Body Candlestick Analysis

We have learned in the previous material that the candlestick body that shows a dominance. If the dominance of buyers get the pressure will form the top tail. Conversely when the dominance of the seller get a boost up will form the bottom tail.

But in addition to determining the next direction we must also measure the level of fairness of body length candlestick.

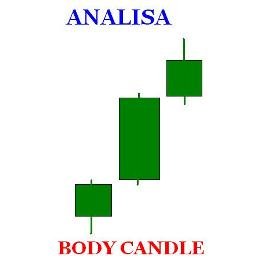

In journey either up or down the market will experience the name of strengthening and pelemahan.Jika are experiencing penguataan then the next body candle is longer than ever.Dengan maximum length in normal conditions is 3 times the previous candle

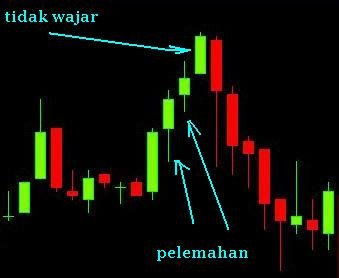

It means that to move further the market needs a strong trend foundation. And the foundation of that strong trend if the slope of the graph is about 45 degrees. Therefore if the next candle suddenly very long once more than 3 times the body candle before this show a haste, this becomes something unnatural. So there will be a correction to return the market to its track as reasonableness. Or there will also be a correction to ensure that the movement is strong enough to move further

Unlike the case with a long candle that breakout.Karena to penetrate the wall support or resistance it needs a great power then the candle that do breakout is always a candle with a long body.

But still, if the candle breakout is too long it becomes unnatural and will raise questions like this: "Is the price too high / low?" So usually after the candlestick breakout body is very long some traders will take profit taking ith closing position. So if followed by another trader then the direction of the next candle to be opposite to the long candlestick direction.

After the market moves away from the trend reversal point, traders who ride the trend get a profit. Therefore some traders will close its position to secure the profit earned.In addition, when the market has moved away from the trend reversal point, now the price is too high / too low so that the less traders who dare to open a position in the direction of the trend.

Both of these are what will then make the market movement slows down and weakened. As a result the body candle is formed shorter and shorter than the previous candle

After a weakening market will move against the direction of the trend that has occurred, but previously will find the right point to reflect away so have the energy to move further.

Under normal conditions the candlestick's weakening body length is above 50% of the previous candle but still shorter than the previous candle. Therefore if after a long candlestick suddenly weakened drastically by forming very small body, this should be questioned sought to know why.

Or when the candle after a sudden weakening candle appears with longer body, then this was also made in the question, because usually the next direction is opposite to this unnatural candle

That's one way candlestick analysis to determine the direction of the next candlestick. Another candlestick analysis is discussed on a different page. To add to your trading discipline you should read it.

that analysis affect to bitcoin trading ? @viviw

next post i'll post the different about trading forex and bitcoin couse have little bit ways.