Bitcoin’s inflation is now more than 3x lower than the U.S. dollar’s

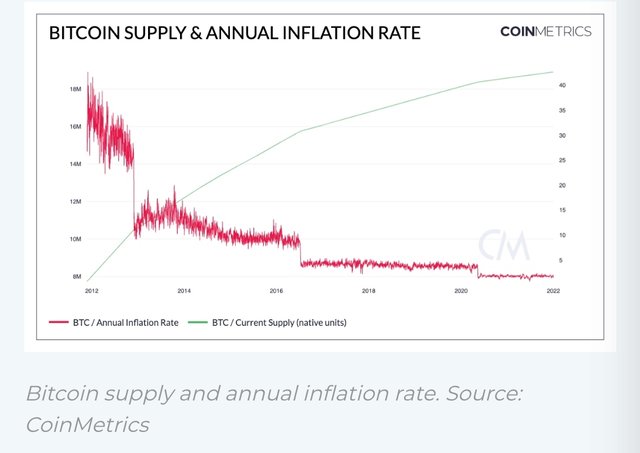

Bitcoin’s position in the financial markets has shifted between a store of value and hedge of inflation, but the asset’s deflationary status is coming into play compared to the United States dollar. With 90% of existing Bitcoin already in supply, the cryptocurrency’s inflation has hit a new low of 1.8%.

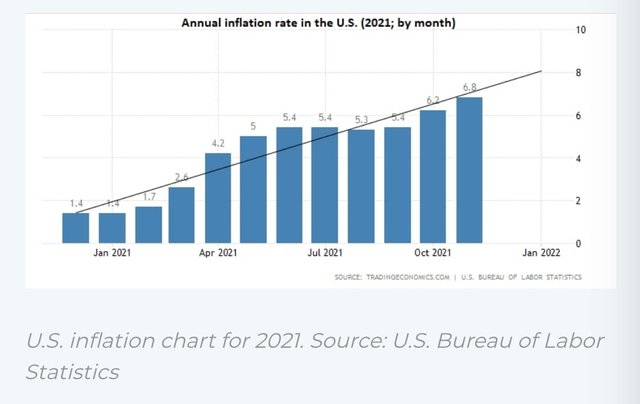

Elsewhere, U.S. inflation has continued to skyrocket, hitting 6.8% in 2021, the highest value since 1982. Therefore, when compared, Bitcoin stands out as a clear winner with about 3.7 times lower inflation rate, according to the latest data provided by CoinMetrics.

Why Bitcoin is beating U.S. dollar’s inflation

Furthermore, the halving nature of Bitcoin means that the asset’s inflation will likely drop further. Bitcoin’s halving results in the asset issuance via block rewards that are cut into half, with the next event set for May 2024, as per the Bitcoin Clock tool.

In this line, Bitcoin is clearly showing its status as an inflation hedge, with the U.S. inflationary rate projected to soar higher in 2022.