Genesis Vision (GVT) Review 3/4/18

Genesis Vision ICO - Decentralized platform for trust management.

(Youtube.com via ICOdrops.com)

Genesis Vision – “the platform for the private trust management market, built on blockchain technology and smart contracts”

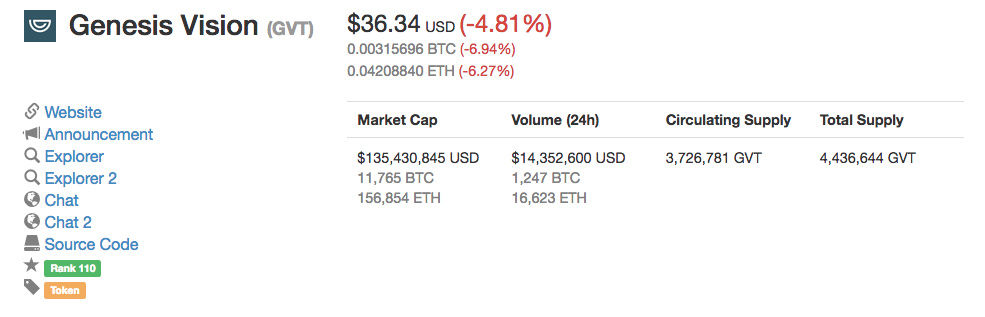

The Facts:

Current price is about $36.34 USD -

Total supply for GVT tokens is 4,436,644 -

This is a strong number for price growth, even once all tokens are in circulation. This number is not too far off from the current circulating supply. According to these numbers, about 84% are already in circulation.

Circulating supply is currently 3,726,781 -

This number of tokens is extremely low for circulating supply. This means that GVT is subject to extreme price swings, in comparison to other projects. This includes positive price movement as well as negative. This supply, matched with the current price, also indicates that this token has tremendous price upside. For example, Bitcoin supposedly has somewhere around 16,888,462 coins in circulation, with a 21,000,000 total supply. Bitcoin has been able to reach tremendous single coin prices, due to the low coin supply. Having a low coin/token supply provides scarcity, and an increase in demand due to low supply (if the project is good). At about $26 currently, GVT could achieve incredible price highs, depending on the projects success.

This amount of supply can also negatively affect liquidity however. Since there are so few tokens, it may be hard for someone to sell a large amount of them at a desired price because they may not be able to find enough buyers at the time of trade, for the desired trade price.

Market cap is currently at $135,430,845 USD -

At roughly $36.34, if GVT went to $263.40 (10x), it would have a market cap of roughly $1.3 billion. This would put GVT just inside the top 25 list of cryptocurrencies on Coinmarketcap according to market cap. (Ranked highest to lowest marketcap). This is with the current total cryptocurrency market cap of about $469 billion.

The kind of growth really depends on the projects success and the hype surrounding it. Becoming a top 25 cryptocurrency is no easy task for most, considering there are about 1500 different coins/tokens on coinmarketcap. At the time of writing this article, GVT is ranked 110th. There is still room for a good amount of growth in my opinion from here, considering the project, although nothing is certain.

24 Hour Volume is $14,352,600 USD -

This is a strong amount of volume. It means people are actively trading GVT and that it has a decent amount of attention, although this fluctuates.

ATH was about $43 -

At $36.34, GVT is not too far from its all time high. This is impressive considering the major hit the majority of the market has taken. However, it also means that its not at a large discount currently, if one were desiring to accumulate GVT tokens.

Exchanges -

GVT is trading on Binance, Kucoin, and HitBTC. Binance is arguably the biggest exchange for alt coins, with the best liquidity, with regards to the multitude of coins/tokens available. They also have tremendous functionality. The downside to this is that the price has likely already spiked due to getting listed on Binance. Although this does not at all mean that there is no future upside or eminent price movement.

(Above stats from Coinmarketcap.com)

Image From: Coinmarketcap.com

ICO:

ICO token sale was from OCT 15 - NOV 15 2017.

No Whitelist.

ICO price was $1.00 per 1 GVT.

ICO fundraising goal of 23,000,000 USD was not met. (Raised 2,836,732)

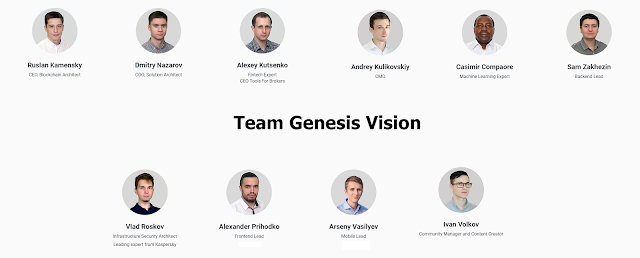

10 team members.

ERC20 Token.

(Above stats from icodrops.com)

The product/technology:

Image From: cmo.com

“Genesis Vision brings transparency and openness to the trust management market” (Genesis Vision short concept video above).

Simply put, Genesis Vision is looking to provide a decentralized platform that allows for greater trust, information, and transparency for private trust management.

For example, a simple example would be as follows:

Say I wanted to grow my money/assets, more so than simply gaining interest in a bank… but did not have the experience required to do so in crypto, stocks, real estate, etc. Or maybe I just did not have the time. I would seek a third party to do this for me. I would transfer money to the company or the individual, and come up with an agreement for growth, and parameters for the risk I was willing to incur, taking into account the potential gain, which would likely be compounded and end up as larger gain than simply sitting in my bank account.

There are several parties involved in this, as described by the Genesis Vision whitepaper:

Managers - These companies or individuals are very experienced. They make a commission based on how much they are able to grow the funds invested.

Investors - The ones who provide the capital/money to the management funds/companies.

Brokers/Brokerage Firms - These are the one’s that have agreements with exchanges and the necessary licenses, etc, to carry out trades, etc. For example, if I wanted to trade on the CBOT (Chicago Board of Trade), I would need to go through a third party (brokerage firm) in order to get trades carried out/executed.

There are quite a few middle men in this process. The investor gives money to the manager. The manager finds trades/investment opportunities, then gives those orders to the broker. The broker then executes those orders on the exchange.

Image From: elitetrack.com

This system of trust management has been gaining momentum over the years. “According to the Boston Consulting Group report Global Asset Management 2016, the total amount of funds in management is more than $70 trillion” (white paper p. 6). This means that there has been a growing interested and participation in this system of operation.

As the GVT white paper explains, the current system for this market is not very transparent, and often times, people do not understand how the process works. “[T]he current solutions boil down to the investor using some software to transfer money to a financial manager and then waiting to receive profits. However, investors have no opportunity to control their own funds. Furthermore, the fiduciary management system itself doesn't give investors any technical abilities to ensure that their funds are returned, nor does it provide an understanding of how the money is used” (Whitepaper p. 8).

This basically means that the traditional system lacks transparency, ease of use, customer control, security, and trust that the customer’s funds will be dealt with properly and returned. These seem to be quite a few problems that decentralization may be able to solve.

Dishonesty, on behalf of companies, is also mentioned. With added transparency, they would likely be held more accountable to perform upstanding practices.

“Our system adds transparency and, on a technological level, increases asset security and information reliability. Decentralization guarantees that one person won't be able to use the entire system for his personal interests” (Whitepaper p. 8).

Genesis Vision looks to utilize blockchain technology and smart contracts to greatly improve the above problems. Genesis Vision will have managers who own their own cryptocurrencies, with amount depending on performance track record. A customer would then buy the managers cryptocurrency holdings on Genesis VIsion’s own internal exchange. This would then make the manager in charge of those funds, that the customer now owns.

“Genesis Vision, in turn, represents a common open source of reliable information about the statistics of the network participants' activities and an absolutely transparent system of investment and profit distribution, built on smart contracts” (Whitepaper p. 10). This sounds like a cool way of going about the system, providing ease of use, transparency, etc.

Image From: cryoplus.com

Advantages for investors, as opposed to the traditional system, as provided by the GVT white paper, page 11.

“Investors have access to managers from all over the world. Information is available on their trading and profit statistics, which is now accessible in one place”.

“The set of managers is not limited by any set of financial instruments”.

“Investors have the ability to invest both in the cryptocurrency and in the fiat currencies”.

“Profit distribution is completely transparent and open”.

“There is better availability of investment portfolios for any request (high-risk, low-risk, etc.)”.

“Investors have additional protection, due to the fact that all managers have a real trading history that cannot be faked”.

“Investing is now not just a transfer of money but the purchase of a cryptocurrency, which remains liquid throughout the process and can be resold at any time”.

There are also several advantages for the private managers, funds, and brokers as well -

These include aspects such as: increased access to investors in other countries (borderless concept)/transparency/healthy competition among managers/ improved flexibility, creativity, strategy, etc/ ability for managers to build their own brand (branded cryptocurrency for investors to trade)/opportunity for brokers to attract worldwide investors/no centralized company/free participation in the network with same terms for all participants/ as well as a few other advantages.

The internal exchange mentioned above will be “the place where investors can purchase and sell managers’ coins. Managers have a limited amount of coins, which depends on their level. Initially, these coins can only be purchased directly from the manager for a fixed price. Afterwards, they can be freely traded among the investors on the internal exchange. In this case, investors set their own price for their managers’ coins. The cost of these coins will depend on the success of a manager’s trading because the manager’s profitable trading makes his/her coins ‘profitable.’” (Whitepaper p. 15).

Image From: carneyco.com

The Genesis Vision Whitepaper, p22., also lists a few possible problems however as well such as:

Scalability (currently on Ethereum blockchain but will switch if problems arise down the road)

Problems with currency conversion (“Brokers will receive money from investors in GVT, but they will need to transfer funds to the manager's account in the manager's account currency”. Whitepaper p. 23). Basically if a country that does not support cryptocurrency desired to get involved, it would be difficult. Solutions proposed would be the ability to quickly exchange to fiat or vice versa. A few other solutions to problems are mentioned as well.

Purpose of GVT token:

“GVT will be used for all investment operations, profit distributions, and managers’ token trading on the internal exchange” (Whitepaper p. 26)

Image From: makcrypto.com

Team:

Ruslan Kamenskiy (CEO) - Seven years of software experience. “Developed a trading system for the stock exchange ‘Saint Petersburg’, was head of the software department of a financial broker company, and implemented HFT strategies for the hedge fund’ (white paper p. 30).

Dmitry Nazarov (Co-Founder) - Software developer. Experience in international finance organizations, including “large UK-based foreign exchange company. Has done recent work in software development consultancy with the International Atomic Energy Agency.

Alexey Kutsenko (Manager of Details for Trust Management) - CEO of Tools For Brokers. This business has over 300 brokers for clients and has been operational for eight years.

Vlad Roskov (Security) - Competitive hacker. Extensive competitive sport hacking experience. Works on financial incidents investigation.

Casimir Compaore (Sr. Software Engineer) - Over ten years of development experience. Worked as information Tech. Officer at the African Union Commission. Microsoft Certified Professional Developer.

Sam Zakhezin (End to End Product Developer) - Various experience in software development.

Arsenal Vasilyev (Mobile Lead) - Seven Years of experience in development. Has developed two projects which have seemingly had strong success. A game for a social network with 300,000 installs, and another app with 120,000 installs.

*For more details/deeper understanding of the technology involved, you may wish to consult the Genesis Vision white paper, in that there is a lot of information involved.

Whitepaper link: https://genesis.vision/white-paper-eng.pdf

Image From: decsped.org

Positives:

Genesis vision has partnerships that were made before Genesis Vision launch. (Partners include 400 brokers worldwide)

Strong Idea to solve a real world pain point.

Improves on key pain points in current system such as transparency and trust.

Capitalistic structure that promotes competition among managers.

Global/borderless system and therefore seemingly infinite opportunity.

Greater flexibility than the traditional system.

Will also have options for traditional investment (Stocks, etc.) incorporated at some point. Versatility.

Negatives:

Potential questionable strength of team.

Fairly Early in roadmap.

Many potential legal implications and regulations they may have to deal with.

Token supply may suffer liquidity issues as it is a very small token supply comparatively.

Image From: clker.com

Thoughts:

In my opinion, Genesis Vision has a unique project. They offer a solution to many of the existing problems with the traditional system. They may be able to improve key elements such as trust and versatility, which the traditional system may be lacking in, as stated. One key element that makes Genesis Vision very attractive, is that they are looking to offer more than just a cryptocurrency market alternative. They are also looking to provide a mixture of the cryptocurrency space, with the traditional system, which provides vastly greater opportunity. I also like the aspect of a performance based system for the managers, which promotes greater growth and results.

On the opposing side, Genesis vision may have their hands full when it comes to regulation. With all the difficulties currently with regulations filtering in, it will be interesting to see how Genesis Vision is affected. It also seems to me as though they have a lot left to accomplish. It will be interesting to see if they can deliver on their vision and their system. The other question is if another project comes along that builds on these ideas, and moves faster. The blockchain space moves incredibly fast. It would seemingly be easy for projects to be usurped. But then again, I do think there is room for multiple projects that have the same goals, but may go about things slightly differently…Just as I think there may be room in crypto for multiple platform plays to thrive simultaneously (ETH, NEO, ADA, etc.) instead of just “one that rules them all” so to speak.

At the end of the day, readers need to decide what they think the future will be for GVT. This review was written about my opinions and my interpretation of data, which can be subjective. In no way am I claiming that I know everything, and therefore, more research may be required by readers. But hopefully I have given a good amount of content to assist in educating the public. GVT could go nowhere in price or even go down. But it could also do very well. Decide for yourself based on the data and your own personal research ;) I have not yet invested in GCT, but may do so in the future. I have also not been compensated by GVT for this review.

(**Everything written, said, tweeted, etc. is based on my personal opinion, my interpretation of the data/material, and is not financial or investment advice whatsoever. I do not claim to be an expert. Articles may be subject to edit/update at the discretion of the writer)

Sources:

ICOdrops.com

Coinmarketcap.com

Genesis Vision Whitepaper

Video:

Youtube.com via ICOdrops.com

Looks like $GVT has been doing good, unlike most of crypto market.

Great article. Maybe you should repost this with today's information in mind. $GVT looks like it is getting ready to make a run imo.