Project Overview: SHRIMPY

Project Overview: SHRIMPY

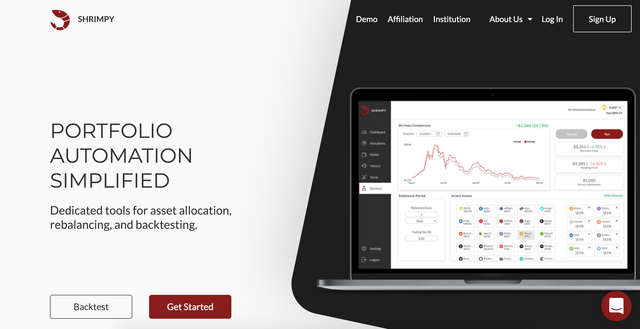

For some of my first pieces for Whale Reports, I wrote guides and reviews for two different third party automated bot platforms, which I will link in the sources below. I am in the process of updating the “Cryptohopper” review, as they have recently undergone a platform revamp and user interface update. The “Nazca Bot” review is a platform that is still growing and making some positive steps toward development. In this article, I will be checking out my third automated bot platform, called “Shrimpy.”

The Shrimpy application is a portfolio management tool and has some automated features to help you manage your crypto assets. With Shrimpy, you can set specific, or dynamic asset allocation as well as rebalancing periods, to aid profitability and decrease general portfolio volatility. Shrimpy lets the user implement a “Blacklist” to ensure that a specific coin is never purchased, if this is something appealing to the user. Shrimpy also offers unique cold storage options which is something that other automated bot services do not offer.

On top of the innovative strategies that Shrimpy offers, there is also a social aspect so you can see what other users have set as an allocation, and rebalance strategy. With this, you can view the highest rated, or most popular allocation strategies, helping everyone adapt to the incredibly volatile cryptocurrency markets. You can also accumulate followers directly on the Shrimpy platform if your shared allocation gains positive traction.

Below I will go into a simple walkthrough and look around of the Shrimpy platform. Below I sign up for an account, click around and look at some of the options that Shrimpy offers. This will be a very basic overview, and I will not be going through the actual act of rebalancing cryptocurrency using the Shrimp platform in the guide, just an overall walkthrough, and look-around of the platform.

Above is a photo of me simply signing up for the platform, the interface I found to be pretty snappy, and responsive.

Shrimpy allows you to set a rebalance period for your portfolio. Breaking down what this means, if you have a portfolio of 5 coins, and 2 have a good performance over a certain amount of time, and the rebalance period triggers, the profits are now evenly distributed from the 2 coins that had a positive performance across the entire portfolio of 5 coins. It is up to the user to determine what they want to set the rebalance period as, and mainly depends on the portfolio strategy. Shrimpy allows the user to rebalance at any time with a button on the website.

Shrimpy offers an innovative option for cold storage and even allows the user to rebalance in their cold storage. This moves cryptocurrency off of the exchange that you may be using, onto the cold storage devices that Shrimpy utilizes to ensure an extra layer of security. They have figured out how to rebalance a portfolio in cold storage with minimal issues, giving the user extra ease of mind.

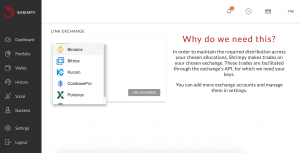

Shrimpy supports multiple exchanges, including Binance, Bittrex, CoinbasePro, and a couple of others. While they do offer support for multiple exchanges, Shrimpy also offers their innovative social sharing option which I will explore briefly below.

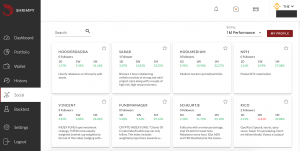

Here is an inside look at some of the social Shrimp strategies that are being shared on the platform. Here, users can sell the allocation and rebalancing strategies they have developed, allowing other users to critique, and even implement the strategies. Some of these strategies have had some pretty good performance recently, with some 1W performances over 10%+ and some months over 30%+.

The Shrimpy automation tool proved to be a smooth way to automate portfolio allocation. It is not a “ trading bot” as its primary automated function is to rebalance the portfolio, however, this can be used in some long term strategies. Shrimpy offers innovative portfolio management options as well as cold storage, for extra security. With the cryptocurrency market being hyper-volatile, it may be advantageous to stick to a certain grouping of coins and rebalance between the grouping. You can help on cutting down on the volatility with Shrimpy, and you can set up an automated strategy where you are profitable in long time frames.

Do you have a product, device, coin, or network that is in need of some content creation or a review? Contact me via email at [email protected] or DM me on twitter at https://twitter.com/DragonBTC

Get 10% off Bitmex fees by using this ref link: https://www.bitmex.com/register/QingZO

Sources:

- https://whalereports.com/dragon-review-basic-set-up-cryptohopper-trading-bot/

- https://whalereports.com/nazca-bot-automation-revolutionizing-how-you-trade/

- https://www.shrimpy.io

- https://help.shrimpy.io/about-shrimpy/introduction

Posted from my blog with SteemPress : https://whalereports.com/project-overview-shrimpy/