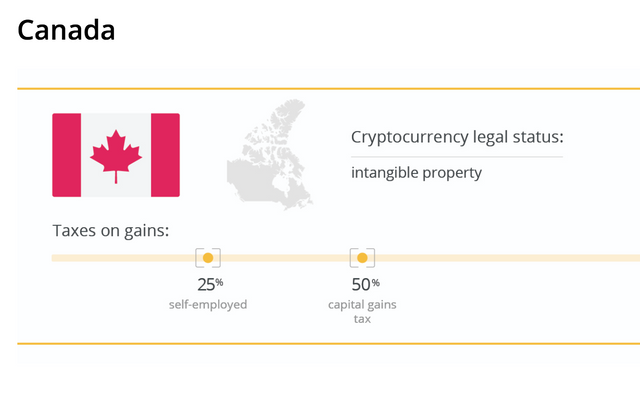

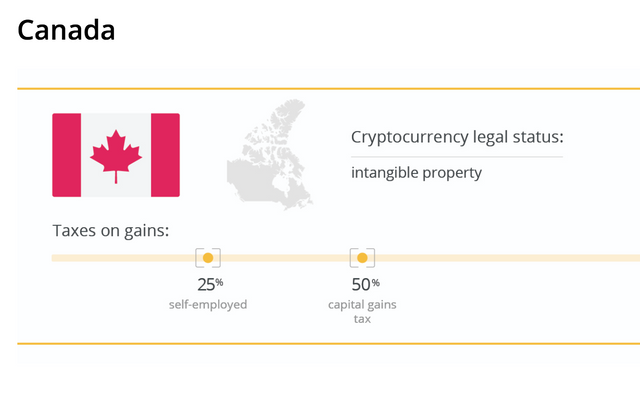

Crypto’s status: Intangible property

Taxes on gains: 50 percent (capital gains tax); 25 percent (self-employed)

According to the government of Canada, “using digital currency does not exempt consumers from Canadian tax obligations,” which means that cryptocurrencies are subject to the Income Tax Act.

That involves selling cryptocurrencies for a profit, mining and doing crypto-to-crypto transactions — in that case, if, for instance, Bitcoin is used to buy Ethereum, Bitcoin is considered to be sold for its value in Canadian dollars at the time of the transaction.

Taxes for investments, which apply to cryptocurrencies, suggest 50 percent for any such gain in Canada. High-volume traders will have to file their taxes with the Canada Revenue Agency as being self-employed, setting aside around 25 percent of their income.

Source:cointelegraph

^^^Grow The STEEM Community...ReSTEEM-UpVote-Follow^^^