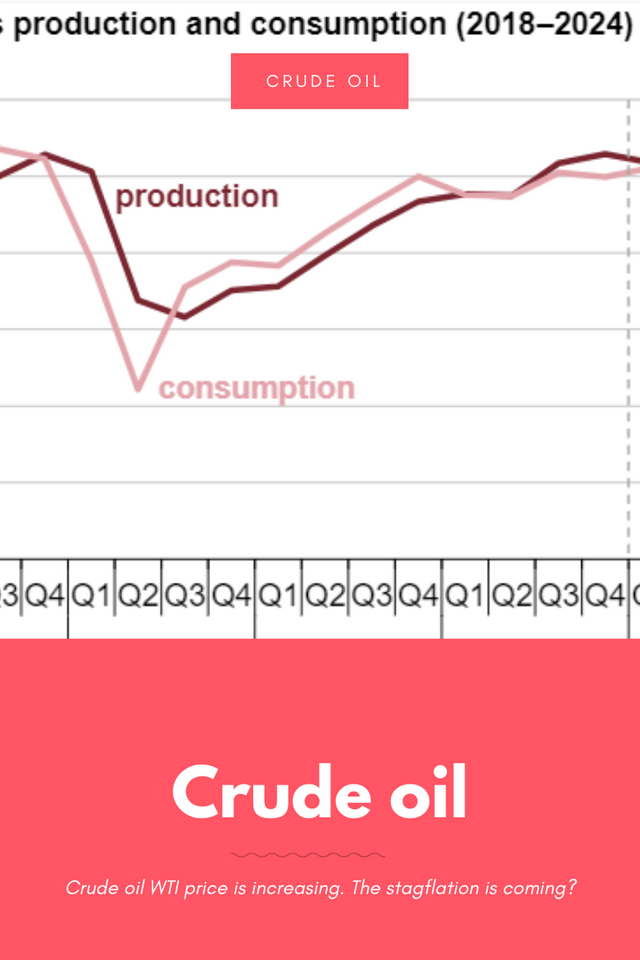

Crude oil WTI price is increasing in 2023. let's know the reason.

.png)

The recent increase in the price of crude oil, specifically WTI (West Texas Intermediate), has sparked concerns about the potential impact on the global economy. As the cost of crude oil rises, it often leads to higher fuel prices, which can have a ripple effect on various industries and consumer spending.

One of the concerns associated with rising crude oil prices is the possibility of stagflation. Stagflation refers to a scenario where there is a simultaneous increase in inflation and unemployment, coupled with slow economic growth. Historically, periods of high oil prices have been associated with economic downturns and increased inflationary pressures.

While it is too early to definitively predict whether stagflation will occur as a result of increasing crude oil prices, it is important to closely monitor economic indicators and policy responses. Governments and central banks play a crucial role in managing such situations by implementing appropriate monetary and fiscal policies.

In conclusion, while the increasing price of crude oil warrants attention and may have implications for the economy, it is essential to consider various factors before drawing conclusions about stagflation. Continued monitoring and analysis are necessary to gauge the potential impact on different sectors and devise appropriate strategies for mitigating any adverse effects.