Cryptocoin Insurance

About Cryptocoin Insurance

The options are financial derivatives sold by an option writer to the option buyer. The contract gives the buyer the right, but not the obligation, to buy (optional) or sell (set optional) basic goods at the agreed price for a certain period or time. set the exact date. The selling price is called the exercise price. There are several types of options. An option can be made at any time before the expiry date of the selection, while other options can only be made on the expiry date (exercise date). Exercising means using the right to buy or sell basic security.

It seems difficult! That's why this project is divided into two parts: Insurance Company and Insurance Option:

Traders and hedge funds have reached an agreement to buy shares

Other customers, who do not want to know how the options work, can buy insurance for the growth or decline of major cryptocurrencies.

How it works?

The price of any option at any time depends on supply and demand and changes continuously. Buyers risk only the money spent to buy the option, for example $ 100. They can not lose more than in other cases. Optionally, theoretically, there is an unlimited risk associated with the price change of the underlying asset (Bitcoin or Ethereum). This is why each put option is accompanied by a security insurance (GS).

A bond is the amount of money (collateral) needed to guarantee the seller the option to meet his obligations. Profits are established by exchanging fixed amounts on a given day and for an option contract. The GS values are indicated in the specification of this contract.

By selling the option, the seller immediately receives the fees paid by the buyer option. The trading platform freezes some of the money on the seller's deposit until the transaction is completed or the position of the option is closed. GS may change as the volatility of the core asset increases / decreases.

If the price of the underlying property is transferred to the seller, he must provide additional security if he continues to hold this option or sell it. This process is regulated by the exchange in automatic mode. If the option seller

does not have enough money on his or her account, the exchange will automatically liquidate this option.

The exchange sets a limit for the maximum number of options that can be made on one side of the market. This protects the exchange with situations that, because of the strong movement of the market in one direction, can not quickly close the options of sellers with lower deposits.

Cryptocoin Insurance has two main sources of income

Transaction exchanges

Profit is created as a trading fee for each transaction on call or investment options. It is 0.5% per transaction or 1% per turn for each commercial part.

With the volatility of options and huge profit opportunities, this commission makes no sense for market players. However, this allows trade to achieve a high return over traditional electronic money trading because of the complete lack of competition. In the event of future competition, the amount of foreign exchange fees may be reduced accordingly.

Insurance company

Revenue generated by the sale of growth insurance products / discount of electronic money.

problem:

No solution for depositing Bitcoin or Ethereum reduction.

At the same time, in this market, volatility has increased, causing people to store large amounts of money in electronic money. In addition, large companies are slow to enter the market (for example, to accept payments by electronic money) for the same reason.There is no special e-money exchange where you can buy / sell options.

The main fear of creating such a stock market is volatility. It seems that anyone who deals with options for stocks, oil or wheat presents enormous risks.There is still no short selling opportunity in the e-money market.

No one can sell electronic money that is not present in the account for a short time. This reduces speculators' ability to minimize price volatility in other markets. This, in turn, leads to an increase in volatility and the consequences are listed in Cl. 1 and 2 above.

Solution:

Cryptocoin Insurance allows you to guarantee a discount or a growth risk for the major electronic money.

Cryptocoin Insurance creates the first exchange of options.

Options allow short sales.

CCIN Token

The CCIN code will be defined for the OIC. Their total is fixed rigidly. All chips not exchanged during the sorting process will be canceled. They will never be released again. They will be set up by Ethereal Smart. The fixed number of fixed NICCs ensures that their buyers increase in value as the exchange rate increases. Cards will be exchanged within 30 days of the end of the ICO.

Companies Cryptocoin Insurance has developed a simple and easy to understand model for increasing the value of CCIN token. 30% of each commission earned through the exchange of options will be transferred to liquid funds. In the coming months, Cryptocoin Insurance sends these funds to buy CCIN chips on the market and burn them.

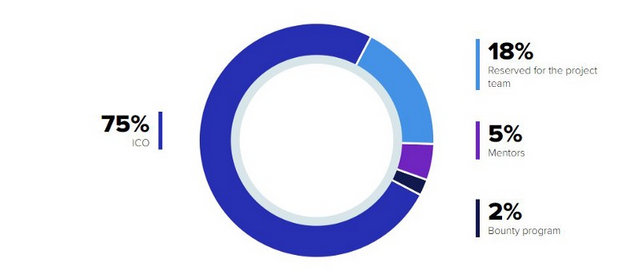

Token allocation

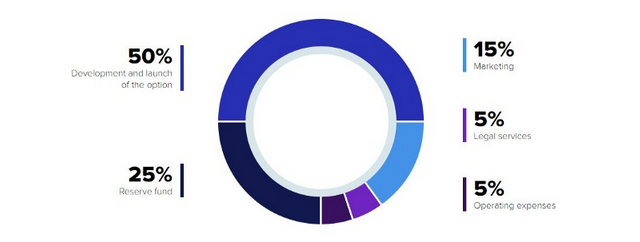

Allocate the product

Project roadmap

Details:

Website: http://ccin.io/

White paper: http://ccin.io/doc/Whitepapereng.pdf

Ann: https://bitcointalk.org/index.php?topic=4948618

Twiter: https://twitter.com/ccin_official

Facebook: https://www.facebook.com/ccinofficial/

Telegram: https://t.me/ccin_official

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=1234556