STOPPING THE BANKS: With ‘King’s Bench’ Legal Tool, Collections of Fraudulent Debts Can Finally Be Halted

By MARK ANDERSON / Stop the Presses News & Commentary

[A version of this article by this writer also appeared at Populist.com and at www.theTruthhound.com]

MECHANICSBURG, Penn.—There’s an unprecedented grassroots effort to bring to heel the profoundly abusive banking system and its main collaborators in the courts and in debt-collection law firms.

Longtime monetary-reform advocate Mickey Paoletta of Mortgage Defense Systems in Mechanicsburg, Pa., (email: [email protected]) has helped scores of individual homeowners being sued in foreclosure proceedings expose their mortgage “loans” as invalid in court.

He’s put in long hours researching and writing legal filings — helping embattled homeowners-consumers understand and fight the mortgage-banking (and credit card) racket — a racket so monstrous that it could very well be the biggest white-collar crime wave in the history of humanity, enabled and conducted not by "outlaws," but by those who are sworn to uphold the law.

Well, due to a little-known but potentially powerful legal option called the “King’s Bench” jurisdiction, Mr. Paoletta is taking things to the next level, countering a powerful racket consisting of debt-collection law firms, banks and other lending agencies, and the courts—all of which play a role in creating and/or trafficking in forged debt documents.

State and local media tend to cover up rather than cover such matters. The newspapers take part in the gravy train by printing paid legal ads to publicize foreclosures. But law firms reap the most. One Pennsylvania firm that only handles debt collection made $72 million in 2016 alone, harnessing the labor of 150 employees to make it happen.

So, given the collective strength of this financial-legal-media syndicate, Paoletta is leveraging the King’s Bench, a British law carry-over applicable in the commonwealths of Pennsylvania and Virginia, and in at least five other states.

According to Paoletta, under the King’s Bench, the Pennsylvania Supreme Court must, as he put it, “reign in the lower-court judges and review their decisions. And not just the judges, but the lawyers themselves, to make sure they’re following their code under the bar.”

That means sanctioning judges and attorneys who do not lawfully uphold their duties.

Moreover, the King’s Bench presses the state’s high court to look at the substance of this matter, especially forged notes being wielded against an unwitting citizenry to dispossess them of their lands and homes. This dispossession is rampant across the nation, but is especially acute in New Jersey and Pennsylvania.

But Mr. Paolettta's approach, which has scored several victories, could effectively free ever-larger numbers of Americans from the modern-day slavery of imposed fraudulent debt, in one fell swoop.

Accordingly, Paoletta recently filed a 15,000-word King’s Bench complaint with the Pennsylvania Supreme Court.

Explaining the complaint, Paoletta told this writer: “When judges ignore securitization audits and document-examination reports that prove the use of forged and fraudulently created documents used for foreclosures, and when these judges grant summary judgments to debt-purchasing attorneys, what you have is a conspiratorial enterprise that is suppressing evidence, and which obstructs justice by denying citizens their due-process rights to file litigation through, but not limited to, the Fair Debt Collection Practices Act.”

The federal FDCPA law turned 40 last year. Although it’s been amended, its core purpose is to eliminate abusive consumer debt-collection practices, promote fair debt collection, and to help consumers dispute and validate the accuracy of debt information.

Paoletta’s Supreme Court complaint also states: “As a matter of fact, there are as many as several hundred aggrieved former homeowners in Pennsylvania alone that have suffered … through the methods and tactics of these … respondents.”

Another complaint passage reads: “We, the People have suffered enough at the hands of these attorneys and their supporting judicial officials. … The people have lost their property through illegal Sheriff’s sales, and the Sheriffs declare that [they] take [their] orders from the debt collectors and do not really care about forged and fraudulent promissory and mortgage-foreclosure documents.”

The current practice of bundling mortgages into investment packages, and in trumping up foreclosure proceedings to entrap struggling homeowners and in effect steal their property, has become hard-wired into society to a shocking degree.

But by exposing specific acts of forgery — like Digital Image Extraction, where people’s signatures are electronically scanned and pasted onto documents that the signatory never signed — Paoletta feels the people can finally turn a corner on this issue and make real progress.

Here's a thought: It may be that past laudable movements to "audit" or "end" the Federal Reserve System have all been like spit wads against the side of a battleship because they've all been top-down efforts.

Instead, we may need to start with commercial banks and other lending agencies, and their collusion with the courts, law firms and media, to arrest the cancer of banks running the country FROM THE BOTTOM UP.

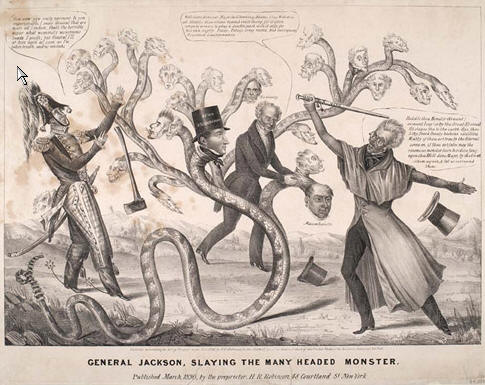

True, that approach is not as sexy and it may be more tedious than slaying the Fed in one swing of the saber. But the rewards are greater. Far greater.

Once We the People learn what happens when a bank makes a loan, and how fraud and deceit, via the banks and their cohorts, permeates society, then even more people can represent themselves in court, throw off the shackles of debt and expose the mega-racket for all to see—all the way up the money-power ladder to the Federal Reserve central bank itself.

Accordingly, it’s important to stress that the banks’ highly secretive and sensitive ledgers are the holy grail. The banks routinely refuse to produce their genuine ledgers in court; that’s highly significant because the ledgers can prove, once and for all, whether banks actually part with any assets whenever they issue what we call loans.

Simply put, if the banks’ net worth or asset balances are not reduced in the loan process, then the banks never actually parted with anything in the first place. The implications of that — in a nation with a debt-money system, where the interest (debt) and the available goods and price levels always exceed the total money supply — are beyond monumental.

Well done very thought provoking and truth revealing article. We need more articles like this on steam it. Facing issues that can be dealt with head on. We need a list of action steps that work from people who have done it