Dot Com Bubble And The Genesis Of The Geniuses

There's a lot of talk of dot com mania nowadays, so let's try to remember how it was like.

Phase 1

And so it begins, suddenly the bulb lights up in alot of heads about the economic potential of the "information highway". Money flows in. IPO filings line up, nobody reads prospectuses. Everyone is a genius when picking stocks is more like shooting fish in a barrell. No matter what the price one paid, there is always plenty opportunities to sell for profit. Very few people suffer losses even though there are mini-crashes here and there.

There's very little or no regulation: anyone with $100 can open an account online without any ID check, there are no restrictions on day trades. Margin trading is available to anyone: 2x, 4x, even 10x.

There's an oversized scalping community: those who went for 1/4, 1/8, 1/16 or even 1/32 of a dollar on each trade (yes, it wasn't all metric system yet). I suspect these people were recycled and repurposed into what eventually emerged under the moniker of HFT.

High-frequency trading (HFT) is a program trading platform that uses powerful computers to transact a large number of orders at very fast speeds. It uses complex algorithms to analyze multiple markets and execute orders based on market conditions. Typically, the traders with the fastest execution speeds are more profitable than traders with slower execution speeds.

Phase 2

Liquidity arrives en masse, as large trading desks turn over millions and millions of dollars in positions every second. Spreads eventually narrow down to a sliver, leaving scalpers out in the cold. This is when blatant pump and dump operations sprout up, penny stocks/pink sheets/OTC scams attract alot of those starved out of scalping.

There are still some stock picking geniuses around when sectors of a new economy are formed and defined and capital rotation comes into place. Others who happen to be in the wrong sector at the wrong time are wiped out real fast. This is when risk control strategies and stops become front and center, every remaining genius starts to preach their variety of stops witchcraft - taking ever smaller quick profits and tightening trailing stops ever so tighter - only to see profits diminish to a trickle.

It becomes very hard to make profit on the long side without taking huge risks. Shorting becomes very popular as the market continues higher, surpassing all bullish projections. It is this true grit skeptics cohort who propel the whole thing into the stratosphere for a blow off top. They keep calling tops, shorting, only to cover as the market gaps higher the next day.

Phase 3

Distribution commences. Large positions are quietly dismantled by institutions and insiders who know the endgame is around the corner. Many remaining original geniuses perish at this time as their stop strategies start to fail badly.

Phase 4

Crash, total devastation and wipe out. A handful of surviving shorts celebrate (those are becoming the newly crowned geniuses who will thrive for years to come by publishing books and speaking on CNBC of their remarkable timing of the peak).

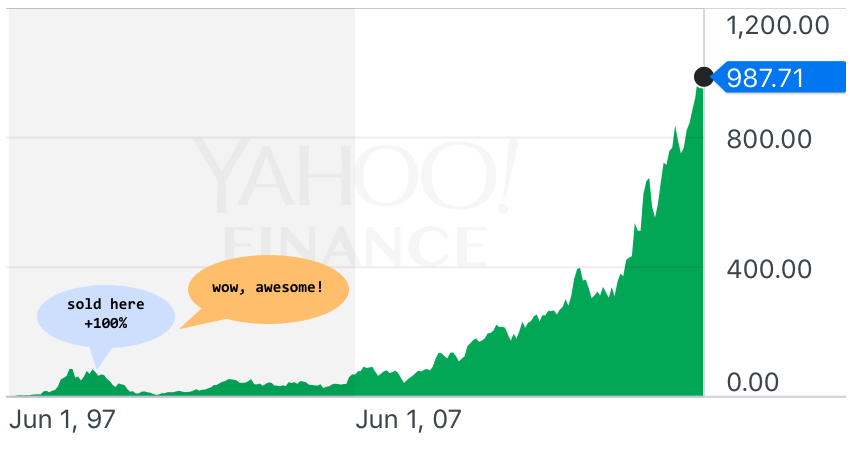

Now what's missing from this picture is a small group of investors who bought early, saw it through and never traded in and out. I wish I could say I'm one of them, it's so much easier in hindsight. But I'm not, I can pull up old statements from Datek and point out at least a few times when I owned sizable positions in Amazon. Those were all liquidated for "nice" profits of 20%, 50% and even 100%, thanks to an elaborate stop strategy.

See similarities in crypto markets? Which phase do you think it's in right now?

I found a nice indicator in Benjamin Graham's book. When IPOs (in our case ICOs) appear every day, it is a sign that a collapse will occur soon. For example, he says that within two years before the collapse of 1962, about 800 new IPOs appeared.

That's interesting and makes sense

this is good for me to see the overall phases of things thanks great post!

You're welcome. So which phase do you think the crypto markets are in right now?

ha! I'd be completely guessing, but it feelz like an "initial" (or 2nd or 3rd early) crashes phase...kind of a small wrap on the knuckles of those who dared to dream ... which is only a bluff because... well, everyone is going to want to put dollars into something ...anything else, pretty soon... and call me a hippy idiot but steem is the only crypto i know which has many of its owners real and accessible, plus baring much soul and art, thus invested personally, and invested timewise as well... i must be revealing how i know nothing about economics- anyway, i feel so many more will be on here once they wake up to the reality that we are collectively mining new earth energies!

I think you're wrong. You are not a hippy idiot, you're very positive and thoughtful person!

As for crashes, there was no any sense of sticky fear yet from what I can tell. By sticky I mean it lasts weeks and weeks and there's a new low every week with no hope of a reversal. Enjoy the rollercoaster ride... Think early Phase 1.