Tron’s USDD Stablecoin Still Hasn’t Recovered Its Dollar Peg

After almost a week trading below a #dollar, Tron’s stablecoin has yet to reclaim parity with the greenback.

Tron’s newly-launched #USDD stablecoin has traded under a dollar for almost a week now, after slipping below its dollar peg on June 13.

#USDD hit an all-time low of $0.9255 on June 19, before recovering to $0.9608 at the time of this writing, according to data from #CoinMarketCap. It remains several cents shy of $1–the value it’s intended to be traded at.

On June 17, the #Tron DAO Reserve claimed that USDD is not depegged, in a pinned Twitter thread. “USDD is a decentralized# stablecoin that depends on an on-chain mechanism & collateralized assets,” the tweet reads. It goes on to argue that #USDD differs from centralized stablecoins such as Circle’s #USDC in not being attached to the dollar “in a very close spread by banking mint and redemption.”

- Is #USDD depegged?

No. USDD is a decentralized stablecoin that depends on an on-chain mechanism & collateralized assets, unlike centralized stablecoin e.x. USDC, which is attached to USD in a very close spread by banking mint and redemption.

— TRON DAO Reserve (@trondaoreserve) June 17, 2022

According to Tron founder Justin Sun, #USDD initially depegged as a result of short sellers targeting the network’s native token #TRX on crypto exchange #Binance. Despite Sun pledging $2 billion from the Tron DAO Reserve to fight the short sellers, USDD has remained stubbornly below a dollar. Earlier today, the Tron #DAO Reserve announced that it has purchased 10,000,000 #USDD in a bid to “safeguard the overall blockchain industry and crypto market.”

What is USDD?

Initially launched as a purely algorithmic stablecoin, USDD’s operating model was changed after Terra’s algorithmic stablecoin UST collapsed last month. The stablecoin now uses a hybrid model in which it’s backed by collateral including #Bitcoin, #TRX, #USDT and #USDC reserves.

The total value of all USDD coins issued by #Tron is just over $723 million, the Tron DAO Reserve’s website states, and the currency has a backing ratio of 324%–backed by $2.3 billion in collateral.

The Tron ecosystem is the third-largest #blockchain by #TVL (total value locked), with just under $4 billion locked into smart contracts across its nine different decentralized finance (#DeFi) protocols, according to data from #DeFi Llama.

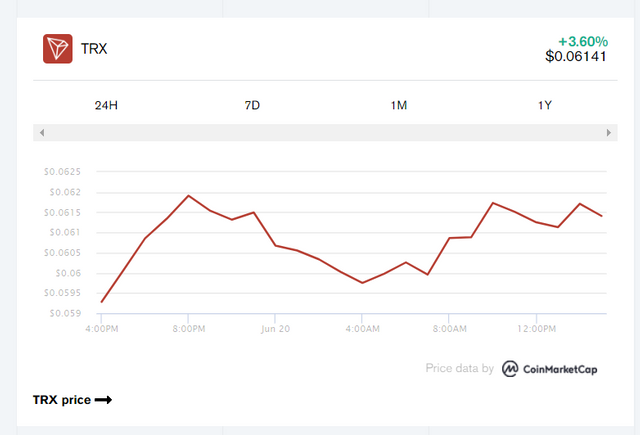

Its TVL peaked in mid-November of last year at $6.74 billion and reached $6.29 billion on June 8, dropping by 36% to $4 billion in just under two weeks amid a broader crypto market crash. Tron’s #TRX token is currently trading at $0.061, down 1% on the day and over 20% in the past week.

“We foresee a very robust future ahead,” the #Tron DAO Reserve wrote in a tweet dated June 17. “We’re only 42 days old, we still have numerous products to build and massive growth ahead.”