Crowd Genie-exchange lending

The Crowd Genie platform is a lending exchange centered mainly on the Asian market, headquartered in Singapore. The idea of this exchange is quite simple and consists in this: after full implementation of all algorithms and tools of work on this exchange, each private investor will be able to issue loans for small and medium businesses, and not just banks, as it was before (and is still in effect today). many financial aspects of the activities of countries around the world). Therefore now, if your company has refused all banks to issue loans - you can safely apply to Crowd Genie. https://www.genieico.net/

This service has already proved itself from the positive side, since it is a sufficiently powerful platform that can provide business lending. Funds for the development of Crowd Genie are also used to increase the value of the portfolio of assets.

The main objective of this credit exchange is to make loans more operative, easy, and also transparent. This platform represents an already established peer-to-peer credit company that seeks to use blockchain and crypto currency technology to bring its professional activity to a new level.

In the long-term plans of this project lies the creation of the largest exchange of assets in Asia. This will lead to the use of products such as a digital passport, P2P lending, asset swapping, and much more.

How does Crowd Genie work?

As for investments on the platform, tokens can be used. All owners of tokens will be able to receive greater revenues than revenues from financial activities, using banks and a modern financial system. Monthly percentages can be transferred to the purse of users in Fiats or CGCoin tokens.

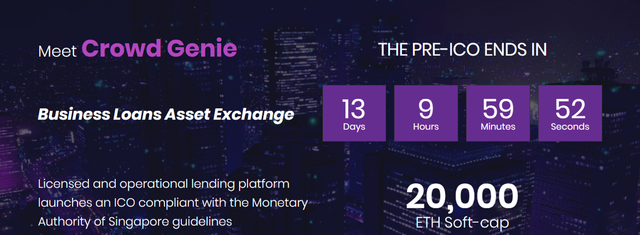

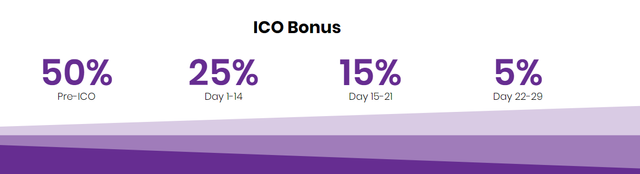

During the conduct of a token for 1 ETN it will be possible to purchase 400 CGCoin tokens, which correspond to the ERC20 standard (built on the Efirium blockhouse). The total offer of tokens will be no more than 60,000,000 units. ICO project is scheduled for the end of February this year.

To join the digital lending platform, you need to pass the user data verification procedure (KYC). Both borrowers and creditors need to verify their identity and payment details. The end result is a digital passport issued individually for each customer.

Lenders can receive interest rates of 12% or more. They can also determine how their interest will be paid off (in various fiat currencies or tokens). Unlike other digital platforms (for example, Bitconnect), Crowd Genie does not advertise the highest possible return for investors. This is proof that this platform does not pursue any fraudulent actions.

More recently, the platform has released an additional software product called GenieShield. GenieShield is designed to provide lenders with more effective data protection and potential risks when the loan is repaid by the borrower. This tool will help borrowers repay their loans only through the Crowd Genie platform.

Advantages of Crowd Genie

Certainly, recently created platform Crowd Genie has a number of advantages for its users:

- Protection of assets of creditors against possible delays in payment of a loan from a borrower;

- evaluation and provision of statistical data on the credit capacity of organizations;

- KYC user data verification technology;

- good reputation in the Asian market of credit exchanges;

- established system of collection for late payments on the loan.

For more detailed information about the project and the terms of participation, I recommend to visit the links below:

WEB page: https://www.genieico.net/

White paper: https://drive.google.com/file/d/1wloXd2lzW_94Q-nVbGjXPj0nT4aiuM97/view

Author: https://bitcointalk.org/index.php?action=profile;u=1047035

will check it !!!