Your Crypto News on Steemit February 7, 2018

- LitePay and LitePal: Litcoin's new Platforms!

- New York wants to enter the Mining Market!

- Ledger Wallet corrupted by Hacker - Beware of receiving Cryptos!

- Steve Wozniak Co Founder of Apple has sold its Bitcoins!

- Otcrit: Build a Platform, not a Product!

- Japanese Airline Peach Aviation wants to accept Bitcoin

- The Protection of Privacy - Part 5 (PIVX)

The developer team of the cryptocurrency Litecoin has announced the imminent launch of two platforms for the Litecoin network. Both LitePay and LitePal are meant to be used for payment processing and make the entire Litecoin transaction process easier. At least LitePay should be launched in February.

Litecoin founder Charlie Lee announced on Twitter that the launch of two Litecoin-related platforms this year is imminent: LitePay and LitePal. While the inclusion of LitePay, for which there are already concrete ideas, is already calculated for February, the development of LitePal is still a long way off - a time towards the end of the year is targeted.

LitePay is designed to drive Litecoin's global adoption by enabling Litecoin transactions between companies from different countries. The platform acts as a payment portal through which payments are processed. With a payment fee of 1%, all transferred sums will be converted immediately from the respective fiat currency into Litecoin. In this way, Litecoin payments are not exposed to the risk of high volatility. LitePay is supported by the Visa network and is available wherever Visa is used.

Also, LitePal is scheduled to launch this year, an official blog is already available - even if this does not reveal too much. The project is designed to provide a simple, secure and fast platform to bridge the gap between traders and cryptocurrencies. The service should be able to be used with PayPal, Western Union, Litecoin and Bitcoin.

This continues the general trend towards technical innovations in the crypto area. However, the development of LitePay and LitePal is not completely new territory. For both applications, BitPay and BitPal already have existing platforms in the related Bitcoin network. Conversely, the activation of SegWit and the associated Lightning Network had been used, in which the Litecoin network was virtually the test laboratory for the much larger Bitcoin community.

The US state of New York wants to enter the mining market to create jobs for its inhabitants. The energy-intensive process could even help boost the economy of the state, which in the past was dependent on polluting industries.

Mining in the north

The agency responsible for the energy budget in New York has appointed the new North Country Data Center Corp. (short: NCDC) allowed 15,000 kilowatts of electricity. The new mining center was planned by Coinmint. The company already has a different mining location and expects the cryptocurrency market to continue to grow. Therefore, the decision to expand business makes sense.

Coinmint would spend at least $ 165 million on the project and create 150 new jobs. In addition, an old steel factory in Massena is to be converted into a mining farm. Once the conversion work has been completed, the necessary equipment has been purchased and trained personnel hired, the NCDC will be able to capture 15% of the global crypto trade.

Good power supply

According to an American TV station, the reason for the choice of location is the good and cheap power supply. The energy network operator of New York hopes that the economy will be boosted by new investors in the region. Therefore, the electricity network operator also included the number of new jobs in its decision.

The NCDC is expected to employ 75 people this year and another 75 next year. The company requires security personnel, IT professionals, electricians and installers, among others.

The new mining center will be located just outside the Canadian border. The American neighboring country has attracted investors in the past due to the favorable electricity price.

A security risk has been discovered in the hardware wallet Ledger. This affects all devices of the manufacturer. Accordingly, caution should be exercised when receiving cryptocurrencies with the ledgers.

Even hardware wallets are not protected from attacks. As you can see from the Ledgers Twitter account, the hardware is not safe from a "man in the middle" attack. This "man in the middle" pushes accordingly between sender and receiver by faking the receiving address and thereby possibly Bitcoin, Ether & Co. tapped.

When you receive cryptocurrencies with the Ledger wallet, you usually generate a new public key for each transaction. For the ledger wallets, this is done by the JavaScript programming language. The responsible code can now be manipulated by malware.

If the affected computer that generates the receive address is affected, the malware replaces the address with a foreign one. Accordingly, all transactions are redirected to this fake address. It seems the malware is programmed to change both the QR code and the address itself.

However, the users are not helpless to the attackers. So you can click a button below at the bottom of the "Receive Bitcoin" menu. Then the receive address will be displayed, which must match that on the display on the hardware wallet. However, this currently only works for the Bitcoin app. The Ethereum app does not yet have this feature.

But there is also a secure alternative for the Ethereum app. If you want to generate a secure address, you have to run the operating system on a CD or a USB stick. Since the system is not stored on the hard disk then it is independent of malware.

Apple co-founder Steve Wozniak said during an event in Sweden that he has cashed out most of his Bitcoin assets. Wozniak has in the past confirmed that he has bought Bitcoin for $ 700. He sold these again after a price increase of more than 1000%.

Wozniak sells Bitcoin

Already on January 24, the entrepreneur spoke at the "Nordic Business Forum" in Sweden. Meanwhile, he stated that he had sold almost all of his Bitcoin. He did not want to be driven crazy by the price. Therefore, he decided to sell his Bitcoin when the price "shot up".

"I had Bitcoin to experiment with, and as the price went up, I said to myself, I do not want to be one of those people watching and watching, and only the number matters. I do not want to have that kind of worry in my life. Part of my happiness is that I do not want to worry, so I sold everything - I got rid of it - except for a small part that I still want to experiment with, "Wozniak said in Sweden.

Co-founder of Apple also added that from now on he would be interested in Bitcoin as a payment option.

Life is about being happy

Last year, Wozniak talked about his first experiences with the cryptocurrency. "I remember thinking about Bitcoin some time ago. At that time, a Bitcoin cost $ 70. "However, he had some problems:" I went online and you had to have a special bank account at a special bank and I could not buy Bitcoin and gave up. Later, I bought it for $ 700. "

After the price of the cryptocurrency had risen by over 1000%, he decided to sell his coins and he is completely satisfied. "If I died and I had wealth and yachts and all these things, would I be as happy as when I laugh? And I thought about the pranks I played, the jokes I made and the music I had heard and that makes me happy. Life is about being happy. "

Many companies fail when they focus on developing a single product or service and try to invest all their energy. Markets are changing with increasing speed, and it's often not enough just to be good at one thing. The problem is that customers are quickly losing interest in a particular product and are interested in new trends. As these trend reversals happen so quickly, companies are lacking the time to react. New strategies sometimes require decisions, capital and time. Since this does not happen overnight, there is a great risk of losing customers and, subsequently, the investment made in their own company. This spiral can quickly mean the end of a company!

The same applies to the crypto market. Here it can happen that companies emanate from potential customers who do not even exist in reality. A perfectly planned marketing strategy and a high-profile advisory board mean that ICOs are sold out in seconds. If the coin or the token then comes on an exchange, the trading volume also corresponds to the ICO clearance speed, as all of the hype and the fear of missing something (FOMO - FEAR OF MISSING OUT) expire. When that happens, the companies have experienced a run, outlining an ideal target audience in their business plan, but not a single real customer. The unwritten rule is that less money is more, because less money allows you to think outside the box and find solutions that you would not otherwise find if you had much more or too much capital at your disposal. Nevertheless, this market may be driven by people who want to make big profits as quickly as possible, and therefore do not pay attention to investing in sound projects.

What we will see in 2018 and beyond is the success of projects that have built not just a product but an ecosystem. The people out there do not just want to buy books on Amazon, they want to buy everything you can imagine, and yes, why not make a streaming service available that you can control through your AI assistant , This comprehensive offering is perfectly tailored to customer needs, and that's why Otcrit does not build a product, but a platform - a place where customers experience a whole range of services that they actually have from a single company not used to the shape. Otcrit wants to be an all-in-one solution for traders and investors.

Otcrit builds this platform to provide the community with knowledge about blockchain economy business models in a transparent way. We will soon see the beginning of a second wave of very successful blockchain projects - those that actually provide a working product and achieve some adaptation. It will be necessary to acquire more know-how if you want to continue to successfully trade and invest in this new phase. The demand for objective information will be greater than ever and investors will need to spend more time analyzing companies. Exchanges will have the big problem of keeping their customers unless they also start to offer a better user experience or better warning systems in terms of newly listed projects. If this market is to become as big as today's stock market, the focus must be on development and research rather than marketing.

In Japan, you can now pay for cars and in-app payment services with Bitcoin. The current wave of red pulling through the crypto-courses does not stop the country from opening up further areas of application. From March, Japanese will be able to settle their airline tickets with the cryptocurrency. However, the primary target group for this service of discount airline Peach Aviation are Asian tourists who want to visit Japan.

Shinichi Inoue, CEO of Peach explains:

Bitcoin payments already possible from next month?

As part of a call to lure visitors from other parts of Asia to Japan, payment in Bitcoin is expected to be accepted by the end of the fiscal year in March 2018. This is facilitated by the Fund Settlement Act, which has been helping to ease crypto transactions since April 2017. Japan's leading low-cost airline is looking forward to partnering with regional governments and companies to spread the use of cryptocurrency.

The original plan envisaged the introduction of the new payment method as early as autumn 2017. Due to fluctuating prices, this start date has been postponed. To what extent this now takes place in view of the still changing courses remains set. "We're checking the timing of the service launch," said spokeswoman for Peach Public Relations. Both Peach Aviation and Bitpoint Japan have confirmed their commitment to implementing their original plans for 2018. The rumor that the airline has already abandoned these plans has been denied on its official website.

Peach Aviation is not the only carrier that accepts Bitcoin. The Polish airline LOT and the Latvian airline airBaltic are already ahead of it. The network of airline payers Universal Air Travel Plan announced three years ago to partner with Bitnet, which would allow customers to buy tickets from more than 260 airlines.

About this column

In this column I take a closer look at one aspect of cryptocurrencies: the protection of privacy. In each issue, I'll take a closer look at a cryptocurrency and see how the privacy of the user is protected.

Introduction

Since PIVX has copied Zero's Zero Knowledge Proofs and Dash's Masternodes, it seems likely that it combines the advantages of both systems. How PIVX works and whether PIVX is actually an anonymous Internet currency, we are now testing.

Particularities

PIVX was launched in February 2016 under the ominous name "Darknet". A special feature is the use of a proof of stake as a consensus algorithm. In a proof of stake, the validity of transactions in the network is not guaranteed by miners, but by the stakers. A staker has a certain number of coins, which he freezes as a pledge to validate the transactions. In return, he gets new coins as a reward for his work. In PIVX these actors are called staking nodes. Attacks for the proof of stake will be discussed in the next section.

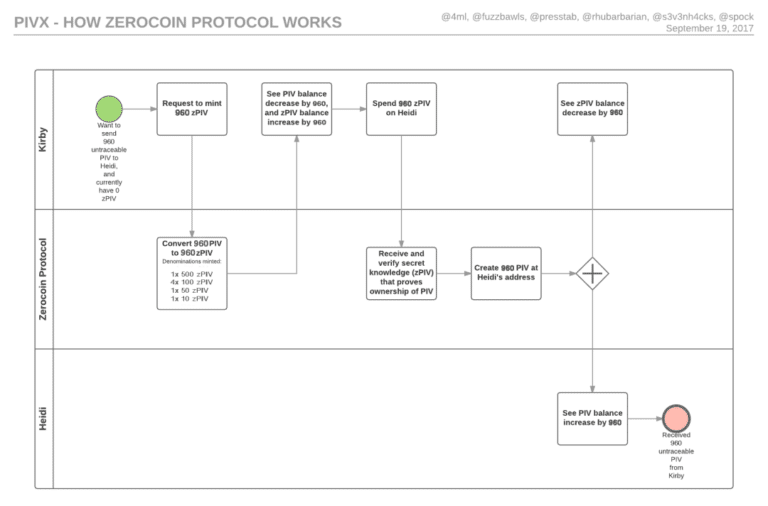

The anonymization happens in PIVX, similar to Dash, through a CoinMixer. The currency is broken down into eight different default values (1, 5, 10, 50, 100, 500, 1000, 5000). The process of mixing is called 'minting' in PIVX. The anonymous monetary unit is called zPIV. A transaction made after the mixing obfuscates the history of the coins. For a third party, it can only be seen that the coins come from the pool to zPIV. The process of a transaction is shown here:

PIVX uses the Zerocoin protocol to split the currency into eight different values and prove the ownership of PIV without revealing the identity of the owner.

Weaknesses

PIVX has some weaknesses that should be mentioned when it comes to robust privacy coins. First, there is the so-called "Rich List" to mention. With public blockchains like Bitcoin or just PIVX it is obvious to all people which address holds how much money. Even if this address is pseudonymous and not directly apparent to who is behind it, this public is at risk for financial privacy. If a stock is kept in zPIV, these stocks are not visible on the blockchain.

Another weakness of PIVX is the consensus mechanism, the Proof Of Stake. When it comes to robust, decentralized consensus mechanisms, there are a few voices in the crypto community who have massive doubts about the proof of stake. The fundamental problem with the proof of stake is that a novice in the system must trust the existing stakers to get a correct version of the blockchain. A freshman can not verify the complete history since the Genesis block, as in the Proof Of Work itself. The system is no longer "trust less".

The last weakness also exists with other CoinMixing Privacy Coins like Dash and Bitcoin. As a user, you have to be familiar with how the cryptocurrency works, so you do not accidentally reveal your identity. An analysis of the blockchain could make connections between wallets with careless handling with PIVX - above all if change is spent from a zPIV transaction to a known change address. For a fee of 1 zPIV, the change can also be sent to a zPIV address - this is highly recommended for privacy.

Current state of the technology

PIVX has used 10% of the block rewards for budget proposals. What this money is ultimately used for is decided by the Masternodes. This model provides at least a financial basis for the further development of PIVX.

View in the future

In 2018, big innovations are in the pipeline for PIVX.

In the first quarter, a deterministic zPIV wallet, an iOS wallet and the so-called 'zPIV staking' are to be rolled out. This was intended to increase user-friendliness and increase privacy for all users of the network through zPIV staking.

Summary

PIVX is an interesting project with a focus on privacy and usability. The mechanisms of PIVX provide privacy for users. In order to be really sure of anonymity and not to make rash mistakes, one should however deal more closely with PIVX. Personally, the use of the Proof Of Stake is a thorn in the side. Time will tell how problematic this consensus mechanism really is.

Here you can read Part 1 (Bitcoin)!

Here you can read Part 2 (Monero)!

Here you can read Part 3 (Zcash)!

Here you can read Part 4 (Dash)!

In case you missed my last news just click here!

I wish you all a great Wednesday!

ⓁⓄⓥⒺ & ⓁⒾⒼⒽⓉ

Best regards

@danyelk

really nice and well writen article!

LitePay and LitePal is a huge step for litecoin and a good step forward for crypto in general.

thank you for this post :)

Your welcome and yes this is a big step for LTC and cryptos let's see what it will have for an impact on the price :))

very good inf today thank you Men have a nice day

Your welcome :)

Have a nice day too.

Disclaimer: I am just a bot trying to be helpful.

informative thanks