3 Things To Learn From Today's Coincheck Hack

It's never a dull day in crypto world, but it's not every day that you see a $400 hack on an exchange. So, when the news about Coincheck NEM hack broke out, I tried to follow the subject closely. Here's what we know so far:

- Coincheck confirmed that over 400 million NEM are missing from customers wallets

- this seems to be the biggest hack in the history of crypto, bigger than Mt Gox (which happened in Japan as well)

- at the moment of writing, NEM is still a top 10 crypto currency, posting only a 10% loss (which shows surprising resilience)

- the exchange is looking into compensating its customers, but it's not yet clear how

The story is still developing and I'm sure we will find out all the details in the upcoming days. But until then, I think I can point out at least 3 things that this (very unfortunate) situation can teach us:

1. Greed is bad

Why would you keep huge amounts of tokens in an exchange? Well, because you want to take advantage of all this volatility and increase your ROI. Many exchanges have now daily limits for both withdrawal and deposits, so it's a common practice to deposit and keep large amounts of tokens in exchanges, to "ride the wave" when the opportunity arises.

But how much is too much? How much is worth the risk of losing it all? How much greed is good greed?

Maybe it's better to keep just a small amount, surf a little - instead of looking for that "big wave" - and call it a day.

2. Decentralized exchanges are the future

This type of hack can only happen in centralized exchanges. A centralized structure creates unique points of failure. Unique points of failure are bad. Very bad. In a way, the rise of exchanges contradicts the most important characteristic of the blockchain technology, which is, in very simple words: get rid of the middleman. A centralized exchange is the middle man.

Add to this the fact that decentralized exchanges are way more difficult to regulate than centralized exchanges and you'll see what I mean.

3. A small pinch for the market, but still a very bad thing for the technology

If you compare this with Mt Gox, in absolute numbers, it's a little bit over it. $400 million compared with $340 million. But if you compare it in percentages, it's insignificant.

When Mt Gox happened, the total market cap of crypto was $13 billion. So, the amount stolen was 2.6% from the entire market. Huge. 3 years of bear market followed.

When Coincheck happened, meaning this morning, the total market cap of crypto, is $537 billion, So, the amount stolen - although bigger than Mt Gox - represents only 0.074%. Not too much, you may say.

But don't get fooled about this. The hole created by this incident it's still $400 million at once. That amount of money dumped in any market, being it black, white or grey, can create very big problems.

And the first thing to be hit by these problems will be the technology itself. Although it's not because of the technology that this happened, but because human greed put again a middle man inside a thing which wouldn't require one, the perception of the technology will grow darker and more twisted.

It was not a good day today, but let's hope we at least learned something from it.

I'm a serial entrepreneur, blogger and ultrarunner. You can find me mainly on my blog at Dragos Roua where I write about productivity, business, relationships and running. Here on Steemit you may stay updated by following me @dragosroua.

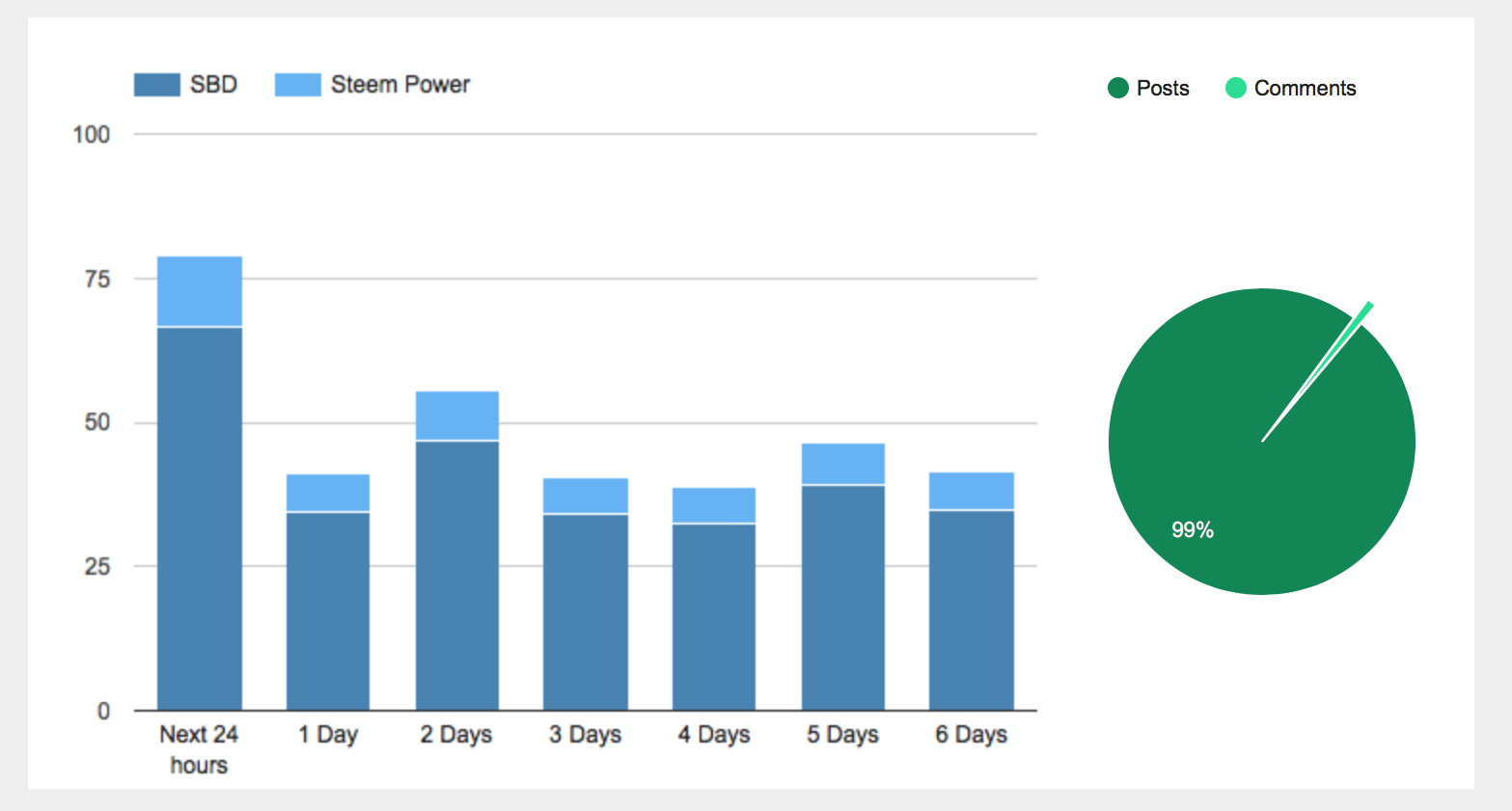

Wanna know when you're getting paid?

|

I know the feeling. That's why I created steem.supply, an easy to use and accurate tool for calculating your Steemit rewards |

In general, this HACK is a terrible thing.

But...as we have a saying here: "There is nothing BAD, which will no turn into GOOD".

This may give a big push to the progress of the decentralized exchanges. Quite a few are just "around the corner" . And I mean the TRUE decentralized creation.

Which must have every of the four major components decentralised

*Capital deposits

*Order broadcast

*Order matching

*The exchange of tokens

Add to this a true "Atomic swaps between different coins" , + NO registration/KYC - and you get how I imagine the next level of (decentralized) exchange .

And it is comin. Coming soon. This spring. After three years of stealth development.

It's name is #Blocknet. They call it

"The Internet of Blockchains"

Decentralized exchanges are truly the future, I just hope people realize this in time

Obviously DEX is the king, but how of then have easy-to-navigate exchange for newbies?

Bitshares is rising too, no surprise there. 2018 will be the year of the DEX

Lessons Learnt: Decentralised Exchanges are the FUTURE!!!

Try bitshares.org

Say no more.

Very interesting take on the sad incident. I wonder what to do with my coins. I have seen the market stay resilient today despite the widespread news. It is a big amount but a tiny fraction of the entire market cap. The exchange too is relatively unknown to the world perhaps. A Bittrex or Binance or Coinbase hack would surely start a meltdown.

Well, it's not like those crazy Canadians who held up a cryptocurrency exchange at gun point.

As things change, they just stay the same.

I totally agree with your 2nd point "Decentralized exchanges are the future".

Well it was just coins taken, not cash. Taking that much cash out of the ecosystem would have rocked the cryptoverse much harder imo. Good lesson to be learned here, never assume your coins are safe when they're not in your wallet. Don't even assume those are safe! Things can be stolen from anywhere, leaving them out on the internet just makes them available to a much larger group of thieves.

I think we're not very far from the moment when those "coins" will be the actual cash...

Yeah they're going to try and run those coins through a million different washing machines lol.

I just keep hoping decentralized exchanges will start getting more traction with people; we see this hacks and failures... and yet here we are, everyone in this industry singing the praises of decentralization, and yet most people are using centralized exchanges.

Makes me ponder to consider whether there is something offered by centralization that simply CAN'T be done in a decentralized manner? Otherwise... why so much hesitancy?