Simple Tips on How to Control Your "Spending"

I believe that you have one professional job and a many sideline jobs. That’s the spirit! However, are you one of the many people who have asked yourself: “How have you spent your money after three years of working?”. Then you grab your calculator and calculated all your salary for that past three years and you were shocked that you’ve earned almost 500,000 Php already.

Where did your money go?

In this blog, let me give you simple tips on HOW TO START CONTROLLING YOUR SPENDING for you to avoid asking yourself “Where did your money go?”. I hope that this will help change your NEGATIVE Income to OVERFLOWING Income.

Let me start with an initial R.A.S. where R stands for Record, A stands for Acknowledge and S stands for Save. As a disclaimer, the information below is all based from my experience and from the experiences of my friends. I know you can somehow relate. Just have fun in reading!

1st Record

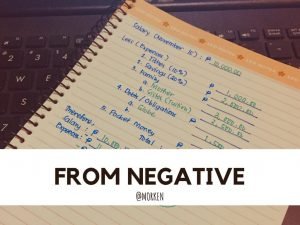

First thing that you need to have is a notebook to be your friend every “pay-day”. You can have any format in writing the data as long as you can understand it. You can do it even if you are not an accountant graduate. The photo below is an example of how you can write down your salary and expenses. I use a negative amount to reflect most of our income. :-)

You must know how much you are earning every salary period or every month. If you have more than one job, include the total amount of your salary in your record. You can have a fifteen-day period or monthly period of recording your salary and expenses whichever you prefer.

In writing, write all your salary and expenses. Record even a single centavo spent in your record book so that you may be able to have an accurate record of data.

2nd Acknowledge

Secondly you need to ACKNOWLEDGE.

For me, this is one key to successfully control your cash outs. You need to acknowledge the things that you are prioritizing and less prioritizing. I say to you now, it’s time to PRIORITIZE the things that you NEED over the things you WANT.

If you are experiencing a negative salary every pay-day, it’s time for you to let go of the things that you WANT and focus first on the things that you NEED.

Anyways, you can go back in having the things that you WANT when you are already financially healed.

If you are in the same situation of the above photo, you can take out first your debt in a telecompany for you to focus on your sister’s tuition and for you to also have a pocket money until the next pay-day. Anyway, you can still have alternatives for you to avail an internet service or you can go back in purchasing it after your sister’s graduation or if there is an increase of your salary and or additional source of income.

Same thing if you can’t resist in buying products in a mall that are marked “SALE”. There are many people who can’t stop themselves in buying products that are on SALE even if it is not part of their CART’S LIST (things needed to buy) of the day.

Most of us forget that “SALE” is still SPENDING. It is just one strategy of businesses to sell their products. SELL is hidden from a word SALE and SALE covers the word SPENDING.

If you can’t resist in spending out your money in malls, then minimize going to malls.

Acknowledge also that you have a problem in spending. Once you acknowledge that you have this problem, you start in researching things on how to treat it. People may see it not as a serious problem but rich-minded people will always think that that is a serious one. However, it can always be healed if you just decide right now.

Please don’t forget to decide earlier! Do not wait for life situation to push you or you’ll regret after.

3rd SAVE

For you not to spend your money on things that you don’t need, you start SAVING. This topic is so beautiful that I want to have a separate blog about this. But to give you a glimpse on how to save, here are my simple tips on how to start saving:

- Have a BIG purpose why you need to save. (BIG purpose like New House, Health Insurance, Life Insurance, Retirement, etc.)

- Start small until it becomes big.

- Just be consistent.

- If you feel spending, go back to no. 1.

Just start with a small saving, be consistent, next thing, make it big, until you will realize you are SAVING more and SPENDING less.

Important Note:

Please do not wait for the last day of your job with your sixty-year old self waiting for your pension monthly. Make a move right now for your future.

Grind, Save, and Invest for you to enjoy life sooner.

STAY AWAY from NEGATIVE!

Promotion:

Please watch out for more tips about spending and saving on my next posts. I hope this short one can help you with your dilemma right now. Do not forget to share this to your friends for them to be financially healed also.

Feeling amazed with this? Why not visit http://pinayteenvestor.com for more financial advices including cryptocurrency topics. The website is run by our very own @smaeunabs.

Thank you.

See you next time!

Posted from my blog with SteemPress : https://morken.000webhostapp.com/2018/10/simple-tips-on-how-to-control-your-spending

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by morken from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.