Amazon And Facebook Eying blockchain: Can They Propel Crypto to New Heights?

It has been an exciting road as cryptocurrency adoption has ebbed and flowed, and just as with the stock market, pundits and commentators have been chomping at the bit to predict what’s next. Many crypto enthusiasts have long been talking about what can propel the industry to the next level, and many believe that all it will take is new SEC guidance or a tech giant like Facebook or Amazon to announce their own cryptocurrency to do so. It is easy to doubt either would issue their own digital currency, but upon closer look it seems as if the writing is already on the wall.

In fact, on April 9th it was reported that Facebook will be seeking a $1 Billion dollar investment from a number of VC firms to begin their first cryptocurrency project. One might wonder why Facebook, one of the most cash-flush companies in the world would be seeking external investment for this project, but the answer is simple: decentralization. Facebook understands that if they are to want to create their own currency then it will have to at least possess a few of the tenets of cryptocurrency, and for that we applaud them. However, because many of the other details about what this token might look like are yet to be revealed, we will reserve judgement for the time being for this likely stable-coin.

On April 9th it was reported that Facebook will be seeking a $1 Billion dollar investment from a number of VC firms to begin their first cryptocurrency project.

One might wonder also why Facebook does not simply purchase an existing blockchain project and rebrand/ tweak it to their liking, considering their accumulation of 88 of various companies and counting, it seems to be their business model. However, blockchain is different; there could be unknown bugs in the code, the existing community might disagree with the sale, and the tokenomics would likely be way off etc…

It’s not all roses for crypto yet, Facebook could still decide after further investigation that crypto isn’t right for them either. This likely wouldn’t come as a huge surprise for the company that likes to control as much as possible, as many of their tenets run counter to that of crypto. For instance, in 2011 Facebook launched Facebook Credits, their first digital currency, only to see it sunset less than two years later. In 2012, they launched Facebook Gifts which also sunsetted only 2 years later as well. In 2015, Facebook launched Facebook Messenger Payments in the US and expanded to Europe 2 years later, but complications still exist across country borders. So, what makes FaceCoin or a new digital currency any different?

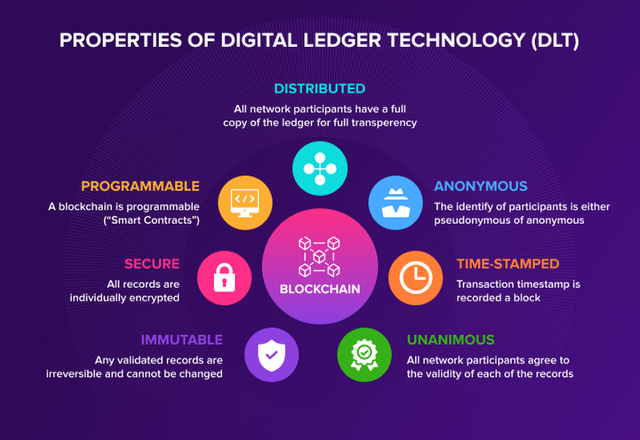

FaceCoin would be run on the blockchain, which offers a variety of new technical capabilities, which didn’t exist previously, including smart-contracts, privacy, and potential to be backed by a stable coin like tether. This news has crypto enthusiasts practically drooling… if Facebook created a currency that they could successfully offload to their 2 billion end to end users, it would be huge. However, harnessing end-to-end encrypted services like Whatsapp, users would presumably desire a privacy feature, but that would create a target for money laundering, tax evasion, and crime.

“if Facebook created a currency that they could successfully offload to their 2 billion end to end users, it would be huge”

Remittances:

Remittances (a transfer of money by a foreign worker to an individual in their home country) are also a huge target for the cryptocurrency industry, weighing in at a half trillion dollars a year. There are essentially a couple of viable options: Facebook can partner with retail companies world wide to get them to accept FaceCoin, or Facebook partners/ sponsors exchanges where FaceCoin can easily be exchanged for fiat or other more fungible digital currencies. If Facebook were to offer a seamless, immediate, user-friendly international remittances platform, this would be enormous.

“The remittances industry could perhaps be the perfect target for a crypto backed Facebook currency, and propel the industry to heights never seen before”

Furthermore, it would allow anyone with a phone and the Facebook app to maintain a personal account in stablecoins backed by a basket of hard currencies. This functionality would instantly become wildly popular amongst people living in countries with hyperinflation (Venezuela, Zimbabwe, etc..) This may seem like the holy grail for a new cryptocurrency, but this would come with a whole host of issues such as: KYC and AML (know your customer and anti-money laundering) laws, privacy/ security issues, and liquidity issues, aside from potentially hundreds of other legal domain complications. However, if there’s one company that might be up to this challenge, it’s probably Facebook.

Amazon

Currently Amazon is the largest e-retailer in the US boasting an impressive 232 billion in sales revenue in 2018 alone making Jeff Bezos the richest man in the world with a net worth of around 150 billion. A large part of what has made Amazon successful have been their plans for aggressive expansion and vertically integrating their supply chains. We all remember the days when Amazon was still an obscure internet retailer, but similarly to Facebook they have gradually made acquisitions to the tune of 86 companies since 1998.

Whether Amazon intends to make their own currency as a use of exchange on their platform is one thing. However, as was reported in February, Amazon is already working with Accenture with plans to implement a circular supply-chain based on distributed ledger technology. There are a number of benefits Amazon would receive by using a DLT system which would allow customers to identify small-scale suppliers and growers on the supply chain and make rewards by using direct payments. Additionally, the new capability is designed to provide better management of inventory and waste elimination, transparency across the supply chain and authenticity of products.

Based simply on Amazon’s incessant hunger for efficiency, innovation, market dominance, and vertical integration it would be more surprising if they didn’t create their own currency. The better question is when, what it will look like, and who they might acquire along the way. As it seems, no existing exchange could be considered too big for Amazon’s appetite with Coinbase (the largest existing exchange) recently being valued at around $8 billion.

In the meantime, a battle between exchanges continues with the likes of Bittrex, Binance, Kraken, Coinbase, Bitfinex, and Bitmex leading the way. It is difficult to predict who will win the race to become the most used platform, but it isn’t likely that one will be the clear winner when the dust has settled. Most likely we will have an ecosystem of different exchanges, wallets and ecosystems based in different countries with different incentives and goals. For example, at Noozzle, we are attempting to create a free and equitable ecosystem where anonymity and privacy are respected to the fullest extent. Of course, the governmental oversight in each country will play a crucial role in the development and functionality.

As an end user or trader, one typically values a few aspects of any exchange: functionality, security, customer service, and liquidity. As an exchange ramps up it can be difficult to grapple with growth and maintain high levels of quality across the board. At Noozzle, we have a different approach to trading that involves always putting the customer first and creating the most seamless user experience. As we continue to develop (we’re releasing our beta and apple store products shortly) we will always make decisions based on what our community holds highest. As you continue to evaluate new and rising projects, don’t be a stranger ;)

One certainty is that the biggest companies in the world will have a significant impact on how this race develops, and they are just beginning to dip their toes in. The sheer fact that Amazon is already planning to implement DLT technology in their supply chain, and that Facebook has been looking for a solution to their gift cards/ e currency issues for some time is validation of the underlying technology enough. The future of money that is borderless, anonymous, decentralized, immutable, and scarce will change the world forever. As world governments continue to grapple with how to control and monitor this new reality we can individually decide what role we would like to play. It is sure to be an exciting next few years for the “internet of money”, especially as the markets are showing strength after a 15 month bear market.

Please give us a thumb up!

- Website: https://noozzle.space

- Twitter: https://twitter.com/NoozzleSpace

- Facebook: https://www.facebook.com/Noozzle.space

- Linkedin: https://www.linkedin.com/company/35614362

- Medium: https://medium.com/@noozzle.space

- Steemit: https://steemit.com/@noozzle/

- Youtube: https://www.youtube.com/channel/UCL07fY3bJCbjQzU_DkQiq7g

- Reddit: https://www.reddit.com/user/noozzlespace

- Official Telegram Group: https://t.me/noozzle_space

- Noozzle Announcements: https://t.me/noozzle_announcement

- Noozzle Telegram Chat: https://t.me/noozzle_live