Goldmint ICO Review

There's less than 7 days remaining of the Goldmint ICO with their their website showing that they've already collected over 830 bitcoin and 4300 ETH. They even managed to collect over $4 million in a single day.

What is Goldmint?

There's a lot of ICO's on going at the moment, I've written about quite a few recently and a lot of them have a lot of potential. Goldmint is unique though as they plan to have their new cryptocurrency backed by the price of gold.

The rise of cryptocurrency in 2017 has been phenomenal but one of the main problems for it gaining adoption as a currency is that it's far too volatile.

As with cryptocurrency gold can be speculated on and the price can rise and decrease but generally not as much as it does with cryptocurrency.

Investors often invest in gold when they feel that the markets are too risky or may go down as its seen by many as a safe investment.

The fact that its fairly rare and just small amounts can be worth large amounts of money make it a great alternative to any ordinary currency.

The problem with it though is its still hard to move and store large amounts, you obviously need a secure vault to store it in for starters.

Goldmint aim to make the process of owning and storing gold simpler and easier for customers, using the blockchain to cut expenses, allowing your currency to moved quickly and protecting you from having your asset stolen.

The new decentralized platform will allow users to trade their gold with others, offer loans and aim to make a profit.

Benefits of investing in gold

Gold has been seen as a sound investment for a long time. Some of the benefits are that its indestructible and can't be manufactured.

- Low volatility: There's only a certain amount of gold available in the world, as I said above it can't be manufactured. This means that as supply rises, the price rises with it. There's no way for more to be produced.

- Tax advantages: In most countries using gold as an investment has tax advantages, in the UK there's no VAT (value added tax) charged on purchasing it, no capital gains tax and tax relief when you use it as part of a pension.

- Low risk: Many investors are worried about their being another banking crisis. A lot of savers have moved their investment into gold as its often seen as a low risk investment.

How much gold is their in the world?

According to gold supply.org the demand for gold is more than the amount that is able to mine, 25% of gold comes from recycling.

Warren Buffet was quoted as saying that the total amount of gold above ground could fit in a cube with sides of just 20 metres.

Estimates of the total supply range greatly from 160,000 tonnes to 2.5 million tonnes. Even the larger figure would mean that a cube with 50 meter sides could hold it all.

The rarity is one of the factors that makes it such a precious metal and asset.

The rise of the cryptocurrency market

Goldmint are aiming to combine the rise of the cryptocurrency market with the more traditional gold market.

The cryptocurrency market has risen massively in 2017, bitcoin has just hit an all time high of $5800, a rise of almost 500% in 2017. The total cryptocurrency market now equals over $160 billion.

Combining gold with a cryptocurreny should bring much more stability to its price.

Advantages over the traditional method of buying gold?

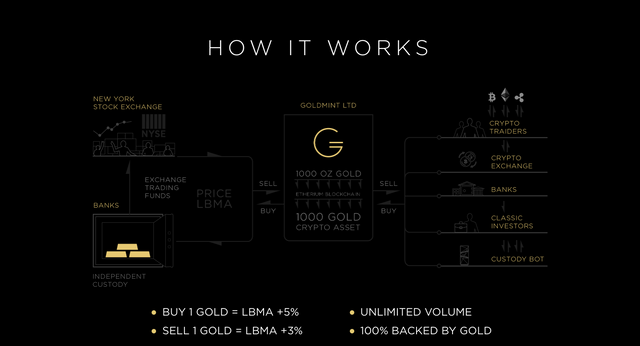

The new platform will give investors a cryptoasset (GOLD), the value of this asset will be based upon the price of real gold. The asset will run on the platforms own blockchain, here's some of the benefits this will offer:

- It acts like a futures contract, giving an agreement to buy gold at a certain point in the future for a pre determined price.

- It allows you to hedge trades.

- GOLD will let you use your gold-backed investments as collateral.

- Trading the asset will become quicker and much easier.

- You'll receive better returns as the bullion price increases.

Goldmint state in their whitepaper that the developers of the project have a long history in both gold and cryptocurrency.

They aim to turn the traditionally used asset of gold into cryptocurrency tokens.

How much gold will they buy?

The platform claims that they plan to expand in 3 stages. Initially they aim to have access to 1% of the world gold circulation, they plan to launch Custody Bot automated storage in pawnshops.

Their next goal is to gain access to a total of 5% of the worlds gold circulation, they hope to do this by expanding into shopping centres.

They slowly plan to then gain access to a huge 10% of the global gold which is worth around $100 billion and are even predicting that within the next 5-7 years gold could be traded in vending machines, and think that their cryptoasset can become the main trading unit for this.

Advantages over their competitors

There's already been some start ups in crypto currency that have aimed to set up something similar, Goldmint believes they have an advantage over these due to:

- Using their own blockchain and their own alt coin (MNT)

- A proof of stake system, miners will be given blocks based upon the amount of MNT they have. Proof of stake is faster and cheaper than proof of work.

- Physical gold and EFTs will be safely stored in a decentralized storage unit.

- Custody bot: The new platform has a storage solution that is programmed to store small pieces of gold without the need for any humans.

- Transparency of all information including the company's reserves.

- Smart contracts for its cryptoassets.

- ETF to allow you to trade much quicker than the traditional method of trading gold.

- Secured loans on the platform backed by assets.

- Passive income as the price of gold increases.

- Fast and simple user registration and identification.

Goldmint target market

Cryptocurrency traders and investors are an obvious target for the new platform, it could be used for hedging volatility in the market.

The platform will also target:

- Ordinary investors: Small-medium sized investors who may of bought traditional gold or could just be ordinary people looking for a safe and secure investment.

- Self employed and small businesses: The new GOLD token can be used as a currency to make payments, the low volatility that it will have make it an ideal payment method.

- Banks: A gold backed cryptoasset offer a new type of investment to banks, cryptocurrency is fast becoming a large industry, banks may prefer the lower volatility that Goldmint has to offer than most other cryptocurrencies.

Secured loans on the platform

The new platform will also be offering secured loans. This process will work as follows:

Loan applications will transfer their cryptoassets to use as collateral on the loan.

The interest rate will be decided at the time the application is made, users who want to secure a loan will have to agree to the terms that the platform sets. Applicants will then be given different options such as the length of the loan they'd like.

If the user defaults then his assets are automatically transferred to Goldmint.

Trading GOLD into FIAT currency

In order for users to trade their GOLD into FIAT currency, users will need to undergo the know your customer process. The cost of 1 GOLD will be set to the price of 1 ounce on the LMBA+5%.

If users choose to pay with a card or paypal then they'll be charged extra commission.

MNT

MNT are the GoldMint tokens, these are used as a proof of stake consensus algorithm. Holding more of the tokens means that he can validate and add more blocks to the chain. Miners will be able to receive up to 75% in commission when they validate transactions.

How will the platform make money?

Goldmint will be charging a commission on all transactions made on the platform including secured loans and commission on transfers made through the platform.

They also aim to make money from exchanging real gold into GOLD and revenue from the Custody Bots.

ICO Details

Token price: Will initially be set to $7

Investors will be given MNTP tokens that can be converted into MNT after enough gold has been mined to support the platform.

Minimum cap: $150,000. If this isn't reached then investors will receive a refund.

MNTP issue amount: 10,000,000 tokens

Conclusion

Having a cryptocurrency backed by gold should bring much more stability to its price unlike other coins. The team behind the project seem to be experienced and have one of the most detailed whitepapers I've read. With the large amount they've raised from the ICO they should be able to market well with the 35% budget they're allocating to marketing. The platform should also attract traditional gold investors who should be able to see the benefits with linking the precious metal to the blockchain which will allow them to transport and store it much easier.

Website: https://www.goldmint.io/ico

Whitepaper: https://www.goldmint.io/static/files/Goldmint_WP_eng.pdf

True there is no VAT to pay on buying physical gold here in the UK but if you are trading on the stock market, investing in commodities then you should be paying tax on profits unless done through spread betting of course.

Plus... all crypto currencies currently fall outside the scope of VAT in the UK anyway! So not sure really why this is a plus for goldmint...