Crypto: Should you max out your credit cards to get a bit of the action?

Crypto has seen a surge recently. Ether is now over $300 and some other alt coins have increased even faster in the past month, a lot of people are making a lot of money.

But, as the saying goes, "you should only invest what you can afford to lose". For those who have no spare money lying around or are already in debt will find it hard to stay on the sidelines. Why should they be left out when they could be making money and even paying of their debts?

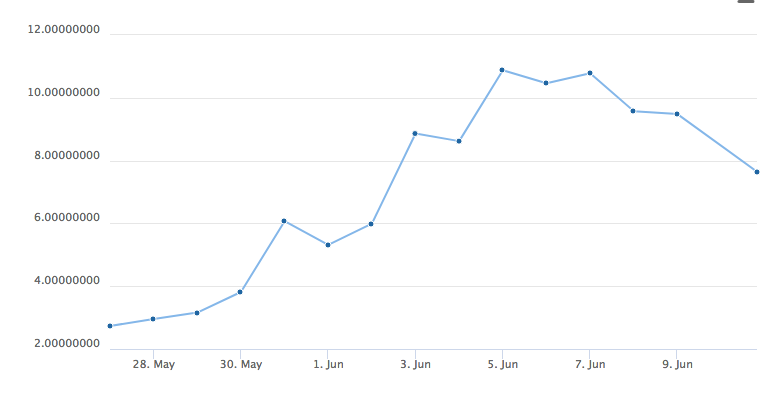

Many people say that crypto is the way of the future and Bitcoin, Ether and other cryptos will be worth hundreds or thousands more than they currently are. Yet others warn that that cyrpto is a bubble. There is truth to both sides. Yes, crypto is the way of the future, but no one can be sure that any of the current crop of coins will last, ie they may well be overtaken by better coins. On the other hand, certainly some of the current coins are over hyped and in a bubble. Just look at the price of Stratis over the past week or so (courtesy of CoinGecko) and it isn't a saw tooth graph:

The viable use cases of coins are crucial. That is why Bitcoin and Ethereum are so valuable, they can and are being used. Particularly Ether with its smart contracts that are already being used commercially - ironically by people that don't realise they are using the blockchain and a cryptocurrency. See this story for a German company that has put all its electric charging units on the Ethereum blockchain.

If you are going to borrow to get into crypto, you need to do the following:

First, do your homework. Read the white paper. Who is behind the coins? Do they have venture funding already, do they have a track record etc. Don't be fooled by slick marketing or even other people on Youtube saying how wonderful a certain coin is, chances is they have fallen for the hype as well.

Second, if you do buy and make money, sell some off to pay off the full amount you have borrowed - don't just make the minimum repayments on your credit card! If you are confident crypto will go up, then you still have coins left that you can make money on.

Third, once you have paid of the money you borrowed to buy into crypto, if you have other debts, sell off 10% of your coins each month until you pay your debts off!

Finally, just remember that the safest thing is not to borrow to get into crypto. There will be winners and losers and you don't want to be on the losing side.

Lol, yeah... max everything out as long as you are prepared to buy untraceable currencies, and then default on all your loans. And then hide for a little while.

As you say, the easiest thing is to probably just avoid the temptation to borrow to invest.

That's what is nice about Steemit in that you can earn Steem without maxing out anything.

Lovely, clear and unemotive article!

Honestly if you are already massively in debt it might not matter much. If you are in such a bad situation with your debt why not take out as big of a loan as you can and buy Altcoins. If it takes off in a year take some money out and pay off your debts, if it doesn't declare bankruptcy. You don't lose much, but the upside is huge.