Kriptonok lost $ 35 billion per day, bitcoin fell below $ 6500 More

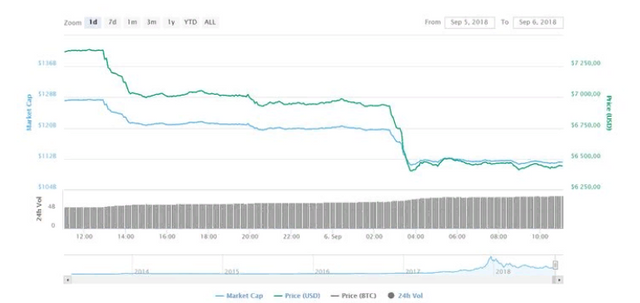

Over the past 24 hours, the Crypto-currency market has lost more than $ 35 billion, falling sharply to $ 200 billion. Bitcoin resumed the decline, which began yesterday afternoon, and in an hour was below $ 6500. Altcoins are also falling rapidly. The sharp drop of the crypto-currency market that began on Wednesday continued on the night of Thursday, September 6, when bitcoin, having fallen in price by more than 12% in aggregate, fell below $ 6500.

The weighted average rate of the first crypto currency was $ 6439.17, while in a number of exchanges, as a result of a sharp decline in the price of bitcoin fell to a mark of about $ 6250. The market capitalization of bitcoin amounted to $ 111.09

billion.

Without exception, all of the first five of the Crypto-currencies are falling. The crypto-currency market at the time of writing is in a downward trend. The total market capitalization of the current currency has reached $ 202.88 billion according to the data of Coinmarketcap. The index of dominance of bitcoin is 54.76%.

The second by the capitalization of the crypto currency Ethereum in the last day fell by more than 20%, thus returning to the indicators of September 2017. Market capitalization was $ 23.21 billion. The cost of one ETH token is $ 228.03.

Also, of the top ten CoinMarketCap, Cardano (ADA) underwent a significant correction, losing about 20% in price. The coin dropped to levels in December 2017 and is currently trading at about $ 0.085. More than 22% lost EOS, almost 19% - Litecoin and Monero.

Among the factors that could affect such a rapid decline in the market, analysts most often call insider news about Goldman Sachs' refusal to create a trading department specializing in crypto currency. On Wednesday, Business Insider sources reported that Goldman Sachs bank continues to observe uncertainty in the regulation of the crypto-currency market.

The report also cited the opinion of one of the bank's leaders who stated that it is necessary to take many additional steps, "many of which are outside the agency of the bank itself," in order to be able to launch operations with crypto-currencies.

Nevertheless, at present, the bank is still considering the possibility of launching custodial services focused on large funds. The company also provides customers with the opportunity to trade bitcoin futures and CFD contracts.

The latter allow the investor to bet on changing the bitcoin price without having to own the underlying asset. Another common version of the drop of cryptology is the general negative mood caused by the decision of the popular platform for the exchange of ShapeShift crypto currency to introduce mandatory registration of users and start collecting personal data.

This step in the potential can also scare away large investors who would prefer to keep the confidentiality of their financial transactions.

Wow very great blog @tima1980 welcome to the Steemit Platform post enjoy and explore @garrettwsllace