What is Order Flow Trading and How to Profit

Order flow is a concept in trading which many claim to understand. Few really do. The order flow of markets is what truly causes price to move.

Order flow can be applied to many aspects of financial markets. There is stop hunting, market microstructure, tape reading, technical analysis patterns and many more. One phenomenon drives these - order flow of markets.

Many traders make decisions based on many different factors, very often labelling it as 'order flow trading' or 'order flow analysis'. More often than not they're right, all of these fall under the category of 'order flow trading', plus many other trading methods.

Order flow trading and the metagame

Without going into too much detail, as I will cover it in a future article, we must understand first the 'metagame'.

This can be described as the 'game within the game'. Going one further, this where player's/trader's make decisions not on a basic strategy based on the game's rules, but based on the other player's/trader's decisions.

If you know your competition is going to do the same move over and over, reacting to this and adjusting your strategy would be playing the metagame.

This is an important concept in order flow analysis, due to trading and financial markets being a competition between humans. (This is despite the influx of trading algorithms - humans still program them).

The importance of this snippet is that reading the order flow of markets often depends on your knowledge of what other traders are likely to do. The term 'weak hand at the table' springs to mind. This is a poker turn of phrase, which means that the weakest player at the table will be exploited.

You must learn how to spot and where to find the weak hands in the market in order to truly understand order flow. The landscape of market microstructure and the order flow of markets heavily relates to the concept of the metagame.

What IS order flow?

Without diving too deeply into how financial markets function and how the price discovery process takes place, there are some concepts that need to be explained. This will be brief but important, so bear with it.

Limit orders

Keeping it light, traders place orders to either buy or sell a particular instrument. These orders, below and above current price, are known as 'limit orders' or 'resting orders'. A buy limit is called a 'bid' and a sell limit is called an 'offer'.

A bid can only be executed at the limit price or lower whereas an offer can only be executed at the limit price or higher. There is no guarantee a limit order will fill (some of us know this all too well). It will only fill if the market price reaches the price of the limit order.

Limit orders ensure that a trader does not pay more than their ideal price for a given security. These orders are the foundation on which order flow and modern markets are built on.

Market orders

Conversely to limit orders, market orders can be executed at a price other than your ideal one. Simply put, a market order will execute a trade for your defined quantity, as soon as possible.

The price you get? The market price.

This means that your order could be executed at a range of prices. They demand immediacy in their execution. Results of this could be that the market orders reduced the existing liquidity of the market.

This is a very important element of overall order flow. Prices will only change once liquidity (read: limit orders) at a certain price has been consumed. Because of this, market orders are the primary reason for changes in price.

Stop orders

A stop order is a type of order which becomes a market order once the price of a security reaches a pre-determined level. Stops are usually referred to as a stop-loss, buy stop or sell stop.

All three of these order types work by the same mechanism. However, a stop-loss is usually an order to exit a market, whereas buy/sell stop orders are to enter a market.

Stop orders offer liquidity to the market, as they are resting orders available for execution. They can also contribute to price change by consuming liquidity when they become market orders.

This enables traders to exploit them and the inefficiencies they create.

Liquidity distribution and order flow

Now that order types are clear and out of the way, we need to understand liquidity distribution.

If big Trader A needs to buy 1000 contracts, yet there is only liquidity to execute 100, Trader A's order will not be filled without them moving the market price up. Trader A doesn't want to buy at higher prices, they want to buy at lower prices.

Stop-losses and the order flow provided

Many traders use stop-loss orders. Stop-loss orders are very important in managing risk on a trade setup and enforcing discipline externally, as opposed to manually exiting a losing position.

However, stop-losses can be a double-edged sword. Their impact on market liquidity is unique. Stop orders combine factors of market orders and limit orders (resting and placed at a price like a limit order, market execution the same as a market order). The structure can consume and also provide liquidity.

Thinking about the dynamics of liquidity, limit orders provide liquidity by allowing traders to execute market orders into them. Stop orders could be thought of performing the opposite. Stop orders provide liquidity by allowing traders to execute their limit orders at the stop price.

An example of the order flow trading landscape

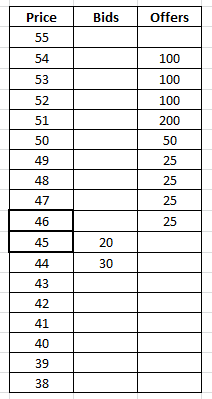

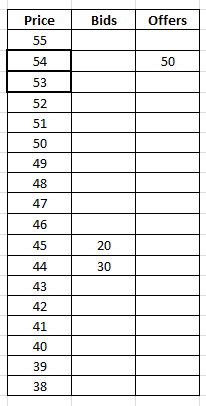

Let's say that John wants to be long on 100 contracts. John needs to initiate a position. Current price is $45/46. The depth of market is as follows:

John then initiates his long position with a market order. His 100 contracts consume the liquidity from the 4 prices above. His average fill price on his long is $47.50 (25 contracts at each of 46, 47, 48, 49). John is also aware that there are is also a 500 contract stop order at $50. This triggers and propels price to $53/54.

Since John already knew that there was a 500 contract stop order at $50, he pre-emptively put a sell limit at $51 for 100 contracts, before even initiating his long position.

With his average entry price of $47.50 and exit price of $51, he has made 3.5 ticks on each contract. While this doesn't sound like much, remember that John was trading 100 contracts.

John has successfully accomplished a 'stop hunt'.

Many novice traders will blame moves like this on unscrupulous brokers widening spreads and the like. While there are some shady brokers out there, it is often simply other market speculators using a reliable method to generate profits.

A chart example of order flow dynamics

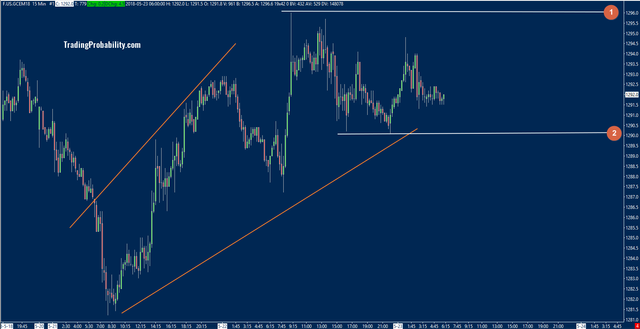

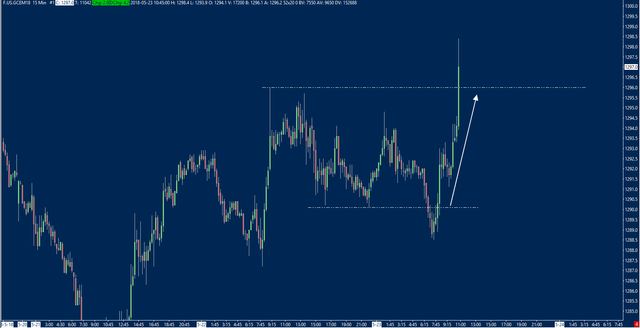

In this example, we're in a short-term uptrend in Gold. Because of this, liquidity is thinner on the offers than the bids. Big traders want to be long without moving price too much and without slippage.

John has identified two regions for potential orders:

- $1296, is where he thinks the price will go and is aware that there are stop orders resting above.

- $1290, is where he believes he can initiate longs without moving market price. He knows that there are sells stops there for him to buy into.

In the above image, we can see that price has in fact moved below $1290. John has been filled at the price he wanted. John is also aware that any traders who initiated shorts into his buy limit at $1290 are now likely trapped. Their buy orders to cover their positions will provide fuel to any rally.

John has a sell limit to cover his long position at $1296. He is almost certain that he will get filled, due to the liquidity (read: stop orders) beyond the multiple highs.

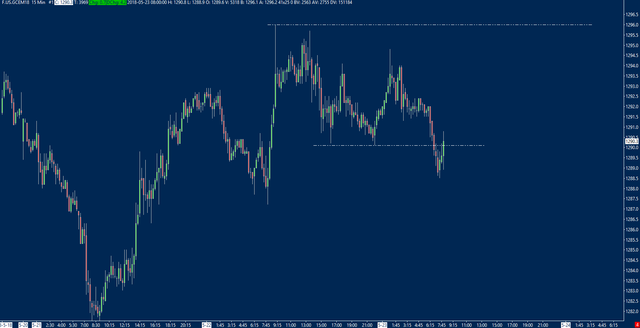

We can see that John has exploited the resting stop order liquidity very well in Gold here. Note the aggressive move up to the liquidity beyond the highs at $1296. Perhaps somebody used the same trick John used earlier.

Order flow trading and stop cascades

One very interesting element of order flow trading a 'stop cascade'. If there are enough stops at one level, they could consume enough limit orders to reach the next level of stop-loss liquidity. This chain reaction is a stop cascade.

We can visualise this by using the Gold chart from before. In this case, stop orders have likely built up behind each of the three highs.

A large number of stop orders beyond the three highs caused the price to move considerably through the uppermost high. This took place within a split second in real time.

The order flow trading mindset

Now that we are thinking more in relation to where orders are placed and the order flow dynamics which they create, let's go back to the concept of the metagame. 'What are the other players thinking?'

Think for a minute about how 'technical' traders think. If you've ever read babypips or the like, that's what I mean. These traders often assign huge moves to head and shoulders patterns or similar, mistaking the pattern as the cause of the effect. The only cause of market moves is order flow, the pattern is not the cause, no matter how much correlation may have been found in studies. (This is not to say that particular market patterns can't provide edge over time, but they are simply not the overall cause of market moves).

This doesn't mean that this trading methodology should be ignored completely. We can aim to exploit participants who trade in these ways, by assuming that their orders will be stacked in these areas.

Technical traders are often taught to buy 'strong' (read: more touches) support levels and sell 'strong' resistance levels. They are also often told to place stop order beyond the extremes of trading ranges, looking for a breakout towards the next support and resistance level.

The order flow which stems from both of these methods of trading support and resistance is very similar. A trader selling resistance will often have a stop-loss just beyond the high of resistance, a breakout trader will have a buy stop just beyond the high to initiate a position long.

How much order flow will occur?

Just because you know where the orders will be, you don't know how many or how large the orders are there. The bad news is that there is not an easy way to know. You don't know how many participants there are, how large their orders are or which strategy they trade.

This is especially true for forex where it's not as easy to see how much volume is being executed on a particular day.

You can make some approximations.

Higher timeframes are generally more important to the order flow dynamics.

In general, traders consider timeframes higher than the one they trade on. Most traders are aware of key daily or weekly support and resistance. Conversely, most traders won't usually be aware of what's happening on timeframes much lower than the one they trade on.

A trader who executes off of the hourly chart will usually have daily, weekly and maybe 4-hour levels on their chart, they won't usually have 5 or 15-minute chart levels.

Areas with more technical factors at play will likely hold more orders.

If there is an area on your chart with a support level, trendline, head and shoulders, moving average etc, there is likely a stack of orders around it. This will cause there to be much more order flow in the region.

Patterns or technicals which take longer to occur will draw in more order flow.

Think back to that 'strong' support level. Visualise a support level which has had 5 bounces off of it. That is the technical traders' heaven. You better believe that they want to buy near that support for another bounce.

What happens when they do?

They add to the mass of stop-losses below the lows.

Using order flow trading

Now that you are aware of where the market is likely to reach for and gravitate towards, there are ways to fit this order flow into your trading. Naturally, you won't be able to push the market around like John did, but you can use order flow to formulate decisions.

We saw a way of utilising the magnetism of liquidity in the gold example. The trader used their knowledge of order flow to take a long position ahead of the highs and cover their longs into the liquidity provided by a mass of buy stops. This method takes advantage of big traders like John who need to use these areas to execute orders without moving price to a disadvantageous position.

Another aspect of that same trade was John initiating his trade by using stop orders to the downside. He used those sell-stop orders to get long into an even bigger liquidity pool.

It's also worth noting that this happened once more in gold after the upside liquidity was absorbed.

Wrapping up

I hope you found this article useful, it took a while to write! This is the baseline of how I think about markets and execute orders. Basing strategies around this framework should put you in good stead. It's always worth thinking about what is really going on underneath the chart and what the causal relationship is.

Posted from my blog with SteemPress : https://www.tradingprobability.com/what-is-order-flow-trading-and-how-to-profit/