Bitcoin: Currency That Will Make History?

Bitcoin is an electronic money that is beyond the control of any central authority,Originally, in 2009, a bitcoin was worth 1 cent of a dollar. Today, it's worth more than 19000$.

2013 was the year of the consecration of this new global phenomenon. Banks are interested, its value explodes. Could it supplant our traditional currencies?.

Birth of the currency

One could say that the history of bitcoin begins in 1983 with the research of "David Chaum", an American student at the University of California at Berkeley on cryptography." David Chaum" was particularly interested in the possibility of sending money by computers anonymously.

In 1998, "David CHAUM" proposes a disconnected system of electronic money in collaboration with FIAT and NAOR.

In 1989," David CHAUM" commercialized his idea by creating the company Digicash. Digicash should set up an anonymous electronic money system that they called "e-cash". Other companies, First Virtual Holdings, Cybercash, and even a division of Microsoft, will follow suit not later. There was even the company Gold & Silver Reserve Inc. which launched an electronic money whose value was guaranteed by gold called "e-gold". The challenge was to enable online payments for the development of online commerce in its infancy at that time.

Faced with a very slow adoption, Digicash closed the doors in 1998. But before declaring bankruptcy, the company had embarked on the development of physical wallets to prevent the possibility of using the same amount several times (double ).

Several other companies will take the idea including Mondex which will develop a physical wallet and a plastic card. Mondex will be acquired by MasterCard.

A recent creation

Nobody knows the true identity of the inventor of Bitcoin. He is called Satoshi Nakamoto and it is he who inaugurated the history of cryptocurrency by reserving the domain name Bitcoin.org on August 19, 2008. This developer, who regularly participated in certain mailing lists on cryptography, n never gave his real identity.

Events began to accelerate in 2009 and was one of the most important points of the year

"Satoshi NAKATOMO" starts working on what will become bitcoin in May 2007 by talking with people interested in the subject in a forum called "cyberpunks".

On January 9, 2009, Satoshi announced the release of version 0.1 of the Bitcoin software. He sends a first transaction three days later to one of his relationships, a cryptographic developer named Hal Finney.

On October 5 of the same year the first dollar Bitcoin exchange rate is released and places the value of Bitcoin at about one thousandth of a dollar.

A few months later, one of the first users buys a pizza for 10,000 Bitcoins! At the time it was only $ 40 at most. Today, the same amount would be millions of dollars.

In 2010, the software improves and several versions come out over the months. The longest known marketplace before filing for bankruptcy in 2014, MtGox, was born on July 17 of that year. Meanwhile, the price of Bitcoin passes successively from $ 0.08 to $ 0.50.

In 2011, following many mentions in the press, Bitcoin is gaining popularity. Parity with the dollar is reached for the first time on February 9, 2011 ($ 1 = 1 BTC). But the value fluctuates, decreases, then rises to reach $ 10 then $ 31 in June 2011! Trading platforms are being created in Poland, Brazil and the United Kingdom, and the first Bitcoin conference is taking place in New York on August 20 of the same year.

The year 2012 sees the biggest theft of Bitcoins ever observed: there are nearly 50,000 Bitcoins that disappear after a software vulnerability discovered at a US host. Later, the Satoshi Dice betting site, based solely on e-money, generates more than half of all Bitcoin network transactions. It is also the year of the creation of the Bitcoin Foundation whose objective is to promote the use of this invention.

The first purchase with bitcoin

-On May 22, 2010, the American Laszlo Hanyecz, a programmer living in Jacksonville, Florida, offers in the bitcointalk forum to buy a pizza with bitcoins. He will receive from Papa John's a pizza against 10,000 bitcoins. This is the first commercial transaction with bitcoin.

-On June 12, 2010, the price of bitcoin against the dollar is multiplied by 10, from 0.008 dollars for a bitcoin to 0.08.

-A few days later, on July 17, 2010, Jed Mc Caleb founded the Mt Gox marketplace. This is the first market place where you can buy and sell bitcoins like in a stock market.

-On November 6, 2010, bitcoin reached a capitalization of US $ 1,000,000 calculated by multiplying the number of bitcoins in circulation at that time by the most recent bitcoin price on the Mt Gox marketplace, or $ 0.50 for a bitcoin.

- On December 8, 2010, the first bitcoin commercial transaction on the mobile takes place when ribuck sends 0.42 bitcoin to doublec.

2013 : acceleration of the history of Bitcoin

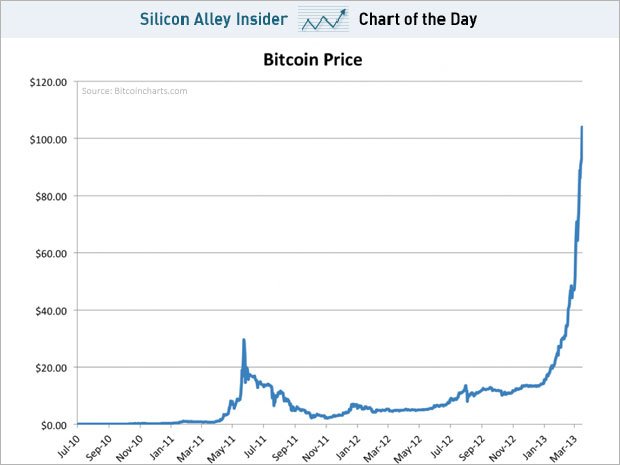

From a price of 20 USD recorded in January 2013, Bitcoin registered rapidly and continuously on the rise during the first quarter of 2013, until reaching the highest of 266 USD during the day April 10, 2013. The bubble then burst as expected, with a rapid drop below 50 USD.

Some wanted to emphasize the concomitance of the Cypriot crisis with the rush observed on Bitcoin (Russian and / or Cypriot investors would have wanted to place their euros in Bitcoins to ensure the "cure" imposed on Cyprus by the European Union ), but many analysts believe that the extraordinary rise of Bitcoin was initially the effect of a pure speculative activity fueled by the recent media interest for the virtual currency: in anticipation of an attraction for this alternative currency, investors would have bought Bitcoin en masse (even though the total amount of Bitcoins in circulation in March 2013 was only 11 million units, with spontaneous generation of 25 Bitcoins every 10 minutes).

This extreme volatility of Bitcoin is detrimental to its functioning, since the essential element of the transaction system it establishes is that each transaction takes about 10 minutes (because each transaction is added to a block that is updated every 10 minutes). If Bitcoin takes or loses 10 USD in a few minutes via trading sites, this can be a problem (and allow some spectacular gains or losses).

The same month, the funds of a German exchange platform, Bitcoin-24, were blocked by the German and Polish justice, resulting in its effective disappearance.

In May 2013, and again in August, the MtGox trading platform also saw a portion of its funds (over $ 5 million) blocked by US authorities over a financial dispute, without causing the bankruptcy of the company.

In August 2013, jurisdictions in Texas and Germany recognized for the first time the value of Bitcoins.

In October of the same year, the US FBI seized the servers of Silk Road, an illegal narcotics site, arrested its alleged founder Ross Ulbricht and confiscated more than 26,000 Bitcoins deposited by users. These Bitcoins are still in the possession of the FBI.

In late October 2013, a student from Oslo recalled that he had bought $ 27 worth of Bitcoins in 2009, shortly after his invention. Noting the surge of electronic money, he found his nest egg, found that the value of his wallet exceeded the million dollars and planned to buy an apartment with this sum.

In November 2013, the value of Bitcoin rose sharply, sometimes exceeding $ 900 and a new version of the illegal marketplace Silk Road made its appearance. The same month, the US Senate held its first official meeting on the subject of Bitcoin.

Parity with the dollar

-On February 9, 2011, for the first time a bitcoin is worth a US dollar in the Mt Gox marketplace.

An Australian is trying to sell his vehicle a 1984 Celica Supra at 3000 bitcoins on February 14, 2011.

-On March 27, 2011, the Britcoin marketplace opens its doors and becomes the first market place where you can buy or sell bitcoins for pounds sterling. A few days later, on March 31st, it is the first transactions against the Brazilian currency, the Real, on the Bitcoin Brazil marketplace.

-On April 5, 2011, bitmarket.eu launches its activities to sell and buy bitcoins with several European currencies including the Polish Zloty and the Euro.

The first bitcoin vending machine

On May 2, 2013, for the first time in the world, a Bitcoin ATM opened in San Diego, California. Then in July, brothers Tyler and Cameroon Winklevoss formally seek approval from the US Securities Exchange Commission for their Winklevoss Bitcoin Trust, the Exchange Traded Fund, ETF, in the United States. For them it will be an opportunity for many individual investors to take advantage of the potential of bitcoin with less risk.

October 29, 2013

Installation of the first bitcoin vending machines in Canada. Called Robocoins, these machines are sold for $ 200,000 each. Holders will receive a percentage of transactions and hope Bitcoin fans in their shop.

Adoption of bitcoin

As of June 2011, the WikiLeaks website is beginning to accept donations of bitcoins to bypass US attempts to suffocate. And on June 29, the company Bitpay launches the wallet as a smartphone application.

On November 15th, WordPress.com announces that its customers can now pay in bitcoin.

In February 2013, Matthew Birkenshaw and Riley Alexander, who had already launched the bitcoins gift giving website GiftsForCoins.com, created PizzaForCoins.com, a start-up for delivery of bitcoin payment pizzas, and Kim Dotcom, an Australian entrepreneur announced that its download service of films and music will now accept bitcoins in payment.

Specialized magazine on the bitcoin

On February 27, 2012, Vitalik Buterin, along with others, created the first specializing magazine on bitcoin and cryptocurrency: Bitcoin Magazine. In May, Bitcoin Magazine releases its first issue on paper. In June, one of the largest US bitcoin online transaction sites, Coinbase, launches its operations in San Francisco, California.

Adam Draper launches a Bitcoin start-up incubator in the United States, BoostVC, in July 2012.

On September 12, 2012, several members of the Bitcoin community set up the Bitcoin Foundation, headquartered in the United States to support the development of bitcoin.

on August 20, 2013, the German Federal Ministry of Finance officially recognizes bitcoin as a private currency, allowing commercial and private transactions. Thus, in Germany, investments of more than one year on bitcoin are exempt from taxes. It must be remembered that two weeks earlier, in his verdict on the US Securities Exchange Commission case against Bitcoin savins & Trust of Texas judge Amos MAZZANT recognizes that bitcoin is a currency or a form of currency.

More than 100000 trader in 91 countries

It is now possible to buy everything with bitcoins: Microsoft software, Dell computers, airline tickets, space travel, books from Amazon. In December 2014, there are just 10,000 traders accepting payments in bitcoins but in February 2015, 100,000 traders accepted bitcoins as payment. And projections indicate that these numbers will reach and exceed 150,000 traders. One-third of these traders are in the United States and the rest are in 90 countries. Since March 2016, precious metals can be bought with bitcoins.

2014: bitcoin crisis of confidence

The consequences of closing Mt.Gox were not limited to the single currency. In many countries, the authorities attempted to impose regulation on the circulation and use of cryptocurrencies. In Japan, it was a question of looking for a way to tax transactions made in bitcoins.

In France, Pierre Moscovici, then Minister of the Economy and Finance, assured that "It is not a question of banishing these currencies but it is necessary to ensure a precautious framing". It pursued several objectives, the fight against money laundering but also the protection of exchange platform clients to avoid cases as dramatic as the bankruptcy of Mt.Gox. In July, the Autorité des marchés financiers also took a stand on the subject, recalling the "particularly high risks" they imply, and calling them "risky investment".

At that time, the slightest rumor about a possible ban on crypto-currencies in China was enough to bring down the price of the BTC significantly. In January 2015, the value of a bitcoin fell below $ 200, before stabilizing below 300 for a large part of the year.

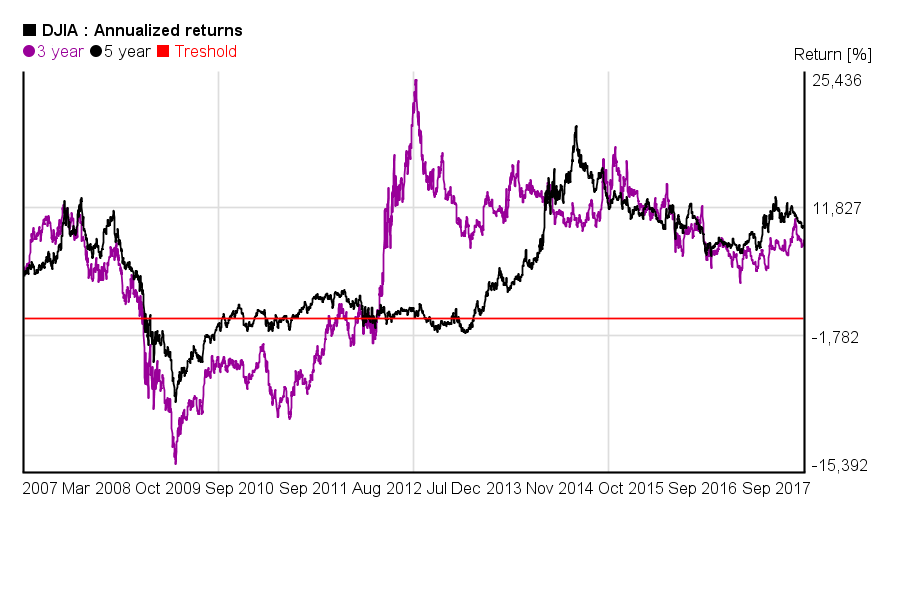

2014-2015: Banks enter the race

Meanwhile, traditional banks have heard about the emergence of bitcoin, and have begun to take an interest in the technology that accompanies it: the blockchain. Goldman Sachs is one of the first to look into this issue in an issue of his home magazine "Top of Mind", distributed to some of his big clients.

The bank explains that in its view, the BTC can not be considered a currency in view of its enormous volatility, or the absence of a mechanism to ensure the stability of its price. It defines it rather as a speculative financial asset used as a means of exchange.

On the other hand, Goldman Sachs already detects some of the potential of cryptocurrency, within the framework of interbank exchanges. She believes that in a scenario where the Bitcoin protocol would be adopted massively in all countries of the world, the various intermediaries taking charge of transactions would have much to lose.

In total, Goldman Sachs estimates that $ 200 billion could be saved by merchants each year if they used Bitcoin for their payments, rather than the traditional banking system. The big winners of this change would be the bitcoin exchange platforms, which would ensure a very lucrative market of about $ 115 billion a year.

An echo in the ear of nine banks, including Credit Suisse, JP Morgan and UBS. They formed a consortium to use this technology to trade in the markets, saving significant transaction costs. For Bank of England, this is a "key technological innovation".

2016: Blockchain highlights its strengths

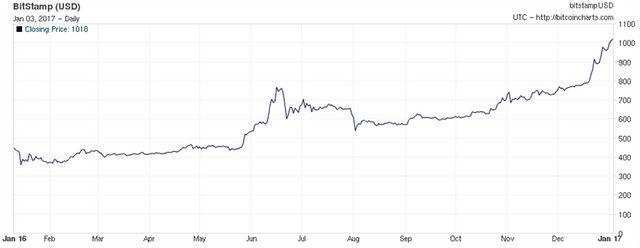

If 2016 is seen by some as the worst year in history, the side cryptocurrency lovers, it was a very good vintage. Bitcoin has been growing almost steadily from about $ 400 at the beginning of the year to nearly $ 1,000 by December 31.

It must be said that many initiatives have been taken all around the world to put crypto-currencies back on the scene. Governments no longer talk about banning Bitcoin, but rather to regulate its use, while blockchain asserts its strengths on the side of banks and insurance.

The development of Ethereum, a new protocol derived from Bitcoin, is no stranger to this development. At a symposium organized by the CSNP, Sandrine Duchene, director of public affairs at Axa, explained that being able to enter contracts in a blockchain, and to execute the terms when their conditions are met, is to be watched closely. Several advantages were put forward by the insurer, including the prospect of having at hand an "inviolable register" and the possibility of enforcing these contracts faster and cheaper.

It is still necessary that these contracts be correctly written. TheDAO incident in June showed that a badly written contract can be the source of catastrophic flaws for a company. In this case, $ 50 million could have been stolen from a decentralized company housed on the Ethereum blockchain. A situation that could be solved with a fork of the blockchain. A precedent of crucial importance in the history of cryptocurrencies: for the first time, one of the famous "falsifiable registers" that pleases both insurers and bankers has been altered, via a fork to return to a previous status.

In January 2016, in Davos, MasterCard will also admit to "study carefully how best to apply the concept of blockchain" in its activities. And for good reason, the fees collected by the payment card managers were the largest savings item pointed out by the Goldman Sachs study, and would be the first losers in case of massive adoption of cryptocurrencies.

The growing interest of the giants of new technologies

If the price of bitcoin could exceed $ 1,000, it is also thanks to the arrival of big players in new technologies. We will remember for example in February 2016 the arrival of IBM and Microsoft with solutions called "Blockchain-as-a-service" or BaaS.

IBM has also made some 44,000 lines of code available to the Linux Foundation supported Hyperledger project, which aims to evolve blockchain technology. This contribution was not innocent, however, since Big Blue had signed an agreement with Japan Exchange Group (JPX), the company managing the Tokyo Stock Exchange. It is thanks to the code provided by IBM Hyperledger to engage in experiments to treat transactions on low-liquidity stock markets, using this technology.

At Microsoft, it is within Azure that blockchains must flourish. The Redmond giant had reached an agreement with Ethereum to make this chain of blocks accessible to its Azure customers, but the company insisted that its users could "access any blockchain, even that of two gus in a garage that have made a fork of Bitcoin with a great idea that people want to try. "

For IBM, the goals are also very broad, the company seeing an "almost unlimited amount of places where decentralized accounting can be used", and so many markets to conquer.

-2017- The dangerous explosion of bitcoin: save who can!

Despite all the denials of techies, Bitcoin continues to fly under the pressure of marketing that makes it a form of Russian roulette that benefits those who know the manipulation. Since March 26th, Bitcoin has risen from $ 973 to $ 2,795 to $ 19,000 today. A real price explosion that can only be explained by fraudulent practices. It went from $ 16 billion to $ 43 billion.

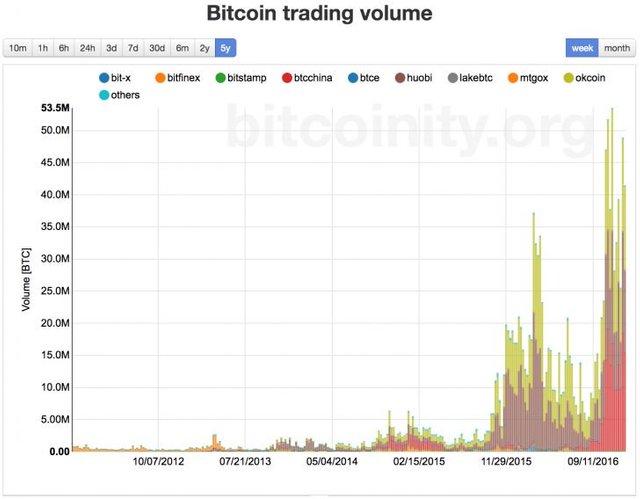

As shown in the graph, the increases are strictly due to an increase in volumes: in other words, there are no movements that reflect an intrinsic value of Bitcoin which, in any case, does not exist since the Bitcoin is not a currency. These are the last buyers who are the pigeons. They will pay a high price for the plunge that will not delay.

But behind this flight, there are formidable manipulators who have resources that are exchange bitcoins exchange of which several leaders are in prison. The founder of the world's largest depository of Bitcoins, now based in Zug, Switzerland, predicts that the value of a Bitcoin will exceed the $ 1 million mark in the next 10 years, taking the entire assembly by surprise and even the most optimists of the sector. Some see it as a replacement for gold. We are in delirium.

On several occasions, these spectacular rises came from the conversion of dirty money into Bitcoin. We do not know what causes these mood swings that fall quickly. They pose a fundamental question: beyond the technology that underlies the object, where does the $ 32 billion value come from?

2009 1 BTC = 0.0001 USD

2010 1 BTC = 0.07 USD

2011 1 BTC = 15 USD

2012 1 BTC = 7 USD

2013 1 BTC = 100 USD

2014 1 BTC = 600 USD

2015 1 BTC = 220 USD

2016 1 BTC= 2200 USD

2017 1 BTC= 19000 USD

https://nxtfolks.com/2017/07/13/world-leading-giants-now-with-bitcoin/

You got a 1.28% upvote from @postpromoter courtesy of @aek081969!

رائع اخي عبد القادر

شكرا اخي هشام

رائع اخي متابع لك واصل

الله يسلمك اخي...ربي يوفقك

@originalworks

The @OriginalWorks bot has determined this post by @aek081969 to be original material and upvoted(1.5%) it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

مقال ممتاز عن تاريخ البيتكوين

حصلت على تصويت من

@arabsteem curation trail !

و تم اختيار مقالتك ضمن مقالات يومية مختارة للنشر اليوم في مقالنا! :)

شكرا لكم على هذا الدعم و الاهتمام...تمنياتي لكم بالتوفيق

Useful inf about this big mama, called BITCOIN! cheers @aek081969

9.81% @pushup from @aek081969

Congratulations @aek081969! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPSneaky Ninja Attack! You have been defended with a 1.26% vote... I was summoned by @aek081969! I have done their bidding and now I will vanish...Whoosh

This post has received a 36.90 % upvote from @kittybot thanks to: @aek081969.