Weekly XDAT Newsletter: 29 April 2019– 05 May 2019

Note from the CEO, Prashanth Swaminathan

XDAT.io was launched towards the end of Q1 2019 and our Bullwhip Movement has started off with great results — we have added around 5000 users to our platform with 400 users whitelisting themselves to become Nodes. This Movement is open until we complete our ICO that is scheduled for end of Q2 2019, so do encourage your friends to join us to earn while trading cryptocurrencies on XDAT.

We would like to thank all the XDATians for joining us in our journey to take Crypto to All. We are launching a newsletter to share XDAT’s developments and market updates with our community and we would encourage you to share this widely to increase awareness of crypto and foster mass adoption.

Market Analysis

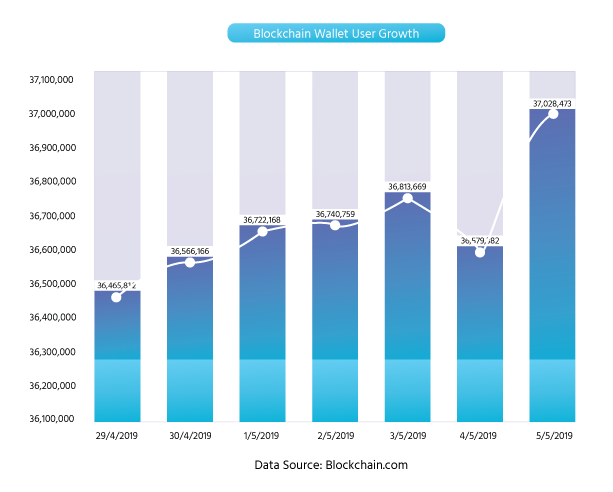

Bitcoin has surpassed previous 2019 high of 5800 and made a new high of 5900 last week. We have witnessed the gradual shift in the range i.e. Support and Resistance. A pullback from the high of 5900 was a much expected event as traders start to take profits. Nevertheless, both technical and fundamental indicators remain healthy with 50-day moving average giving crossover to 200-day moving average. The cryptocurrency space demonstrated a mix of both positive and negative developments throughout the week. A knee-jerk reaction was witnessed after the ‘Bitfinex-Tether’ controversy but the market recovered quickly with Bitcoin breaking above 5600 levels and marching to 5800 levels. Fundamental catalysts remain strong as blockchain digital wallet users and active addresses are on the surge.

A recent report by Blockchain Capital suggested that over 11% of the Americans hold Bitcoin and over 65% of them know about the first crypto. As far as price action is concerned, Bitcoin held comfortably above its 200 days simple moving average, which remains one of the most important metrics. Bullish divergence of a Higher low in Bitcoin price and Lower low in oscillator indicates a good entry point during retracement in the uptrend.

Institutional Interest

Institutional interest was witnessed in the Digital Asset Space with one of the United States’ most coveted exchanges, ErisX launching new spot market for Digital Assets. Further, ICE- the owner of both NYSE and Bakkt acquired crypto custody company Digital Asset Custody Company. Additionally, Fidelity Investments mentioned in one of their reports that more than half of the institutional investors consider the idea of including Digital Assets in their Portfolio. Overall, we expect the market to hold on to the gains and push towards sustainable upmove. One of the biggest names in the Cryptocurrency space — Grayscale Investment announced this week that they have achieved $1.3 billion in Asset under Management.

We believe that for the coming week, traders should expect a range bound movement with resistance at 5930 -6000 and support at 5600 levels.

Major Development this Week

--> Bitcoin — To boost the investment in Bitcoin, Grayscale has launched a multi-million dollar marketing campaign that includes a year of national TV commercials.” In another development, a recent survey conducted by Harris Poll concluded that more than 1 in 10 Americans currently hold Bitcoin.

--> Ethereum — Core developer Hudson Jameson stated that a third-party audit of the ASIC -resistance ProgPow algorithm has been funded. In another development, major Audit firm Deloitte migrated its clients from Ethereum to Vechain. Additionally, two mainstream companies — Tesla and Amazon talking are about Ethereum which is a net positive for the Blockchain firm.

--> Ripple — Banks have kept their faith on Ripple despite dwindling price. The company has recently collaborated with Saudi British Bank’s (SABB) for Instant Cross-Border payment services. Another development this week suggested that Ripple’s escrow account has released 1 billion tokens totalling $308,89 million according to the whale-alert service. Further NASDAQ has decided adding Brave new coin’s Index for XRP to Global Data Service.

--> Ethereum Classic — Stevan Lohja, the Technology Coordinator at Ethereum Classic Labs recently announced through a Blog post about the upcoming developments on the network for creating a Turing Complete and proof-of-work platform. First quarter has been eventful for the token as they implemented the multi-Geth Ethereum Virtual Machine Layer.

--> Bitcoin Cash — A new mining entity by the name Satoshi Nakamoto’ currently controls around 40% of total hashrate.

--> EOS — EOS joined the bandwagon of crypto options on Financial Technology platform YouHolder. Other Cryptos on the platform are BCH, BSV, XRP, DASH, ETH and so on.

--> DASH — Mining activity in DASH is at an all time high as per the data from Bitinfocharts. The hash rate activity despite slump in the overall market is positive for the company.

--> TUSD — As the Bitfinex-USDT news broke out, TUSD shot up trading premium to USD. It has enjoyed the confidence with HODLers standing at 13,788 at the time of writing compared to 6,396 of USDT. The stablecoin remains strong holding $199,063,885 USD held in escrow accounts according to the recent Audit report.

Wider Market Update: Weekly News Analysis

--> Andreessen Horowitz, the ace Crypto investor has raised $2.75 billion for two new funds according to the fund’s official announcement.

--> The Wall Street Journal reported that Facebook is working on long rumoured Cryptocurrency based Payment system, internally called Project Libra.

--> A report from Coinschedule suggested that UAE is the top destination for token sales. UAE achieved top spot primarily because of the two token sales namely the GCBIB raising $142 million and Bolton Coin which raised $67 million.

--> Paxos announced its new partnership with Ontology wherein up to 100 million PAX tokens pegged to 1:1 to the US Dollar will be issued on the Ontology blockchain network. Unlike many other stablecoins, PAX has received the approval from NYDFS (New York State Department of Financial Services) which implies that the stablecoin is audited by the top US firms.

--> As many as 11 international organizations and 24 financial authorities came together at the Federal Reserve Bank in New York to discuss about the crypto regulation.

--> Venezuela is one of the worst hit countries by inflation and the citizens are migrating from the bolivars to Bitcoin. A new metrics from Coin.Dance suggested that recently total volumes in Venezuela on Localbitcoins touched 35.9 billion sovereign Bolivars.

--> SeedInvest, the subsidiary of Circle has now acquired the Alternative Trading System License which means that the company can now facilitate the trading of traditional securities. As of now, the entity is not allowed to tokenize equity, though the chances are that it might get the nod in future.

--> Cryptocurrency Merchant Bank Galaxy Digital has reported loss of $272.7 million in 2018. According to the annual financial report, the company holds 9,724 Bitcoin valued at $36.4 million, 2.4 million EOS worth $6 million, 92,545 Ether worth $12.3 million and 60,227 Monero in its portfolio

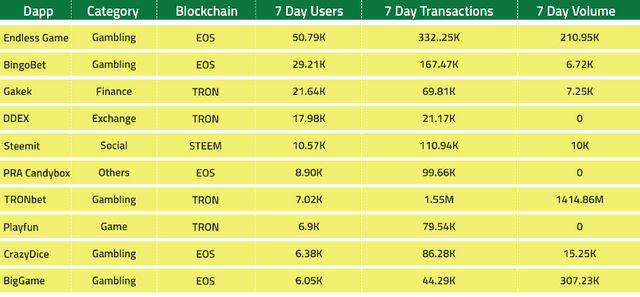

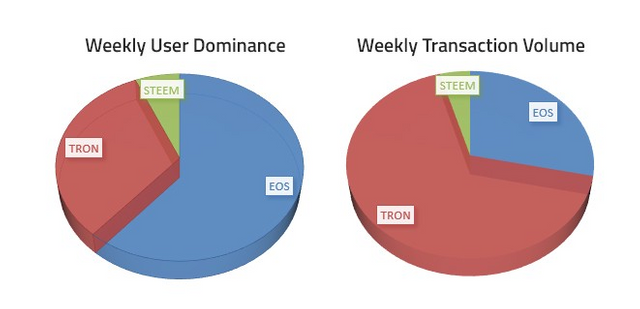

Weekly Dapp Statistics

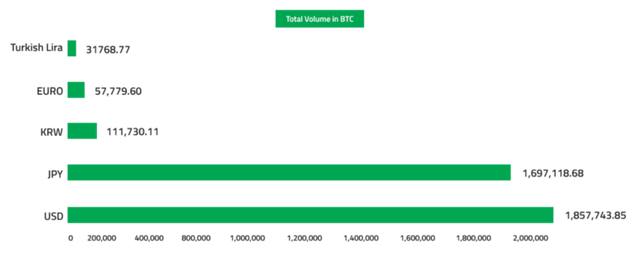

Fiat to Crypto Trade

IN DISCUSSION

Developers’ Disenchantment with Hard Forks — What went wrong?

Since its inception Bitcoin has seen nearly 40 Hard Forks but few garnered love from investors. Most of the Hard Forks are now biting the dust as Bitcoin fundamentals keep on improving.

Why Hard Fork?

The basic idea behind Hard Fork is to create a superior token in terms of technology, thus eliminating some of the shortcomings that the core code is inflicted with. However, in the past few years, most of the Hard Forks turned out to be quick money minting projects. It didn’t take the investors and developers very long to understand the difference between the Hard Forks that are just a cheap knock-off and Bitcoin.

Developers not interested in imitation game?

An interesting report was published by Electric Capital towards the end of Q1, 2019 showing the overall progress on the developer’s side. The exhaustive report titled as “Dev Report” stated that Bitcoin has the 2nd highest number of core protocol developers 10+ years after founding. A set of interesting graphs were released in the report showing the number of developers for Litecoin and Bitcoin Cash have declined or remained flat between January 2018 and January 2019. On the other hand, Bitcoin has maintained a healthy interest from developers during the same period.

Similarly, Ethereum has also seen a flat to a positive number of developers throughout the same period. In fact, the project is on the top in terms of core developers. It is worth noting that the market throughout 2018 remained in tight grip of the Bears. That, however, did not deter the top-tier developers from BUIDL- ing.

Developers tend towards the original, even though few forks such as Bitcoin Cash have been trying to move ahead of the big brother.

It could arise from the reason that the top tier developers are less after the monetary benefits as compared to the development.

Classic Case of Valeant Pharma

The crash of Valeant Pharma could be a good reference point here as we move towards establishing the point — the product should not compromise its core functionality.

What R&D is to a Pharma Company, Decentralization is to Bitcoin. Back in 2015, short seller Fahmi Quadir bet on Valeant Pharma Crash, citing that the company has closed R&D centre and is focusing on growth through acquisitions. Although, there were so many other reasons that Quadir believed would crash Valeant, closure of R&D was the primary reason that paved the way for further research.

Now, coming back to the Crypto space, Decentralization has been a concern for tokens such as Bitcoin Cash, even though we have seen a lot of updates and developments happening. Last year, a hacker Group Bitpico disclosed that BCH is highly node centralized. Then came a range of startling revelations from the hackers. Hacker group shared the screenshot showing that 98% of the IP addresses were physically located close to each other. Also, Bitpico noted that BCH is spending around US$1,00,000 monthly to run the nodes. Further, 49% of all the nodes according to this hacker group is being run in the Alibaba Facility. However, they later stated that one-fifth of their IP addresses were blocked by the network which they were using for stress-testing.

Not Betting on Hard Fork Crash

Hard Forks might serve good, and chances are they might even surpass the originals at some point of time. However, this would not be possible without the Developers who are pre-cursors to the users. It’s time that these tokens look for red flags in their project and attract more niche developers to upgrade the codes. Moreover, the underlying idea should be to keep as close with Satoshi’s Vision of Decentralization as possible while not giving up on the technology advancement.

Disclaimer

Every effort is made to provide accurate information in this newsletter. However, XDAT cannot guarantee that there will be no errors. XDAT makes no claims, promises or guarantees about the accuracy, completeness or adequacy of contents herein and liabilities for errors and omissions.

Information provided in this correspondence is intended solely for information purposes and is obtained from sources believed to be reliable.

XDAT is not responsible for any losses incurred as a result of using any information contained here. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Any third party opinions, links, news, research, analysis, prices, or other information contained in this newsletter are provided as such as general market commentary and do not constitute as investment advice.

None of the content published in this newsletter constitutes a recommendation that any particular cryptocurrency, portfolio of cryptocurrencies, transaction or investment strategy is suitable for any specific person. The services and content that we provide are solely for informational purposes. The generic market recommendations provided by XDAT are based solely on the judgment of its personnel and should be considered as such. You acknowledge that you shall enter into any transactions relying on your own judgment. Any market recommendations provided by us are generic only and may or may not be consistent with the market positions or intentions of our company and/or our affiliates.

Exciting updates coming your way, stay tuned!