Here Are The Giants Who Became The World's Crypto

Cryptocurrency investment has not faded until recently. Nowadays, investors (traders) in the crypto market are not only retail investors, but institutional investors are starting to explore this digital investment instrument.

Although the last two weeks the movement of several cryptos has entered a bearish trend in short, many other cryptos are still quite alive today. The number of investors in crypto doesn't seem to have decreased.

In the current booming crypto investment trend, there are people or companies who certainly took part in pushing crypto prices to record high levels.

First, of course, the 'pom pompers' bitcoin cs, namely Elon Musk. Currently, Elon Musk, through his electric car company, Tesla Inc. owning bitcoin of US $ 2.5 billion or the equivalent of Rp. 36.25 trillion (assuming Rp. 14,500 / US $).

Tesla revealed that it had invested in cryptocurrency worth US $ 2.48 billion at the end of March. Earlier this week, Tesla had sold bitcoin and made a profit of US $ 101 million from the sale of Bitcoin. At the end of March, Bitcoin was valued at US $ 59,000 per coin, as compiled from CNBC International, Wednesday (28/4/2021).

In its report, Tesla did not include Bitcoin as a mark-to-market asset. This means that profits and losses are recorded by the company if Bitcoin is only sold, not when Bitcoin is held by the company.

In early February, Tesla announced that it had invested US $ 1.5 billion in Bitcoin. This figure is equivalent to 7-8% of Tesla's cash and cash equivalents. The reason is, looking for the maximum return from cash owned by the company and using it as an alternative payment.

In his presentation on the financial performance of the first quarter of 2021, CFO or master of coin Tesla Zach Kirkhorn said that his party chose to invest in Bitcoin looking for a place to store company cash that was not immediately used, providing attractive returns and well-maintained liquidity while awaiting the launch of the factory in Austrin. (USA) and Berlin and the uncertainty of semiconductor and port capacity.

"You know from a corporate treasury perspective, we are quite happy with the amount of liquidity in the Bitcoin market. Our ability to build our position to the first place was very fast. When we sold it later in March we were able to execute it very quickly," he explained.

Apart from Tesla 'Elon Musk', another individual crypto market maker is Mark Cuban. But Mark Cuban is the market maker of the Dogecoin crypto 'meme'.

Mark Cuban is the owner of the Dallas Maverick NBA basketball team and a number of other small startups. Forbes noted he has a fortune of US $ 4.4 billion.

Previously he was a cryptocurrency critic. But now his attitude softened. On The Ellen DeGeneres Show he showed his support for Dogecoin.

"When someone asks me if Dogecoin is a good investment, I would say it's not the best investment in the world but it's much better than a lottery ticket, and it's a great way to learn and start understanding cryptocurrency," he said as quoted by Forbes, Thursday ( 29/4/2021).

Earlier this week Mark Cuban announced that he would begin accepting payments by Dogecoin at authorized stores selling Dallas Maverick merch.

"We are on the right track to make 6,000 Doge [coin] transactions in April," said Mark Cuban.

When asked why use Dogecoin. He said "Doge is the only coin people use to transact. People are spending their Doge and that means more businesses will start accepting it."

Apart from Elon Musk and Mark Cuban who are considered as individual crypto market makers, US banking institutions, JP Morgan Chase also seem to be considered as institutional crypto market makers, because JP Morgan became the first United States (US) bank to create digital currency or cryptocurrency. .

The bank transacts over US $ 6 trillion in corporate funds worldwide every day in a massive payments business. In the trial period of the next few months, a small portion of the funds will be transacted using a digital currency called "JPM Coin".

The purpose of the digital token, which was created by engineers at the New York-based bank, is to be able to instantly complete inter-client payments.

Apart from the JP Morgan Chase bank, there are also companies or institutions that invest in crypto, especially in bitcoin and become a market maker for the bitcoin market.

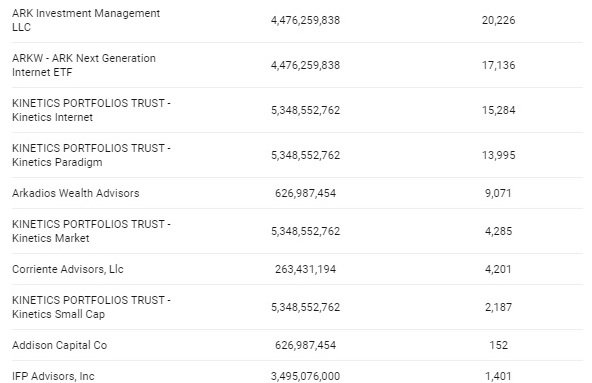

Based on data from the US Securities and Exchange Commission in August last year, it showed that 20 of these institutions invested in Grayscale Bitcoin Trust (GBTC), a product of Barry Silbert's New York-based Grayscale Investments, LLC.

The following are market makers from institutions in bitcoin cryptocurrency

Largest Bitcoin Holder As of June 30, 2020

The increase in crypto currencies, especially bitcoin, was also driven by whales who of course have a very large portion of bitcoin, generally between 10,000 and 100,000 bitcoins.

The whales can play a big role in bitcoin price movements, because if the total value is around US $ 550 billion, reported the CryptoPotato report in March.

CryptoPotato reported earlier this year that there were 115 wallets that had more than 10,000 bitcoins. Before crossing US $ 60,000 / BTC, the previous record price of bitcoin at US $ 58,000 / BTC was reached on February 24.

Bitcoin whales can also be categorized into market makers or the Indonesian term is 'dealer'. Meanwhile, by definition, whales in bitcoin is a term in crypto that refers to individuals or entities that own large amounts of bitcoin.

Not only in bitcoin, whales also have quite a lot in other cryptocurrencies, so they have the potential to manipulate currency valuations.

They are called "whales" because their role is likened to being able to disrupt the role of small fish in an ocean. These small fish are what is meant by ordinary individual investors who invest in a crypto market, of course, with an investment value that is much smaller than the whales.

Whales can also be a problem for bitcoin due to the concentration of wealth, especially if it remains silent and even if it decreases liquidity, which in turn can increase price volatility.

The volatility increases when these whales move a large number of bitcoins and are transferred all at once.

Because they may try to sell their assets, but in smaller amounts over a longer period to avoid drawing attention to themselves, and they can produce market distortions, sending prices up or down unexpectedly.

Under these conditions, can crypto investors with a small investment value know who the whales are? Of course, it is very difficult to know who the whales are, because they must be using pseudonyms so that they are not easily detected.

However, according to the Investopedia site, the following names can become whales in bitcoin today, if measured by the value of their holdings in bitcoin.

Here are the candidates who might be whales on bitcoin.

- Satoshi Sakamoto

For crypto investors, especially in bitcoin, this name is certainly no stranger to hearing. The mystery of the name Satoshi Nakamoto has yet to be satisfactorily resolved, but recently the story has undergone several changes.

One possible candidate for the "real" Satoshi Nakamoto is Craig Wright, an Australian businessman who claims to have invented cryptocurrency with the help of his friend Dave Kleiman.

In 2019, Wright was sued by Kleiman property, half of the 1.1 million bitcoins reported. The details of the case are complicated and made more of a secret between Wright and Nakamoto, but if Wright did own 1 million bitcoins, he would definitely be one of the top three bitcoin whales.

- The Winklevoss Twins

Cameron and Tyler Winklevoss, best known for playing Armie Hammer in the film The Social Network, were early adopters, fans, and 'evangelists' of bitcoin. They reportedly own more than 100,000 bitcoins, and investopedia places them on the list of the top three whales.

- The Draper Team

The Draper team is a venture capitalist from the United States (US) as well as the founder of the firm Draper Fisher Jurvetson, Draper University, Draper Venture Network, Draper Associates, and Draper Goren Holm. \

Draper has invested in bitcoin on the Baidu, Hotmail, Skype, Tesla, SpaceX, AngelList, Twitter, DocuSign, Coinbase, Robinhood, Ancestry.com, Twitch, and Cruise Automation platforms.

He was also an early investor in bitcoin, where he purchased about 42,000 bitcoins for six US dollars each and deposited them on the Mt. The current Gox is no longer operational, after Mt. Gox was hacked by hackers. As a result, Draper lost all of its ownership in bitcoin.

In July 2014, Draper received broad coverage for its purchase at a U.S. Marshals Service auction. around 30,000 bitcoins confiscated from the Silk Road marketplace website. His current holdings place him in the top 15% of all bitcoin investors.

- Barry Silbert

Barry Silbert is the CEO and founder of the Digital Currency Group, which has invested in more than 75 bitcoin-related companies. Digital Currency Group is also the owner of CoinDesk.

Silbert also briefly participated in the same US government auction as Draper and reportedly earned 48,000 bitcoins, placing it as a bitcoin whales according to investopedia.