Dumb Money Lesson - Fear Is The Mind Killer

As a young teenager I was deeply into Sci-Fi. And of course I had to read the quentessential book by Frank Herbert, DUNE. When Paul Atreidis is tested by the Bene Gesserit, with the Gom Jabbar.

I must not fear.

Fear is the mind-killer.

Fear is the little-death that brings total obliteration.

I will face my fear.

I will permit it to pass over me and through me.

And when it has gone past I will turn the inner eye to see its path.

Where the fear has gone there will be nothing. Only I will remain.

Of course I believed this line was to be used when we are in a situation where physical harm canhappen to us. After several years of accumulating wisdom I've come to realize that overcoming our fear created in our own minds is the true test. When Paul finishes with his humanity test he is surprised that his hand is damaged. The device causing the pain, activated nerve impulses to his brain. The fear was being caused by a trick to his mind. That was the true test.

Winning or Losing

In Behaviorial Economics is a an idea called Prospect Theory. This theory boils down to most people hate losses more than they love gains. This creates a bias in our perceptions of risk. There is also another bias that has to deal with humans not liking heights. With this two biases we can end up taking profits too early and letting losses continue. This is because we believe that one bird in the hand is better than two in the bush and anything that goes up will come down.

Trade Thesis

BTC is due for a major correction. This means when it happens, it is likely going to be swift. Everybody is going to be looking for a life boat. Only two directions can they go. I break the holders of BTC into two categories. Fiat money and crypto money. Fiat money are people who are dabbling into this new fangled technology called blockchain. Crypto money is people who've had a little experience with exchanges and holding various crypto currencies.

If we look at the probabilities as being fifty/fifty either way. BTC drops hard or BTC continues it's march upward.

BTC Drops

If you are a fiat money person you will be trying to convert your BTC to fiat. This leads me to believe that the exchanges will be vulnerable to a run on the bank. No one will be able to get into fiat. This will lead some people to go into other cryto. If you are crypto money and you haven't moved out of BTC, then you've started playing the Greater Fools Theory, in other words you can be classed as a market timer, eventually instead of running for the fiat exit you will move into other cryptos.

BTC Upwards

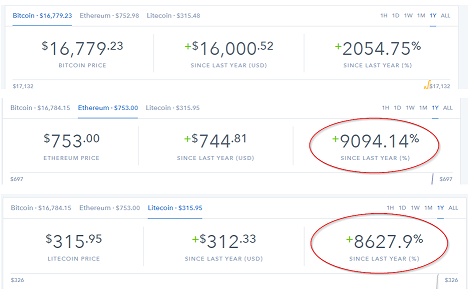

There appears to be a lagging correlation between BTC and other cryptos. As it moves higher, other cryptos eventually move higher. I believe this is caused by people becoming comfortable in BTC and they want to get even larger returns from some other crypto. See this image:

Who wouldn't want 4x-5x returns over BTC.

My Fear

So far my best returns are happening right now! I so much want to pull some profits out. My fear is that I'm totally wrong on my trading thesis and that I'll lose it all. I wrote this post so that I could put my reasoning out there to see if I'm missing anything.

Side Note

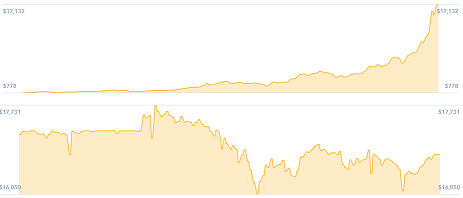

Which crypto would you invest in. The Top? The Bottom? I think everyone would select the Top. I played a trick on you. They are the same crypto -BTC- just different time scales. Top one is 1year and bottom is 1day.

Trading Derivatives?

Crypto Forex Trading

OpenLedger Referrer

After trading cryptos for about 1.5 years I stopped and switched to the HODL strategy. A big part of my cryptos are parked at bitfinex where I lend them :) In the last 2.5 years this worked mire then well 💪

I've gone away from the taking profits early to holding on for longer periods

Yeah .. I think you just need a lot of skill and luck to daytrade cryptos without loosing money as it is pretty unpredictable.