I will put forward an alternative approach to investing that might be useful to you. Its based on the principles of capital preservation and disciplined trading. I’ve written about the importance of capital preservation before in this post:

Preservation of your capital should be your number one priority whether you are investing for the long term or trading on a regular basis. You can’t invest money that you don’t have. Warren Buffett once said:

I only have two rules in investing;

Rule one: Don’t lose money.

Rule two: Refer to rule one.

How do I apply this to develop a trading plan?

The approach I am proposing today is based on a trading tool known as a stop loss. A stop loss is defined as:

A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price. Stop loss orders are designed to limit an investor’s loss on a position in a security.

Investopedia.

By applying this technique, you are saying that you will only hold a given investment if its investment price stays above a certain price. It is usually based on a percentage of the purchase price, and if executed, ensures that you can never lose more than a certain % of your original investment.

Let’s demonstrate with an example. Say you bought a holding in EOS at $10 a coin. Prior to entering this trade, you would determine how much capital you were willing to risk. In our example we will use 10%.

So, you buy EOS at $10 and place a stop loss order to sell at $9. That way, no matter what happens to the price of EOS, you can never lose more than 10% of your money on this trade, even if the price of EOS goes to zero.

Let’s extend our example and put some real numbers in. We’ll buy 100 EOS @ $10 for a total cost of $1,000.

Trading without a stop loss.

In the above example, if EOS goes up in price from $10 to $15, we have made a tidy return of 50% on our trade, or $500 dollars.

If the price of EOS fell to $5 however, then we have now lost 50% of our investment. That’s a loss of $500.

Trading with a stop loss.

Lets now assume that when we purchased our original stake in EOS we also placed a stop loss order at $9, which is ten % below our purchase price. Using the same scenario as above, if the price goes to $15, then we have made a profit of 50%. If the price falls to $5 however, our stop loss is executed at $9 so we exit our trade at that point booking a loss of 10% or $100.

So, in the case where the trade moved against us, we are $400 better off for having used the stop loss strategy. If we still believe EOS is a good investment, then we can buy back in at the lower market price of $5 because we have the cash to do so.

How to trade like a professional!

Let’s extend our example to cover a larger portfolio. Imagine we had $10,000 to invest and wanted to ensure that we minimised our risk of loss. A common saying amongst investment traders is that you should never risk more than 2% of your capital on any given trade. 2% of $10,000 is $200. The use of stop loss orders allows you to achieve this.

With $10,000 to invest we can make 10 investments of $1000 each and place a stop loss order 20% below the original purchase price for each trade. With these stop losses in place the maximum we can lose on any given trade is $200. This satisfies the 2% rule. I will demonstrate this principle with the following expanded example.

One thing to note about professional investors is that they understand that they will not get every trade right. Depending on the type of asset that they are investing in, a professional trader will expect to place a number of investments that make a loss. The art of trading is to ensure that the investments that do well make you enough money that you are compensated for the investments which lose. This is the origin of the common share market saying:

cut your losses and let your winners run

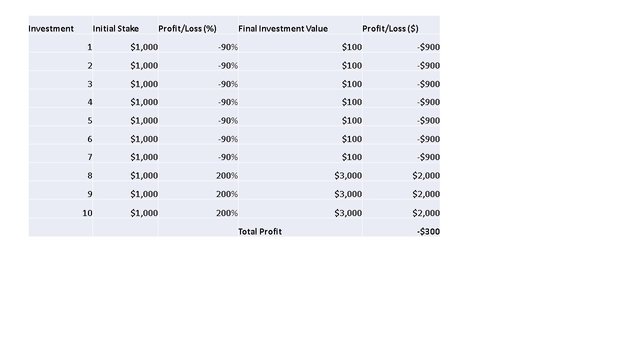

When you are trading exceptionally risky assets such as small capitalisation shares, derivatives or in our case crypto currencies, it is not uncommon for a trader to be wrong more often than they are right. The art of trading is to ensure that your losses do not cripple your portfolio. Let’s imagine for our example that we place 10 trades, and we expect seven of these to make a loss and three to be winning investments. Each of our losing trades will lose 90% of its value, whilst each of our winning trades will triple in price.

Looking first at our results without a stop loss we can see the outcome as shown in the table below.

Things to note in this example are that even though our winning trades have done very well (tripling in price), we have still made a total loss of $300. Obviously if you can execute more successful trades, then your profit margin will be better however if you subscribe to point to that I outlined above which is the most block chain projects will fail then we should expect that a large number of investments in these projects will also fail.

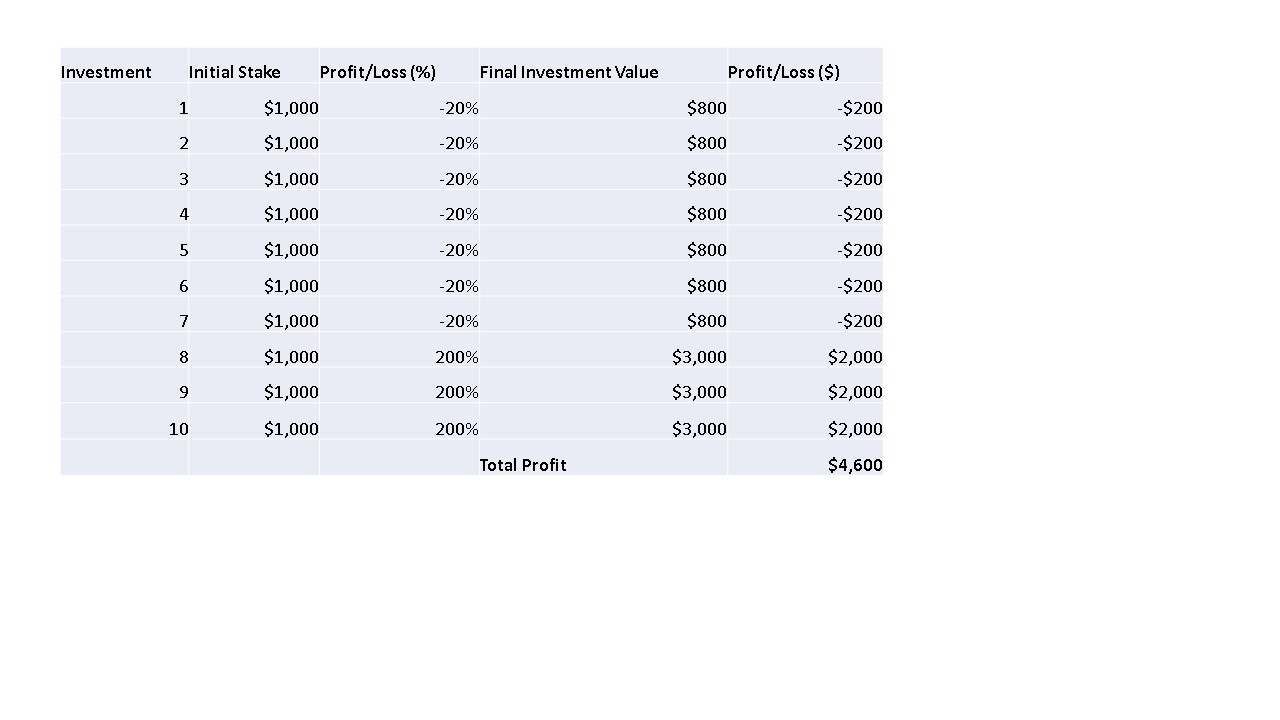

Compare the results above with those shown in the next table which incorporates the use of a 20% stoploss for each trade.

The real time results for each investment are exactly the same, the difference is that in this example our use of a stop loss has limited our losses. So even though seven of our selected investments lost 90% of their value, the most we could lose on any given trade was $200. The end result was that we made a total profit of $4600, which represents nearly 50%, despite only getting 3/10 investments right. This is the power of the use of stop losses.

Investor psychology, stop losses and market timing.

The easiest way to incorporate a stop loss strategy is to trade on an exchange that offers stop loss orders. Not all exchanges do. Poloniex and Binance are two exchanges that offer this feature.

You can try to implement a stop loss strategy manually but will come up against two obstacles:

- Cryptocurrencies are so volatile that one of your investments could lose 30% overnight and you will miss your exit point while you sleep. To properly execute this strategy manually you would need to watch the market 24/7.

- Investor psychology will kick you in the arse. Despite the best of intentions, all humans, even the most disciplined traders are undermined by their own psychology. Saying that you will exit a trade after a 10 or 20% loss is one thing. Actually doing it is another thing altogether. If you can automate the process you have a much better chance of it working.

Frequently asked questions.

Where should I place my stop loss?

This is a difficult one. 10% below your purchase price is a good rule of thumb in traditional investment markets like shares. With crypto investments the volatility is so extreme that if you make your stop too close to your purchase price you run the risk of before forced to exit your trade too early. This is somewhat similar to receiving a false indicator in technical analysis. If you make it too large though then you risk larger losses on your investments. I would think that somewhere between 10%-20% would be a good start point. Once you have tried the strategy you will find a point that suits you.

What if my stop loss forces me to sell and then later on the investment makes a lot of money? Haven’t I missed out?

Yes, you have. Suck it up and move on to your next trade. This situation will happen to you at some point. The emphasis of this strategy is capital preservation and missing some opportunities is the cost you pay to protect your downside. There will always be more opportunities, so don’t over think this.

Conclusion

The above outlines the benefits of using stop losses when trading crypto currencies. It is not a strategy that will suit everyone. It is worth understanding however and if executed well, can significantly enhance your trading profits, while minimising your chances of losing big on any one investment. There is an extension to this strategy, which employs a modified type of stop loss known as a trailing stop loss. I will cover this in a subsequent article.

Great work @aghunter. Any thoughts on how you set your stop loss %. For crypto's would it be higher say 20% to avoid being taken out during a spike? Is there some guidance based on previous price action variance?

I think about 15%. This is a hunch, not a proven number. I haven’t been using stop losses much up till now as I mainly trade through Bittrex and they don’t offer them. I have a binance account, so I am going to set up a portfolio there with stop losses on each trade. I’ll post the results so you’ll be able to see how it goes. 😉

I look forward to seeing your results @aghunter!

Another great article @aghunter! There is so much to navigate but I find the world of crypto investing fascinating.

Theoretically - on a bad day for the crypto market could you risk selling everything with stop loss orders?

Yes, this is true. But if you imagine you had bought 1 BTC at $18,000 last month. The market went up a bit to almost $20k and then dropped. So your stop loss would have kicked in at $16,200 and you would have sold your BTC and pocketed the cash. You could now use that money to buy back in at about $9,500. Now you would own 1.6 BTC.

You’ve saved $6,500 that would have been lost if you had just HODL’d, plus if you really like BTC as an investment then you now own more BTC than you started with!

Given recent volatility you would have been forced to sell everything as you say, but the market has fallen by over 50%. The stop loss means you miss most of the drop and you’d be sitting in cash right now and could decide if you wanted to buy back in.

Ahhhh! Now I get it! Makes perfect sense now that I understand! Lol

Thanks for sharing this post with us, and yes to become trader we should not rely on hope, luck and grace, firstly you have to take action to understand the trading system then you can plan according to your investment plans, firstly you take action, the luck, hope and grace is secondary things. Thanks for sharing this informative and motivating post with us. 🙂

Stay Blessed.

"I only have two rules in investing;

Rule one: Don’t lose money.

Rule two: Refer to rule one."

I like this sentence, thank for sharing @aghunter

I am very amazed with you @aghunter, your post is always interesting to read, very nice post once, I really like your post.

Nice post @aghunter , thanks for sharing..

beautiful a post, I like your post @aghunter

very good, I am very amazed with you @aghunter.

Amazing post,very educated,tq for shared this..

Blockchain backed dollars .....this is really a great concept ...i mean this will never make it come down ...that is why i love steemit.....i feel amazed when i think how @ned & @dan came to have such great idea.....both are irrationally genius......